Mounting tension grips the crypto market as Mt. Gox, once the world’s largest Bitcoin exchange, moves over $1 billion worth of Bitcoin for the third time this month. With every transaction, fears of a looming sell-off grow stronger.

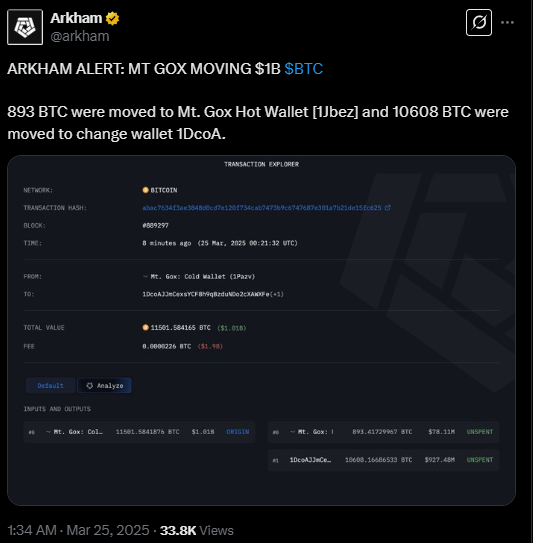

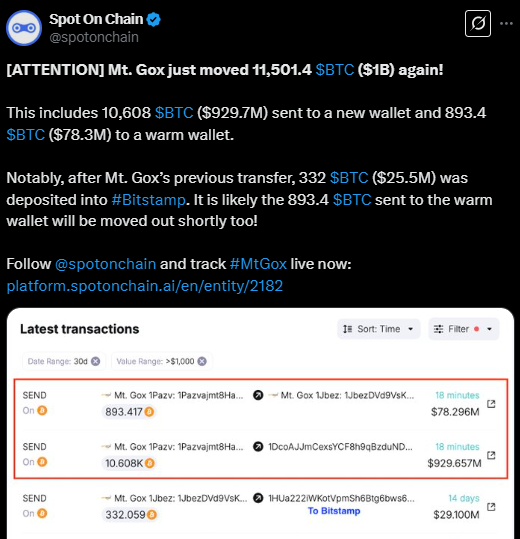

Early Monday, blockchain sleuths flagged another hefty transfer, 11,501 Bitcoin, worth nearly $1 billion, quietly shuffled across Mt. Gox-controlled wallets. Blockchain analytics firm Arkham Intelligence confirmed that 893 Bitcoin (roughly $78 million) landed in a cold wallet, while a staggering 10,608 Bitcoin (around $929 million) shifted to a change wallet, sparking immediate speculation.

This latest move follows two earlier transactions this month, 12,000 Bitcoin on March 6 and 11,833 Bitcoin on March 11, totaling over $3 billion moved in less than four weeks. Adding to the intrigue, one of those transfers reportedly made its way to Bitstamp, hinting that parts of the hoard could soon hit the open market.

Market on Edge: Is a Sell-Off Inevitable?

The Bitcoin community is watching closely. Historically, movements from Mt. Gox wallets have stirred panic, triggering sell-off rumours. Given that the exchange still holds 35,000 Bitcoin valued at $3.1 billion, any hint of liquidation could sway market sentiment.

Adding fuel to the fire, Spot On Chain suggests the 893 Bitcoin sent to the warm wallet could be moved out soon, potentially hitting trading platforms. While the Bitcoin market has grown more resilient, an unexpected flood of coins—especially from such a storied source could still rattle prices.

For many, these massive transfers signal something more calculated: creditor repayments may finally be near. After all, it’s been over a decade since Mt. Gox collapsed under the weight of an infamous hack that siphoned 850,000 Bitcoin, a loss that defined crypto’s early turbulent years.

A Tokyo court-appointed trustee has been steering the bankruptcy proceedings since 2014. Yet, even as the repayment plan inches forward, delays persist. The latest setback came last October when the trustee extended the final repayment deadline to October 31, 2025, citing incomplete creditor procedures.

Despite the slow pace, the option for creditors to receive payouts in Bitcoin adds another layer of complexity and risk to the market. If those coins re-enter circulation, the impact could be significant. Still, a 2024 Reddit poll revealed that most creditors aren’t in a hurry to sell, potentially muting immediate market shock.

The Bigger Picture

Mt. Gox’s saga is more than just another chapter in crypto’s rollercoaster ride. It’s a stark reminder of the industry’s early vulnerabilities and how far it’s come. Yet, it also underscores an ongoing struggle: navigating legacy risks while chasing mainstream adoption.

The market’s reaction to these moves will be a litmus test. Can Bitcoin absorb billions in potential sell pressure? Or will the ghosts of Mt. Gox trigger another wave of volatility?

One thing is clear—every move from those wallets will be watched, tracked, and dissected. With Bitcoin trading near historic highs, the stakes have never been higher.

What Comes Next?

As the countdown to October 2025 continues, traders should brace for more wallet activity and the uncertainty it brings. Whether these transfers lead to actual sell-offs or remain part of internal restructuring, Mt. Gox’s shadow still looms large.

For now, the market holds its breath. But in crypto, calm can be deceptive.