Bitcoin extended its gains over the weekend, holding steady near $104,000 late Sunday after reclaiming the psychologically significant $100,000 level for the first time in several months. The asset briefly touched $105,000 earlier in the day before pulling back slightly.

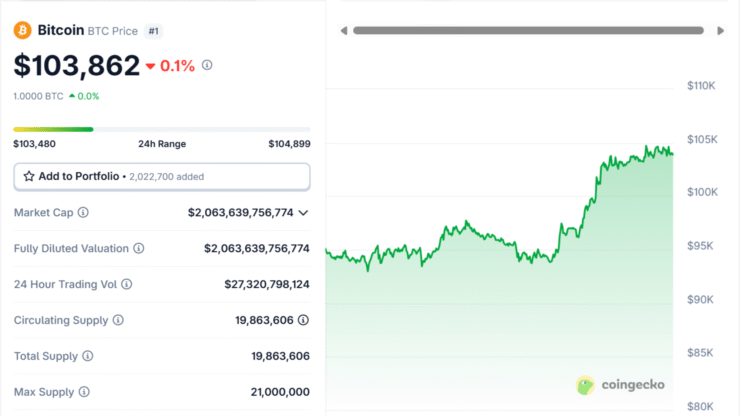

As of press time, Bitcoin was trading at $103,862, showing minimal movement over the previous 24 hours. The current price places it roughly 4.5% below its all-time high of $108,786, set in January.

While sentiment remains broadly positive, analysts caution that a near-term pullback is possible given the velocity of the recent rally. Still, technical indicators continue to support the bullish case. Vincent Liu, CIO of Kronos Research, noted that Bitcoin is trading above both its 50-day and 200-day moving averages—widely seen as a sign of sustained upward momentum.

“Rising institutional adoption and a favorable 2025 outlook point to a plausible path toward another ATH,” Liu said.

Technical Signals Suggest Rally May Pause Before Next Leg

Despite Bitcoin’s strong performance, some analysts warn that momentum indicators are entering overbought territory. The relative strength index (RSI), a widely used tool to assess market sentiment, has climbed into a zone that often precedes consolidation or minor corrections.

However, BTC Markets Analyst Rachael Lucas says this doesn’t necessarily indicate a bearish reversal.

“A retest and consolidation above the key psychological level of $100,000 would be a healthy development,” Lucas said. She added that sustained support at this level could act as a springboard for another leg higher in the coming weeks.

Trade Optimism and ETF Inflows Fuel Bitcoin’s Upside

Bitcoin’s strength is being bolstered by improving macroeconomic conditions and consistent institutional inflows. Over the weekend, U.S.-China trade talks concluded in Switzerland, with both delegations signaling meaningful progress. Chinese officials described the outcome as achieving an “important consensus,” while U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are expected to provide further details on Monday.

The easing of geopolitical tensions has buoyed broader market sentiment, driving renewed demand for risk assets—including cryptocurrencies.

In parallel, spot Bitcoin ETFs continue to attract capital, while corporate treasury activity adds further tailwinds. According to Vincent Liu, large-scale purchases by institutional players like Strategy—formerly MicroStrategy—have introduced a layer of structural demand to the market.

“As macro events like the upcoming U.S. CPI release on May 13 loom, investors must stay vigilant, manage risk wisely, and maintain diversified strategies to navigate this high-volatility landscape,” Liu added.

Quick Facts

- Bitcoin is trading at $103,926, roughly 4.5% below its all-time high of $108,786.

- Technical indicators show strength, but the RSI suggests a short-term consolidation may be near.

- Trade progress between the U.S. and China has improved risk appetite across financial markets.

- Institutional ETF inflows and corporate treasury accumulation continue to support Bitcoin’s upside momentum.