Traditional banks and fintech companies are racing to capitalize on the booming stablecoin market as major financial institutions position themselves for a future where cryptocurrencies play a key role in global payments.

Following in the footsteps of crypto-native firms like Tether and Circle, leading banks such as Bank of America and payment giants like Stripe and PayPal are exploring their own stablecoin offerings.

According to a Report by the Financial Times, this surge in institutional interest comes as regulatory acceptance of stablecoins continues to grow, particularly in the United States and Europe.

Unlike the fierce opposition faced by Meta’s Libra project six years ago, stablecoins are now seen as a legitimate component of the evolving financial system, with U.S. lawmakers actively debating regulatory frameworks that could provide more clarity for traditional firms.

The Exploding Role of Stablecoins in Global Payments

Stablecoins, pegged 1:1 to fiat currencies like the U.S. dollar, have primarily been used to facilitate cryptocurrency trading.

However, their use in real-world payments and cross-border transactions is rapidly expanding. Companies like Elon Musk’s SpaceX are already using stablecoins to repatriate funds from satellite sales in Argentina and Nigeria, while firms like ScaleAI pay their overseas contractors in digital tokens.

Transaction volumes soared to $710 billion last month, up from $521 billion this time, a year ago, while the number of unique stablecoin addresses has jumped by 50% to 35 million, according to Visa data.

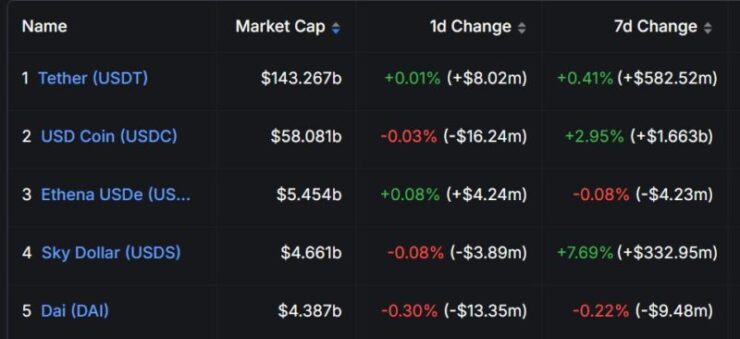

The market is currently dominated by Tether (USDT) and Circle’s USDC, with a combined issuance of nearly $200 billion. However, with banks and fintech firms now entering the space, competition is heating up.

Regulatory Green Light Encourages Adoption

As governments and regulators move to establish clear rules, financial institutions are gaining confidence in launching stablecoin-related services. Bank of America CEO Brian Moynihan recently stated, “If they make that legal, we will go into that business,” signaling the firm’s readiness to issue its own stablecoin under new U.S. laws.

Meanwhile, the European Union has implemented new rules requiring stablecoin issuers to comply with strict financial regulations, while the UK is preparing similar guidelines. Standard Chartered has already responded by planning the launch of a Hong Kong dollar-backed stablecoin, taking advantage of newly established regulatory frameworks in the region.

Beyond traditional banks, fintech giants are moving aggressively into stablecoins. In one of the largest stablecoin-related acquisitions to date, Stripe completed a $1.1 billion purchase of stablecoin platform Bridge, reinforcing its strategy of integrating crypto-powered payments. PayPal, which already operates the PYUSD stablecoin, plans to expand the use of its token in 2025, focusing on cross-border B2B payments.

Even Klarna, a major “buy now, pay later” lender, has reversed its crypto-skeptic stance. CEO Sebastian Siemiatkowski recently announced on X,

“OK. I give up. Klarna and me will embrace crypto! More to come… Last large fintech in the world to embrace it.”

Can New Entrants Compete with Tether and Circle?

Despite the growing institutional interest, new stablecoin issuers face an uphill battle in competing with dominant players like Tether and Circle. For example, PayPal’s PYUSD recorded just $163 million in transactions last month, a fraction of Tether’s staggering $131 billion in stablecoin transfers during the same period.

Visa data also highlights the challenge of adoption: while 122 million stablecoin transactions occurred globally last month, Visa’s payment network processed an average of 829 million transactions per day, demonstrating how far stablecoins still have to go to compete with traditional finance infrastructure.

Analysts also warn that the stablecoin market may not be able to sustain dozens of competing coins, as investors will likely scrutinize issuers based on trust, transparency, and credit risk.

Quick Facts:

- Bank of America, Stripe, PayPal, and Standard Chartered are all exploring stablecoin issuance as part of their payment strategies.

- Transaction volumes hit $710 billion last month, with the number of unique stablecoin addresses rising by 50% over the past year.

- The U.S., EU, and UK are moving forward with stablecoin regulations, giving institutions more confidence to integrate crypto-backed payments.