Ethereum co-founder Vitalik Buterin has once again made waves in the crypto market this time by offloading a series of meme tokens for 71.69 ETH, valued at approximately $136,684, and minting 315,382 DAI. The move, flagged by OnchainLens, comes amid growing scrutiny of the meme coin sector’s speculative frenzy and volatility.

Buterin’s token dump included sizable holdings of FML, SHIB, VB, and AWESOME, with the bulk of sales triggering modest price reactions, except for his earlier trade involving DHN, which sent shockwaves through that project’s market.

Among the meme tokens liquidated were:

- 146.18 billion FML — sold for 2.51 ETH

- 180.88 billion SHIB (Shiba Inu) — sold for 0.987 ETH

- 7.17 billion VB — sold for 1.57 ETH

- 366.47 million AWESOME — sold for 1.44 ETH

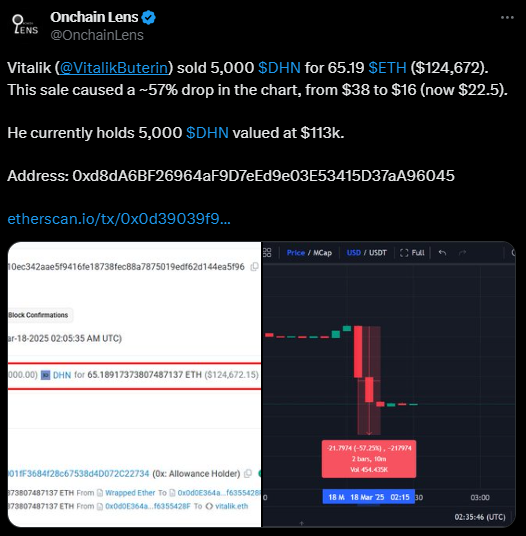

These moves pale in comparison to Buterin’s earlier 65.19 ETH ($124K) sale of 5,000 DHN tokens, which tanked DHN’s price by 57%, collapsing from $38 to $16 almost instantly. Despite the sell-off, Buterin still holds another 5,000 DHN, now worth around $113,000—a holding that keeps market watchers on edge.

What’s Driving Vitalik’s Meme Token Exit?

While Buterin has made no official statement, his actions speak volumes about his stance on meme tokens and their hyper-speculative nature. Known for occasionally donating or selling meme coins he receives unsolicited, Buterin’s sell-offs often signal discomfort with unsustainable hype cycles surrounding such projects.

The timing also raises questions. With Ethereum’s broader ecosystem stabilizing and meme coins seeing surging yet volatile valuations, Buterin’s liquidation suggests he’s positioning away from assets that lack long-term fundamentals.

Moreover, minting 315K DAI one of the market’s most trusted stablecoins, indicates a shift towards stability and liquidity, a prudent move amid potential market uncertainty.

How High-Profile Exits Impact Meme Coin Markets

Whenever an influential figure like Buterin offloads tokens, the effect is immediate. The DHN crash serves as a prime example, wiping out more than half its value in hours.

These trades fuel debates within the crypto community:

- Are meme coins a legitimate part of the ecosystem or simply retail traps primed for pump-and-dump schemes?

- Do developers and whales wield too much price influence in these thin markets?

While meme tokens like Shiba Inu (SHIB) boast massive communities and billion-dollar valuations, events like this highlight the fragile trust and unpredictable nature of meme coin investing.

As Buterin’s latest trades ripple across the market, interest in his personal journey is also surging. “Vitalik: An Ethereum Story”, a documentary exploring his rise as one of crypto’s most influential pioneers, is slated for release April 15 on Apple TV and Prime Video.

The film offers an intimate look at how a curious teenager evolved into the mind behind Ethereum the platform that launched DeFi, NFTs, and countless meme coins that now dominate the crypto landscape.

Final Takeaway

Buterin’s strategic exit from meme tokens may be more than a simple trade it could be a subtle commentary on the sector’s fragility. As crypto markets mature, high-profile moves like this highlight the growing divide between fundamental-driven assets and speculative meme coins that rely on hype rather than utility.

For investors, the message is clear: meme tokens remain high-risk, high-volatility plays—and when the creator of Ethereum signals caution, the market would be wise to listen.

With meme coins dominating headlines and institutional money eyeing crypto, the coming months will reveal whether meme mania fades or finds a way to evolve beyond its speculative roots.