Defunct crypto exchange Mt. Gox has transferred nearly $1 billion worth of Bitcoin, its second major transaction in less than a week, raising speculation that creditor repayments may finally be near.

The latest 11,833 BTC transfer occurred on March 11, coinciding with Bitcoin’s brief drop to $76,784, its lowest level in four months. While the market quickly rebounded, the sudden movement has investors questioning whether Mt. Gox’s long-awaited repayments could introduce fresh selling pressure.

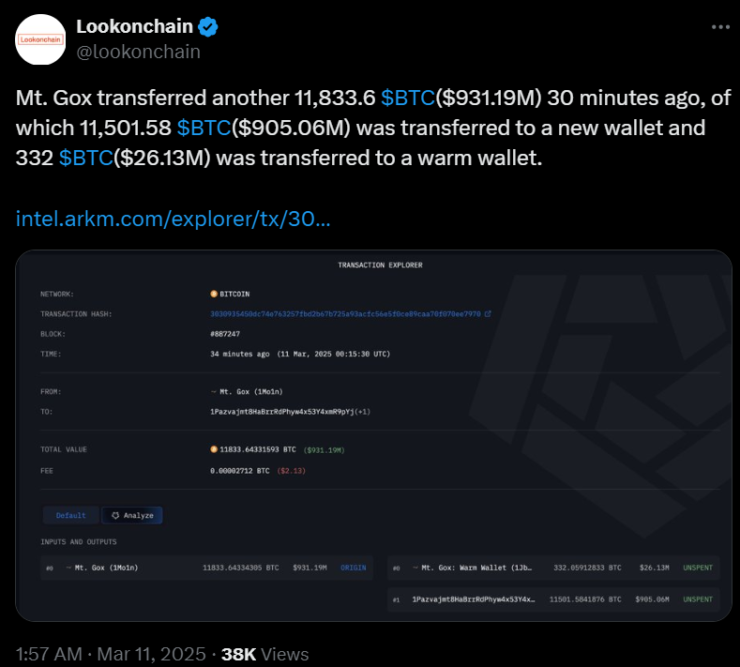

According to Lookonchain, citing Arkham Intelligence data, the latest Mt. Gox transaction involved:

- 11,501 BTC ($905.1 million) sent to a new wallet.

- 332 BTC ($26.1 million) moved to a warm wallet, potentially for creditor distribution.

- Total transaction cost: Just $2.13 in network fees.

This follows a March 6 transfer of 12,000 BTC, valued at over $1 billion, of which $15 million were moved to BitGo, one of the custodians handling repayments.

Bitcoin Reacts to Mt. Gox’s Movements

Bitcoin’s 2.4% drop to $76,784 immediately after the transaction was not coincidental.

While Bitcoin rebounded to $79,275, the market remains on edge, particularly as Mt. Gox’s remaining 24,411 BTC ($1.94 billion) could still be liquidated.

Some analysts believe the impact of these transfers could be overstated. Arthur Hayes, Maelstrom’s Chief Investment Officer, dismissed panic-selling fears, urging investors to “be patient” in a March 11 X post, predicting that Bitcoin may bottom around the $70,000 level before stabilizing.

Mt. Gox creditors have waited over a decade for compensation since the exchange collapsed in 2014. While repayments were expected sooner, last October, the exchange extended its deadline to October 31, 2025.

The big question: Will creditors hold or sell once funds are distributed?

- Long-term Bitcoin believers may choose to hold their BTC, limiting sell pressure.

- Early investors and institutions could offload their holdings, adding volatility.

- The market’s reaction will largely depend on how and when these repayments occur—a gradual rollout would soften the impact, while a sudden mass sell-off could trigger short-term price dips.

Mt. Gox: A Shadow Over the Crypto Market

At its peak, Mt. Gox handled 70-80% of all Bitcoin trades, before a devastating hack in 2014 wiped out up to 850,000 BTC.

Since then, $9.2 billion in recovered Bitcoin has been held in various Mt. Gox wallets. With the latest transfers, it’s clear that preparations for repayments are actively underway.

Whether these transactions signal an imminent payout or just routine wallet restructuring, one thing is certain the market is watching Mt. Gox closely.

What’s Next?

As Bitcoin trades near $79,000, investors should brace for continued volatility as more Mt. Gox funds move.

- Regulatory clarity on how the repayments will be handled could ease concerns.

- Bitcoin whales and institutional players may counteract selling pressure by absorbing excess supply.

- Macroeconomic factors, including Federal Reserve policy and ETF inflows, could help Bitcoin maintain its long-term trajectory.

For now, the Mt. Gox saga remains an unresolved chapter in Bitcoin’s history—one that could still shake the market before finally coming to an end.