A major Bitcoin whale has successfully closed a high-risk short position totaling over $516 million, capitalizing on a recent price correction ahead of the anticipated Federal Open Market Committee (FOMC) meeting this week.

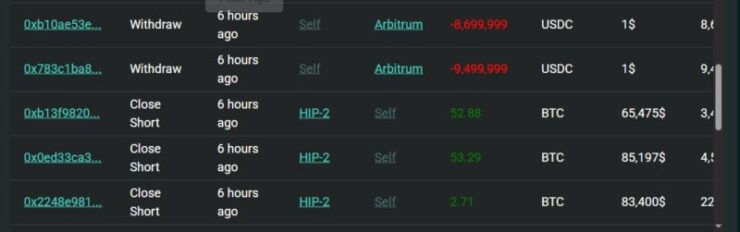

Blockchain data reveals that the investor opened a leveraged short position on 6,210 BTC, valued at approximately $84,043 per Bitcoin, utilizing 40x leverage to amplify potential gains. This strategy, however, exposed the whale to significant liquidation risk, with the position set to be liquidated if Bitcoin’s price surpassed $85,592.

During the trade, a publicly-coordinated group of traders led by pseudonymous trader CBB reportedly attempted to push Bitcoin’s price higher to force liquidation. In response, the whale injected an additional $5 million into the position, bolstering the margin and maintaining control.

Despite the pressure, the whale successfully closed the position within a few hours, realizing a profit of approximately $9.46 million.

Whale Shifts Focus to Ethereum After Closing Bitcoin Short

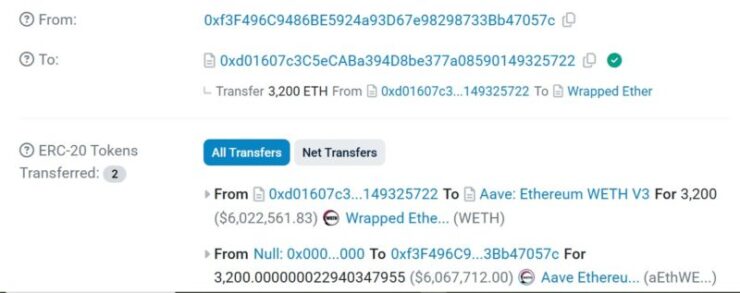

Following the successful closure of his high-profile Bitcoin short, the whale promptly redirected attention to Ethereum (ETH), using a portion of the profits to accumulate the asset. On-chain data from Etherscan shows the trader purchased over 3,200 ETH, valued at approximately $6.1 million, at 7:31 a.m. UTC on March 18.

The move to accumulate Ether coincided with heightened market anticipation ahead of the upcoming Federal Open Market Committee (FOMC) meeting scheduled for March 19.

Market participants widely expect the meeting to provide clearer signals on the Federal Reserve’s monetary policy direction for 2025—a key factor influencing investor sentiment toward risk assets like Bitcoin and Ethereum.

The timing of the whale’s transition from Bitcoin shorts to Ether accumulation suggests a strategic repositioning in response to shifting macroeconomic conditions and potential volatility surrounding the Fed’s policy outlook.

Bitcoin Faces Resistance Ahead of FOMC Meeting

Bitcoin’s price has recently encountered significant resistance at the $85,000 level, with multiple attempts to surpass this threshold proving unsuccessful. Since March 12, BTC has formed daily candle highs between $84,000 and $85,200, but has been unable to close above $84,600.

This price action unfolds in the context of the upcoming Federal Open Market Committee (FOMC) meeting, scheduled for March 18-19, where the Federal Reserve will announce its latest monetary policy decisions. The meeting is particularly significant for investors, as it may offer insights into the future direction of interest rates and economic policy.

Recent economic indicators show that inflationary pressures are beginning to ease. The February U.S. Consumer Price Index (CPI) reported a 2.8% year-on-year increase, slightly below the anticipated 2.9%, suggesting that inflation may stabilize.

Market participants widely expect the Federal Reserve to maintain current interest rates at 4.25% to 4.50% during this meeting. According to the CME FedWatch Tool, there is a 99% probability that rates will remain unchanged, with only a 1% chance of a 0.25% rate cut.

Historically, Federal Reserve meetings have considerably impacted the cryptocurrency market. Higher borrowing costs and a risk-averse environment drive investors away from speculative assets such as cryptocurrencies, resulting in decreased demand.

Analysts caution that if Bitcoin fails to break through the $85,000 resistance, it could drop to $73,000, a level identified as weak support. This scenario parallels the 2021 crypto market downturn, emphasizing the importance of risk management and historical analysis.

Quick Facts:

- A crypto whale earned $9.4 million in profit after shorting Bitcoin with $516 million at 40x leverage.

- The trader opened the position at Bitcoin’s price, ranging near $84,000, and closed it after the price dropped to around $83,000.

- High-leverage trading by whales remains a key driver of volatility and risk in crypto derivatives markets.