In a daring and attention-grabbing move, a crypto whale has positioned themselves at the center of market chatter by shorting $445 million worth of Bitcoin (BTC) while simultaneously taking a highly leveraged bullish stance on the MELANIA memecoin.

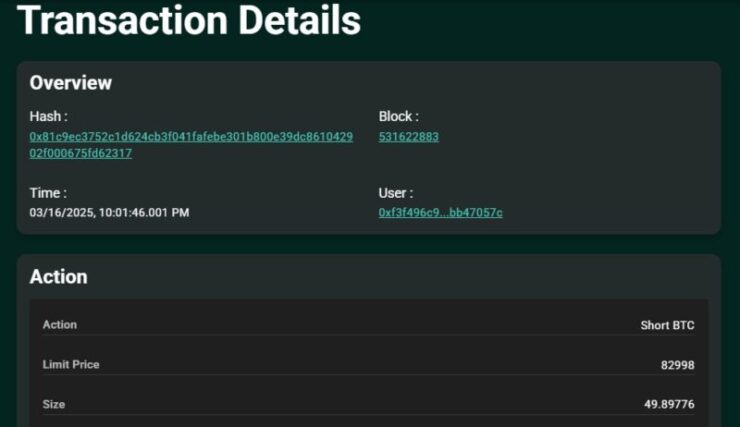

Despite Bitcoin stabilizing above $84,000, bouncing off its 200-day moving average last week, this whale took a starkly contrarian view. Using 40x leverage, the trader opened a colossal short position worth over $445 million on Bitcoin perpetual futures via the Hyperliquid platform. As of press time, this position has generated an unrealized gain of $1.3 million, with a tight liquidation threshold set at $86,000.

The move didn’t go unnoticed. On Sunday, pseudonymous trader CBB publicly rallied fellow traders on X to form a bullish coalition to force a short squeeze by driving BTC’s price above the whale’s liquidation level. In a coordinated effort, the market briefly pushed Bitcoin past $84,690, prompting the whale to deposit an additional $5 million USDC to shore up the margin and stave off liquidation. Despite the aggressive attempt, the whale’s position held firm.

Bullish on MELANIA Token Amid BTC Short

Interestingly, while shorting Bitcoin, the same whale opened a 5x leveraged long position on the emerging memecoin MELANIA, speculating on its price surge. The MELANIA token is linked to MKT World LLC, a Florida-registered company reportedly owned by Melania Trump, wife of U.S. President Donald Trump.

This whale’s bold play mirrors broader trends across crypto markets in recent months. Leveraged trades—both long and short—have surged, particularly as traders look to capitalize on high-risk, high-reward assets like memecoins. In parallel, major memecoins, including those tied to public figures or political themes, have seen meteoric rises, often fueled by social media hype and strategic timing.

Hyperliquid Applauds Transparency

The recent high-stakes Bitcoin short and memecoin long trades have not only shaken up the crypto market but also thrust decentralized exchange Hyperliquid into the spotlight. The platform took to X to highlight how its transparent trading framework played a pivotal role in making these headline-making moves visible to the public in real-time.

“When a whale shorts $450 million+ BTC and wants a public audience, it’s only possible on Hyperliquid,” the exchange proudly posted.

“Anyone can Photoshop a PNL screenshot. No one can question a Hyperliquid position, just like no one can question a Bitcoin balance. The decentralized future is here.”

By making every trader’s position viewable on-chain, Hyperliquid argues it’s redefining how trading transparency operates—eliminating doubts about trade authenticity and allowing the broader market to react in real-time.

Due to whale-driven market drama, this isn’t the first time Hyperliquid has been in the limelight. Last week, the platform made headlines when another influential whale executed a controversial “liquidation arbitrage” strategy. By strategically extracting floating profits, the whale created a margin shortage that triggered a cascade of liquidations, shifting risk exposure to Hyperliquid’s own HLP vault.

Quick Facts:

- A crypto whale has taken a $445 million short position on Bitcoin with 40x leverage, anticipating a price decline.

- The same investor is bullish on the MELANIA memecoin, reflecting a high-risk, high-reward strategy.

- Traders attempted to liquidate the whale’s Bitcoin short position by driving up the price but were unsuccessful.