Cryptocurrency markets and global equities plunged after the Trump administration implemented sweeping tariffs on major U.S. trading partners. The financial fallout escalated sharply over the weekend, prompting renewed fears of a worldwide recession. On April 5, President Donald Trump introduced a blanket 10% tariff on all countries, with elevated rates targeting key economies—34% for China,

Emmanuel Dela Cruz

CME Bitcoin futures opened sharply lower Monday after President Donald Trump ruled out a trade agreement with China, intensifying market turmoil. The April contract began trading at $79,590, down 5.6 percent from Friday’s close of $84,250, before declining further to $76,800, according to Google Finance. The sell-off coincided with a broader market retreat. Dow futures

Bitcoin Futures Fall After Trump Rejects China Deal

Jim Cramer has issued a stark warning of a potential market crash reminiscent of 1987’s Black Monday, citing President Donald Trump’s sweeping tariffs and escalating global tensions. The CNBC host described the market conditions as aligning with “the 1987 scenario,” referencing the single-day 22.6% plunge of the Dow Jones Industrial Average. “If the president doesn’t

Jim Cramer Warns of Black Monday Crash as Crypto Braces

Codex has secured $15.8 million in seed funding to develop a blockchain tailored for stablecoins, placing it at the top of this week’s AI and crypto-related funding announcements. The raise, announced Friday, was led by Dragonfly Capital and also drew backing from major crypto players including Coinbase and Circle. Dragonfly Capital contributed $14 million of

Codex Tops AI Blockchain Fundings With $15 Million

Tariffs introduced by President Donald Trump could set off a chain of economic shifts favorable to Bitcoin, according to Arthur Hayes, co-founder of BitMEX. In a series of posts on X, Hayes outlined how the proposed trade measures may weaken the U.S. dollar, trigger global monetary easing, and push investors toward Bitcoin. “Global imbalances will

Arthur Hayes Says Trump Tariffs Could Trigger Bitcoin Rally

Bitcoin is holding above key price levels as markets brace for the release of the March nonfarm payrolls (NFP) report, a critical barometer of U.S. labor market strength. The cryptocurrency’s resilience comes amid heightened geopolitical and economic volatility following President Donald Trump’s sweeping tariff announcement targeting 180 nations. At press time, bitcoin traded near $84,320,

Bitcoin Holds Strong as Markets Brace for Jobs Report

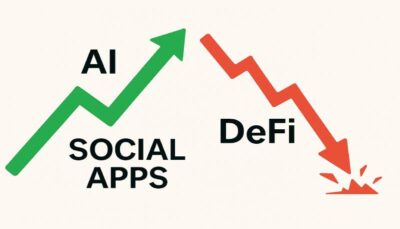

A $2 billion wave of exploits and rising economic pressure has triggered a sharp decline in decentralized finance (DeFi), even as artificial intelligence and social applications gained millions of new users. According to a Q1 2025 report by DappRadar, DeFi’s total value locked (TVL) fell 27% to $156 billion, while AI and social dapps recorded

AI and Social Apps Soar as DeFi Value Crashes

Lawmakers in Minnesota and Alabama are pushing forward legislation allowing their states to invest in Bitcoin, joining a growing movement across the United States. On 1 April, Republican state leaders in both states introduced bills that, if enacted, would authorize the creation of Bitcoin reserves managed by state entities. In Minnesota, the proposed legislation—formally titled

Alabama and Minnesota Advance State Bitcoin Investment Plans

A wave of U.S. tariffs announced by President Donald Trump is threatening to upend the Asian supply chain critical to Bitcoin mining. The announcement, made Wednesday, set a baseline 10% tariff on all U.S. imports starting 5 April and harsher duties on select countries by April 9. Thailand and Malaysia—both key locations for crypto hardware

Trump Tariffs Threaten Bitcoin Mining Supply Chain

Russia’s top finance official is doubling down on digital financial assets as a cornerstone of future BRICS trade. Speaking to reporters in Moscow, Finance Minister Anton Siluanov emphasized the need for innovative financial infrastructure to shield member states from third-party influence in international trade. “We are considering our various financial innovations on the BRICS floor,”

Russia Pushes Digital Assets to Boost BRICS Trade Independence

Anthony Scaramucci has condemned the New York Attorney General’s lawsuit against Galaxy Digital as a misuse of legal power, calling it “lawfare” driven by the state’s controversial Martin Act. The SkyBridge Capital founder made the remarks in a March 28 post on X, responding to the $200 million settlement reached between Galaxy Digital and the

Scaramucci Criticizes New York AG Lawsuit Against Galaxy Digital as Lawfare Over Terra Dealings

The Blockchain Group, a France-based technology firm specializing in data intelligence and decentralized systems, has acquired 580 Bitcoin worth approximately $50.64 million, according to a March 26 announcement. The purchase was completed by its fully owned subsidiary, The Blockchain Group Luxembourg SA, using proceeds from a previously issued convertible bond. This brings the company’s total