Bitcoin’s bullish momentum continues to build as Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), hinted over the weekend at another major Bitcoin acquisition—just days after the company’s latest $555 million purchase.

In a post on April 27, Saylor fueled speculation by writing, “Stay Humble. Stack Sats”—a phrase commonly used in Bitcoin circles to encourage steady, disciplined accumulation. His message follows Strategy’s announcement last week that it had added 6,556 BTC to its treasury at an average price of $84,785 per coin, bringing the firm’s total Bitcoin holdings to over 500,000 BTC.

Industry watchers now believe a fresh purchase announcement could be imminent, possibly as soon as Monday. The timing coincides with a notable uptick in whale activity. On-chain data shows a trend score of 0.90 for wallets holding over 10,000 BTC, indicating significant accumulation over the past several days.

This renewed institutional interest comes alongside broader market optimism, fueled by strong inflows into Bitcoin ETFs and growing confidence that Bitcoin will play an even larger role in institutional portfolios moving forward.

Strategy’s Bitcoin Leadership Spurs Global Corporate Adoption

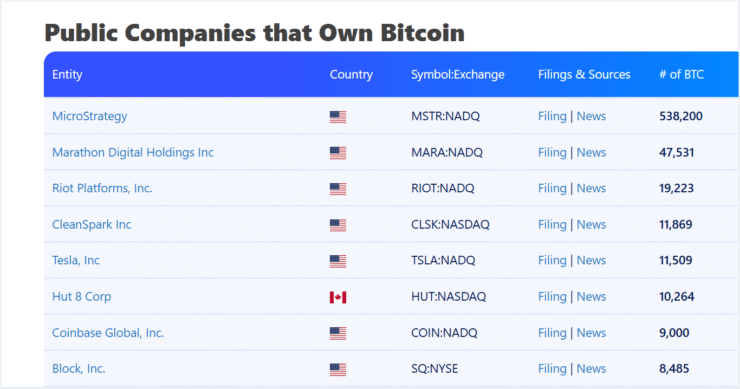

Strategy has firmly cemented its position as the world’s largest corporate holder of Bitcoin, with more than 538,200 BTC under its control—valued at over $50.5 billion, according to Bitbo data.

The firm’s aggressive Bitcoin accumulation strategy, spearheaded by Michael Saylor, has not only set a new benchmark in corporate treasury management but has also catalyzed a global wave of institutional adoption.

One notable example is Japan’s Metaplanet, which recently crossed a major milestone by amassing over 5,000 BTC as of April 24. Metaplanet has publicly positioned itself as Asia’s leader in Bitcoin adoption, directly modeling its approach after Strategy’s blueprint of using Bitcoin as a primary reserve asset.

As Bitcoin matures into a mainstream treasury component, Strategy’s influence continues to reshape how corporations worldwide approach digital asset exposure and long-term value preservation.

Bitcoin Whales and ETFs Power Surge

Bitcoin’s recent rally is being fueled by a renewed wave of whale accumulation and robust inflows into U.S. spot Bitcoin ETFs, signaling growing institutional and high-net-worth interest as BTC eyes the psychological $100,000 milestone.

According to data from Glassnode, the number of Bitcoin wallets holding at least $1 million worth of BTC surged from 124,000 on April 7 to over 137,600 by April 26. This sharp rise highlights that large investors have aggressively resumed accumulation, particularly during price dips below the $100,000 threshold.

At the same time, Bitcoin exchange-traded funds have seen explosive demand. U.S. spot Bitcoin ETFs recorded over $3 billion in net inflows over the past week, marking their second-highest week of net investments since launching. Data from Farside Investors shows that renewed ETF interest has played a crucial role in driving Bitcoin’s nearly 12% weekly recovery, pushing the asset closer to new highs.

Together, whale activity and ETF inflows are laying a strong foundation for Bitcoin’s next major move, with many analysts now predicting a potential breakout if current momentum sustains.

Quick Facts

- Bitcoin’s price has surged above $94,000, fueled by aggressive accumulation from large-scale investors.

- Michael Saylor of Strategy hinted at a new Bitcoin purchase, following a recent $555 million investment.

- The number of Bitcoin wallets holding over $1 million worth of BTC has surged notably in recent weeks.

- U.S. spot Bitcoin ETFs recorded over $3 billion in inflows last week, indicating strong institutional demand.