Tesla has maintained its sizable Bitcoin position into 2025, with its Q1 earnings report confirming it held $951 million in digital assets as of March 31. This marks a modest decline from $1.076 billion in December 2024—driven primarily by market volatility rather than any asset sales.

According to Bitcoin Treasuries, Tesla’s Bitcoin holdings remain steady at 11,509 BTC, with no transactions recorded during the quarter. This consistent approach underscores the company’s long-term commitment to digital assets, even as it navigates macroeconomic headwinds and a softer-than-expected earnings season.

While Tesla missed revenue expectations in Q1, its Bitcoin portfolio remains one of the largest among publicly traded companies—second only to Strategy (formerly MicroStrategy) in total BTC holdings.

The update also marks the company’s first quarterly filing under the new FASB accounting rules, which now require firms to report crypto holdings at fair market value, providing investors with a clearer view of value fluctuations driven by price changes.

Tesla’s decision to hold through market turbulence signals continued institutional confidence in Bitcoin’s long-term potential, despite short-term pressures from interest rate speculation and global trade policy uncertainty.

Bitcoin Price Dip, Not Sales, Behind Tesla’s Crypto Decline

Tesla’s reported drop in crypto asset value this quarter appears to stem entirely from market price declines, not active selling. According to data from Arkham Intelligence, the automaker made no Bitcoin transactions in the past three months. Its BTC holdings were still valued at approximately $1.049 billion as of this week—higher than the $951 million reported in the Q1 financials due to Bitcoin’s price rebound in early April.

The discrepancy highlights the impact of the new FASB standard, which replaces the older impairment model with mark-to-market reporting. The shift represents a major step toward transparency for publicly traded companies with crypto exposure—particularly influential players like Tesla.

Tesla reported Q1 revenue of $19.34 billion, falling short of analyst expectations of $21.37 billion. However, TSLA shares rose over 2% in after-hours trading, reflecting investor resilience and interest in the firm’s broader innovation roadmap, including its strategic Bitcoin positioning.

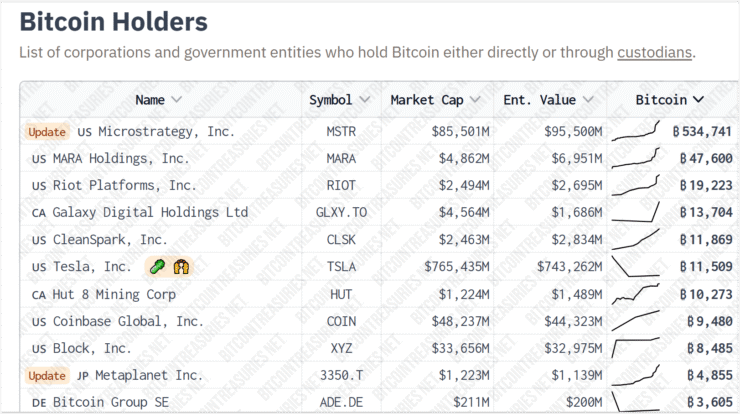

Top Corporate Bitcoin Holders in 2025

As Bitcoin cements its role as a treasury reserve asset, a number of major corporations continue to expand their exposure—treating BTC not only as a hedge against inflation but also as a tool for financial innovation and balance sheet diversification.

- Strategy (formerly MicroStrategy) remains the largest corporate Bitcoin holder, with 528,185 BTC under the leadership of Executive Chairman Michael Saylor.

- MARA Holdings, a digital asset infrastructure firm, holds 47,531 BTC, much of it earned through its expansive mining operations.

- Riot Platforms has acquired 19,223 BTC, reflecting its integrated approach to mining and treasury management.

- CleanSpark, a clean energy and mining firm, holds 11,869 BTC, aligning its BTC strategy with its sustainability goals.

- Tesla, led by Elon Musk, holds 11,509 BTC, with no movement recorded in Q1 2025—affirming its long-term position despite recent market volatility.

A notable new player is 21 Capital, a crypto SPAC launched by Brandon Lutnick in collaboration with Cantor Fitzgerald, SoftBank, Tether, and Bitfinex. The consortium plans to allocate $3 billion into Bitcoin at a valuation of $85,000 per coin, aiming to rival Strategy’s position in institutional BTC accumulation.

Quick Facts

- Tesla held 11,509 BTC, valued at $951 million as of March 31, 2025.

- The company made no Bitcoin transactions during Q1, maintaining its crypto position.

- The decline in value from December’s $1.076 billion reflects price movement, not asset sales.

- Tesla remains among the top five corporate Bitcoin holders globally, despite its Q1 revenue miss.