An unidentified cryptocurrency whale injected $14 million in Ether and repaid millions in stablecoins to prevent the forced liquidation of a $340 million position. The maneuver came amid a sharp market downturn that has already wiped out billions across decentralized finance (DeFi) platforms.

According to blockchain analytics firm Lookonchain, the whale holds 220,000 ETH in a MakerDAO vault — one of the largest positions on the platform. To reduce the risk of liquidation, the investor deposited 10,000 ETH, worth approximately $14.5 million, and repaid a total of 3.52 million DAI.

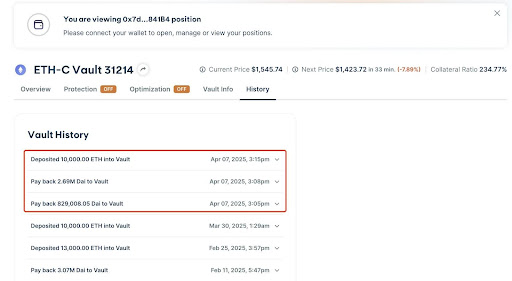

“If $ETH drops to $1,119.3, the 220,000 $ETH ($340M) will be liquidated,” Lookonchain stated on April 7. Ethereum was trading at $1,545.74 at the time of the adjustment, but was projected to fall to $1,423.72 within 33 minutes — a 7.89% decline.

Whale Adjusts Maker Vault to Avert Risk

The whale’s vault, identified as ETH-C Vault ID 31214, was significantly restructured. Prior to the changes, the position faced liquidation at higher price levels due to a mounting debt balance. As of the latest update, the vault holds a collateralization ratio of 234.76% with 220,000 ETH locked and approximately 144.85 million DAI in debt.

On April 7, the whale deposited 10,000 ETH, repaid 2.69 million DAI, and made an additional repayment of 829,008 DAI. These actions lowered the liquidation price to $1,119.30 — significantly below the projected near-term ETH price.

The whale’s strategy appears designed to give the vault more flexibility amid volatile market conditions. The vault still has over 60,000 ETH available to withdraw, suggesting the investor maintains a buffer despite the looming threat.

Massive Market Liquidations Intensify Pressure

The action followed a broader market rout that triggered widespread liquidations across major DeFi platforms. On April 6, another Ether investor lost more than 67,000 ETH — valued at over $106 million — in a liquidation event on Sky, another DeFi lending protocol.

Sky, like MakerDAO, uses overcollateralization to secure loans, typically requiring users to deposit at least $150 in ETH to borrow 100 DAI. But steep market drops rendered many positions vulnerable.

In the last 24 hours, over 446,000 positions were liquidated, with total losses exceeding $1.36 billion, according to CoinGlass. Of that, $1.21 billion were long positions, while $152 million were shorts. The single largest liquidation was a $7 million Bitcoin position on OKX.

Market turmoil followed a major policy move from U.S. President Donald Trump, who announced reciprocal import tariffs on April 2. The announcement triggered a historic $5 trillion loss in the S&P 500 — the index’s largest two-day drop on record.

Despite the selloff, some analysts see signs of stabilization ahead. Michaël van de Poppe, founder of MN Consultancy, said the tariff announcement may mark the end of market uncertainty. “Liberation Day is basically the peak of that period, the climax of uncertainty,” van de Poppe told Cointelegraph.

Crypto analytics firm Nansen estimates a 70% probability that markets could bottom by June, depending on how the tariff negotiations evolve. Market participants are now positioning for potential rebounds in digital asset prices over the coming weeks.