Ethereum co-founder Vitalik Buterin has proposed a fundamental change to the blockchain’s architecture by suggesting the replacement of the Ethereum Virtual Machine’s (EVM) contract language with the RISC-V instruction set—a move aimed at supercharging Ethereum’s execution speed and strengthening its position against high-throughput networks like Solana and Sui.

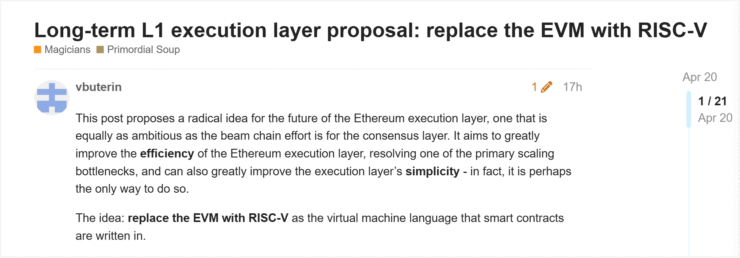

In a blog post published on April 20, Buterin outlined several critical bottlenecks hampering Ethereum’s long-term scalability. These include stable data availability sampling, sustaining competitive block production, and improving the performance of zero-knowledge (ZK) proof systems.

Buterin believes that adopting RISC-V—a free and open standard often used in chip design—could enhance smart contract execution and streamline ZK functions that are increasingly integral to Ethereum’s scaling roadmap.

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum,” Buterin wrote.

“But for the execution layer to see similar gains, this kind of radical change may be the only viable path.”

The proposal comes at a time when Ethereum is under growing pressure to maintain its leadership in the smart contract space. As monolithic blockchains with higher throughput continue to gain traction, the call to overhaul Ethereum’s core infrastructure reflects both a technical and strategic response to shifting market dynamics and investor concerns.

To ease the transition, Buterin emphasized that legacy EVM contracts would remain functional and interoperable with the new RISC-V standard. His proposal outlines a dual-support structure that includes both EVM and RISC-V contracts running in parallel, as well as the development of an interpreter to convert EVM code into RISC-V format when needed.

“There are a number of ways to implement this kind of proposal. The least disruptive is to support two VMs, and allow contracts to be written in either one,” he wrote.

This hybrid model, he suggests, would future-proof Ethereum’s execution layer without alienating existing developers or disrupting critical smart contract infrastructure already in use.

Ethereum Faces Revenue Squeeze as Fees Collapse

Ethereum’s long-standing scalability challenges have taken a new toll on its economic fundamentals, with recent data revealing a collapse in both network fee revenue and Ether’s market performance.

According to Etherscan, blob fees—transaction fees collected from Ethereum’s layer-2 networks—plummeted to just 3.18 ETH during the week of March 30, amounting to roughly $5,000 at the time. That figure reflects one of the lowest weeks for layer-2-related income since the introduction of EIP-4844.

In April 2025, Ethereum’s average transaction fees dropped to approximately $0.16—marking the network’s lowest fee environment since 2020. While this drop is partly a win for user accessibility, it also underscores a growing concern: revenue leakage from Ethereum’s base layer due to the success of its own layer-2 scaling solutions.

Brian Quinlivan, marketing director at on-chain analytics platform Santiment, attributed the drop to a shift in user behavior.

“Instead of sending base-layer transactions, users are increasingly engaging with smart contracts or transacting through more cost-efficient layer-2 platforms,” he said.

While layer-2 adoption has dramatically lowered costs and improved throughput, it has also cannibalized fee income on the main Ethereum chain. This has raised red flags for long-term sustainability and investor sentiment. As confidence erodes, Ether has seen substantial price pressure, with analysts warning that it could dip as low as $1,100 if revenue concerns continue to mount and the base layer remains underutilized.

Quick Facts

- Vitalik Buterin proposes replacing Ethereum’s EVM contract language with RISC-V to enhance execution efficiency.

- The proposal aims to address scalability bottlenecks and improve zero-knowledge function performance.

- Ethereum’s network fees have dropped to their lowest since 2020, raising concerns over base layer revenue.

- The RISC-V transition could help Ethereum stay competitive with high-throughput blockchains.