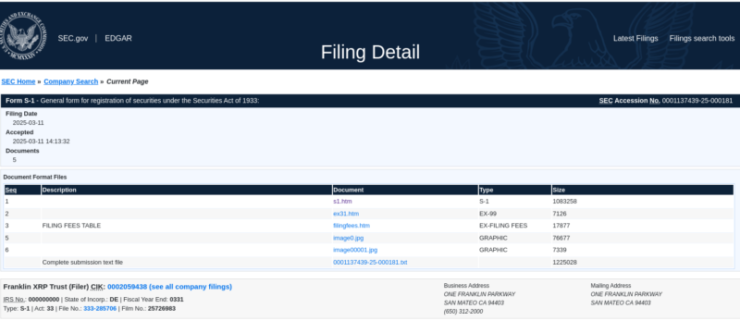

Franklin Templeton has submitted a Form S-1 to the U.S. Securities and Exchange Commission (SEC) seeking approval for an XRP exchange-traded fund (ETF), which places it among many firms vying for a cryptocurrency fund tied to the asset. The filing follows Franklin Templeton’s earlier establishment of the Franklin XRP Trust in Delaware on 28 February 2025, underscoring a broader push by asset managers to expand digital asset offerings beyond Bitcoin and Ethereum ETFs.

The proposed Franklin XRP ETF would hold XRP tokens stored by Coinbase Custody Trust Company, LLC, and cash assets managed by State Street Bank and Trust Company.

If approved, shares of the fund would trade on the Cboe BZX Exchange, allowing investors to gain exposure to XRP without directly purchasing the cryptocurrency.

The ETF’s net asset value (NAV) will be determined using the CME CF XRP-Dollar Reference Rate, aggregating pricing data from major crypto exchanges, including Coinbase, Bitstamp, Kraken, and LMAX Digital.

The SEC’s review of the filing will be closely watched, given its ongoing scrutiny of XRP’s regulatory status. Despite a court ruling that XRP is not a security when sold on exchanges, legal uncertainties and evolving crypto regulations remain potential hurdles for approval.

XRP Market Reacts to ETF Filing

Following Franklin Templeton’s ETF application, XRP’s price surged 8% within 24 hours, reaching $2.19. The price movement reflects growing optimism among investors about potential institutional adoption. Crypto analyst CasiTrades noted that XRP maintains key support levels at $2.04, with resistance points at $2.25 and $2.70, suggesting continued volatility as the market digests the implications of the filing.

This surge mirrors past market reactions to crypto ETF announcements, particularly Bitcoin and Ethereum ETFs, which saw increased institutional interest upon regulatory approval. The SEC’s decision on the XRP ETF will likely influence broader market sentiment toward digital asset investments.

Franklin Templeton joins an expanding list of asset managers, including Bitwise, Grayscale, WisdomTree, 21Shares, Canary Capital, and CoinShares, that have submitted XRP ETF proposals. The SEC reviewed Grayscale’s XRP ETF application on February 14, initiating a 240-day evaluation period. Other filings, including those from WisdomTree and Canary Capital, have entered the public commentary phase, a required step in the SEC’s review process.

The agency has historically been cautious about approving crypto-related financial products, particularly given its protracted legal battle with Ripple Labs over XRP’s classification. However, recent approvals of Bitcoin and Ethereum ETFs suggest a shifting regulatory landscape that could favor additional digital asset ETFs.

Franklin Templeton Expands Crypto ETF Offerings

Franklin Templeton’s XRP ETF filing aligns with its broader strategy to establish a foothold in cryptocurrency-based financial products. The firm has previously launched Bitcoin and Ethereum ETFs and recently applied for a Solana ETF. This aggressive expansion reflects a growing demand for diversified crypto investment vehicles amid increasing institutional interest in the sector.

The ETF’s structure positions it to attract investors seeking exposure to XRP through traditional brokerage accounts rather than direct crypto ownership. The fund would continuously offer shares at NAV, with only authorized participants able to create or redeem creation units. Coinbase Custody’s involvement as custodian and Coinbase’s role as the prime broker further integrate the product into established financial infrastructure.

The SEC’s decision on Franklin Templeton’s XRP ETF will be a critical indicator of regulatory sentiment toward digital asset funds beyond Bitcoin and Ethereum. Approval could pave the way for additional crypto ETFs, while rejection would reinforce concerns over XRP’s regulatory status.

Despite legal clarity on XRP’s non-security designation in exchange sales, regulatory risks remain. The fund’s structure avoids holding non-XRP crypto assets without explicit regulatory approval, reflecting a cautious approach to compliance. Franklin Templeton will charge an annualized sponsor’s fee, covering operational costs such as custody, administration, and legal expenses.