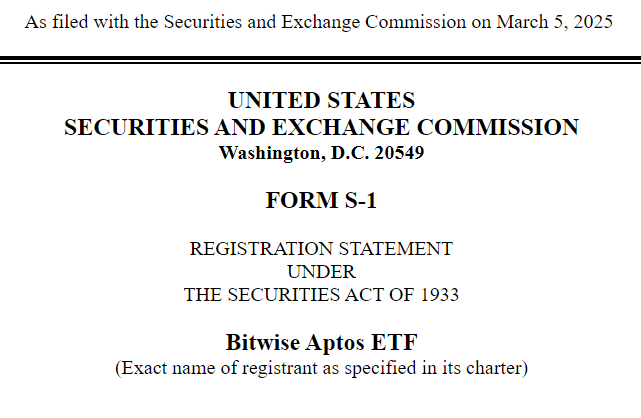

Bitwise has officially filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC) to launch a spot Aptos (APT) exchange-traded fund (ETF), signaling a growing institutional appetite for altcoin-based investment products. As regulatory attitudes toward crypto funds appear to be shifting, Aptos could join a wave of new digital asset ETFs, offering broader market exposure beyond Bitcoin and Ethereum.

This move comes as crypto asset managers seek to capitalize on increasing demand for diversified investment options, particularly as traditional financial institutions begin warming up to digital assets. While Bitcoin and Ethereum ETFs have already gained regulatory approval, the introduction of altcoin-focused ETFs marks a potential turning point for broader crypto adoption.

The March 5 filing marks the next step in Bitwise’s efforts to diversify crypto ETF offerings, following its initial Delaware registration filing last week. The Bitwise Aptos ETF is part of a broader trend of expanding altcoin-focused investment vehicles, which also includes Bitwise’s filings for Dogecoin (DOGE) and XRP exchange-traded funds.

Aptos, a Layer-1 blockchain developed by Aptos Labs, aims to enhance scalability, efficiency, and smart contract capabilities for decentralized applications (dApps). With a market capitalization of approximately $3.8 billion, Aptos’ APT token ranks as the 36th largest cryptocurrency, according to market data.

The Aptos blockchain is designed to compete with other Layer-1 solutions like Solana and Ethereum, offering an alternative infrastructure that focuses on speed, security, and ease of development. The blockchain utilizes the Move programming language, which originated from Meta’s (formerly Facebook) Diem project, further distinguishing it from other blockchain networks.

Altcoin ETFs Gain Momentum in a Shifting Regulatory Landscape

The U.S. government’s recent stance on digital asset regulations appears to be opening doors for new crypto investment products. The SEC’s approval of spot Bitcoin ETFs earlier this year set a precedent for altcoin-focused funds, with issuers now exploring ETFs tied to other major digital assets.

Institutional demand for diversified crypto investment options is rising, with firms like Bitwise and 21Shares actively launching staking-based products in Europe. In November, Bitwise introduced an Aptos Staking ETP across six Swiss exchanges, while 21Shares launched a similar product on Euronext Amsterdam and Paris. These staking products allow investors to earn passive rewards while holding crypto assets, showcasing an expanding range of financial instruments tailored to digital assets.

Altcoin ETFs represent an evolution in crypto investment accessibility, making it easier for institutional and retail investors to gain exposure to a diverse range of assets. The success of these funds will likely depend on regulatory clarity, institutional interest, and overall market conditions.

What Does This Mean for the Crypto Market?

If approved, the Bitwise Aptos ETF could provide institutional and retail investors with easier access to APT, removing technical barriers associated with buying, storing, and staking the asset directly. A successful launch could also pave the way for additional Layer-1 blockchain ETFs, expanding investor options beyond Ethereum and Solana.

As institutional investors increasingly recognize digital assets as a legitimate asset class, the launch of an Aptos ETF would indicate that altcoins are gaining acceptance beyond retail speculation. With Aptos offering a unique technological proposition, its inclusion in a regulated investment vehicle could further validate its long-term value proposition.

The bigger question remains: Will U.S. regulators fast-track approval for altcoin ETFs, or will they continue their historically cautious approach? With institutional interest surging and regulatory clarity improving, the crypto ETF landscape is poised for significant evolution in 2024 and beyond.

Looking Ahead

As the regulatory environment becomes more accommodating to digital assets, it is likely that other Layer-1 networks and established altcoins will follow Aptos in seeking ETF approval. Investors will be closely watching how the Bitwise Aptos ETF application progresses, as it could set a precedent for future filings.

With more financial products bridging traditional markets and crypto assets, the industry is poised for a new wave of adoption, fueled by regulated investment vehicles that make digital asset exposure more accessible to a wider range of investors.