Ethereum co-founder Vitalik Buterin has spoken out in support of early Bitcoin investor Roger Ver, calling his prosecution “absurd” and “politically motivated.” As Ver faces extradition to the U.S. over alleged tax evasion, the case has ignited a broader debate on regulatory overreach, financial sovereignty, and the U.S. government’s stance on crypto.

On April 30, 2024, the U.S. Department of Justice (DOJ) charged Roger Ver with tax evasion, alleging he failed to pay exit taxes after renouncing his American citizenship. Shortly after, Spanish authorities arrested Ver, holding him in prison for several weeks before he posted $163,000 in bail on May 17, 2024.

While free on bail in Spain, Ver remains in legal limbo, fighting extradition to the U.S. His legal team has argued that the U.S. exit tax law is unconstitutional, calling it vague and a violation of due process.

Ver, widely known as “Bitcoin Jesus” for his early advocacy of cryptocurrency, maintains that the case is not about taxes but about punishing him for his pro-crypto stance.

Vitalik Buterin Condemns Ver’s Prosecution as “Politically Motivated”

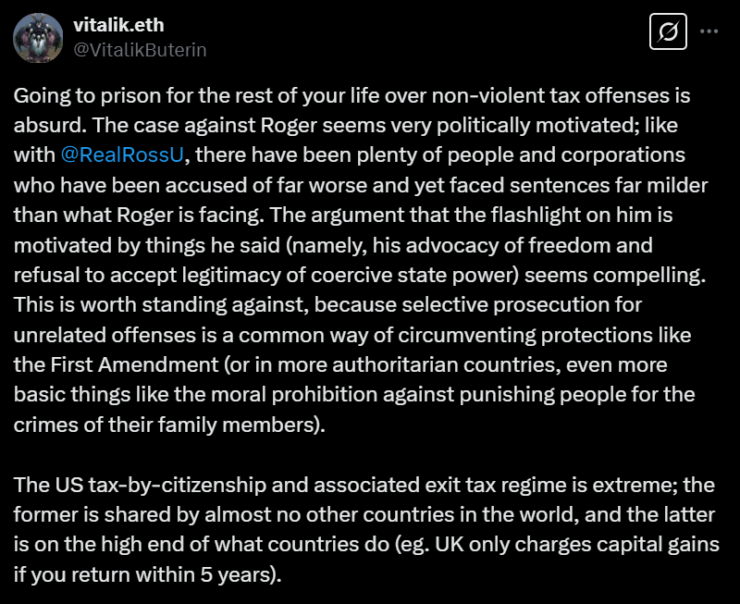

Vitalik Buterin has now publicly joined the growing chorus of voices calling for an end to the case against Ver. Reposting a message from Silk Road founder Ross Ulbricht, Buterin labeled the case an overreach by the U.S. government.

“The US tax-by-citizenship and associated exit tax regime are extreme. The former is shared by almost no other countries in the world, and the latter is on the high end of what countries do,” Buterin wrote.

He pointed out that in the UK, expatriates only pay capital gains tax if they return within five years, a stark contrast to the U.S. exit tax policy, which taxes citizens based on their assets at the time of renunciation.

Even more troubling, Buterin highlighted allegations that the IRS pressured Ver’s legal team to obtain privileged information, calling it a “bad faith move” that could undermine the integrity of the case.

Crypto Community Sees Ver as a Target of Anti-Crypto Policies

Ver’s case has drawn widespread criticism from crypto investors and advocates, many of whom believe that the Biden administration has ramped up its crackdown on crypto entrepreneurs.

Some see Ver’s prosecution as part of a larger pattern of aggressive enforcement actions targeting high-profile figures in the industry, including:

- Coinbase and Binance’s regulatory battles with the SEC.

- Criminal charges against FTX founder Sam Bankman-Fried.

- The DOJ’s previous scrutiny of Tether (USDT) and stablecoin issuers.

The timing of the case has fueled speculation that U.S. regulators are using taxation as a pretext to target outspoken crypto advocates.

The Growing Push for U.S. Tax Reform

Ver’s legal fight also coincides with a renewed push for tax reform in the U.S. As dissatisfaction with the Internal Revenue Service (IRS) grows, some lawmakers and citizens are advocating for:

- Abolishing income tax altogether.

- Dismantling the IRS.

- Replacing the current system with a flat tax or national sales tax.

While these proposals remain politically contentious, Ver’s case has reignited debate about whether U.S. tax laws are too punitive, particularly for expatriates.

The Future of Ver’s Case

As Roger Ver fights extradition from Spain, his legal team is moving to dismiss the charges entirely. Whether he succeeds or not, his case raises fundamental questions about the U.S. government’s approach to financial sovereignty, crypto, and taxation.

Meanwhile, with figures like Buterin, Ulbricht, and other crypto leaders speaking out, the case could evolve into a wider battle over regulatory overreach.

A Defining Moment for Crypto Freedom

The U.S. government’s case against Roger Ver isn’t just about taxes, it’s about the future of crypto advocacy, financial freedom, and the limits of government control. With Vitalik Buterin now publicly backing Ver, pressure is mounting to end the prosecution and set a precedent for how crypto pioneers are treated worldwide.

Will Ver win his fight against extradition, or will his case become a warning sign for other crypto entrepreneurs? The next few months could determine the future of regulation and financial independence for the crypto industry.