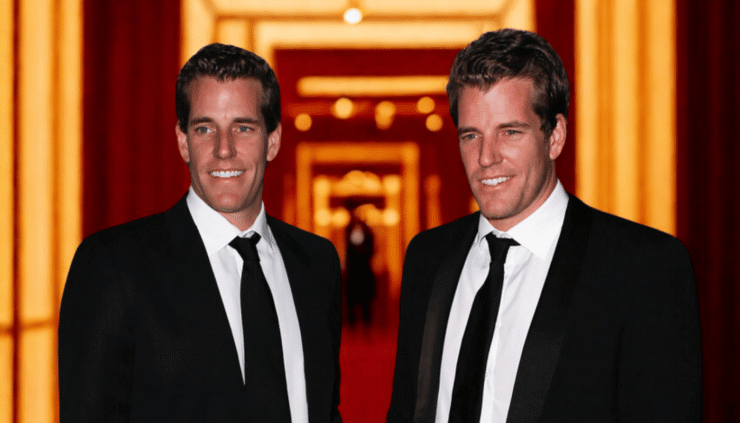

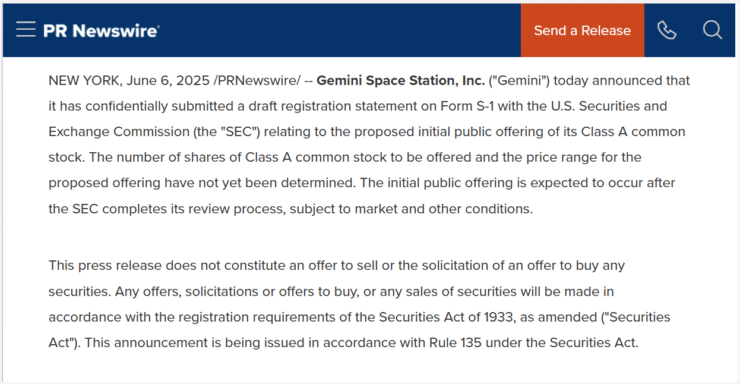

Cryptocurrency exchange Gemini, led by billionaire twins Cameron and Tyler Winklevoss, has taken a major step toward going public. On Friday, the New York-based company announced it has confidentially submitted a draft registration statement to the U.S. Securities and Exchange Commission (SEC) for a proposed initial public offering (IPO).

While the firm offered no further comment beyond its press release, the filing signals Gemini’s entry into a rising cohort of crypto companies exploring public listings amid renewed investor enthusiasm for digital assets.

Gemini’s potential IPO follows closely behind Circle’s highly anticipated public debut. Circle—the issuer of the USDC stablecoin—was met with strong market reception, highlighting a growing appetite among traditional investors for well-regulated, crypto-native firms. While Circle’s IPO was widely considered a landmark moment for the space, Gemini’s move strengthens the narrative that Web3 companies are increasingly integrating into mainstream financial infrastructure.

Founded in 2014, Gemini was built with a focus on compliance and institutional-grade infrastructure. In addition to its exchange services, the firm also operates a stablecoin (GUSD), NFT marketplace, and crypto custody offerings. The Winklevoss twins, early Bitcoin investors best known for their legal dispute over the origins of Facebook, have consistently positioned Gemini as one of the most regulation-forward companies in the crypto sector.

The exact valuation and timeline for the IPO remain undisclosed. Market observers will now closely watch the SEC’s review process and broader macro conditions that could shape Gemini’s debut on public markets.

Gemini Follows Circle, Eyes IPO Amid Regulatory Shift

Gemini’s IPO plans arrive on the heels of Circle’s blockbuster listing on the New York Stock Exchange, where its stock (CRCL) closed nearly four times above its initial offering price. The surprise rally has reignited momentum across the digital asset sector, encouraging other firms to pursue public listings amid shifting investor sentiment.

Gemini’s ambitions mirror the earlier public path of Coinbase, which in 2021 became the first major U.S. crypto exchange to go public. As institutional interest returns and valuations stabilize, the climate appears increasingly favorable for Web3-native companies to make the leap into public markets.

Adding fuel to the optimism is a changing regulatory landscape. Under President Trump’s new administration, the SEC has begun pulling back from the hardline enforcement tactics seen in recent years. Several high-profile lawsuits have been quietly dropped, and top officials have signaled a desire to foster open dialogue with crypto companies.

This softer tone could ease the IPO process for firms like Gemini, which has consistently emphasized regulatory compliance as part of its brand. The company’s timing—filing just one day after Circle’s successful IPO—suggests growing confidence that the U.S. is once again warming to crypto innovation.

Quick Facts

- Gemini has confidentially filed for an IPO with the SEC.

- The move comes just one day after Circle’s successful NYSE debut.

- Gemini was founded in 2014 by Cameron and Tyler Winklevoss.

- Its offerings include crypto exchange services, GUSD stablecoin, NFTs, and custody.

- Regulatory momentum under the Trump administration may support more crypto IPOs.