In a major shift for crypto regulation, Vermont has officially dropped its legal challenge against Coinbase’s staking services, citing the SEC’s recent decision to abandon its case.

This move signals a potential loosening of regulatory pressure on staking services, a key battleground in the ongoing fight between U.S. regulators and the crypto industry.

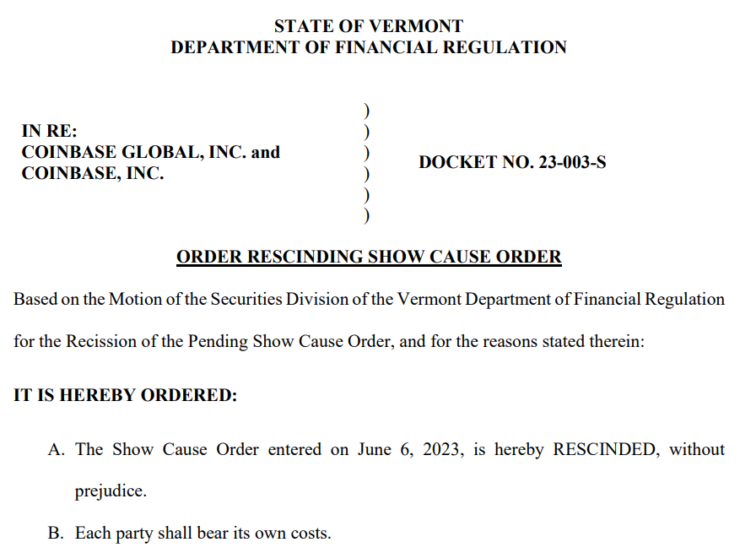

Vermont’s Department of Financial Regulation announced on March 13 that it would rescind its “show cause order” against Coinbase, following the SEC’s dismissal of its lawsuit against the exchange on Feb. 28.

“In light of the dismissal of the Federal Action and the likelihood of new federal regulatory guidance, the Division believes it would be most efficient and in the best interests of justice to rescind the pending Show Cause Order, without prejudice,” Vermont regulators stated.

Vermont was one of 10 U.S. states that joined the SEC in June 2023, alleging that Coinbase’s staking services constituted unregistered securities offerings. However, with the SEC dropping its case, Vermont has become the first state to back down, setting a precedent that could influence other jurisdictions.

Coinbase Calls for More States to Follow Vermont’s Lead

Coinbase’s Chief Legal Officer, Paul Grewal, welcomed Vermont’s decision, urging other states that still have ongoing staking-related actions to “take a page from Vermont’s playbook.”

“As we have always said: staking services are not securities. We applaud Vermont for embracing progress and providing clarity for its citizens who own digital assets,” Grewal wrote in a March 13 post on X.

However, Grewal emphasized that the fight isn’t over. He called on Congress to seize bipartisan momentum and pass comprehensive digital asset legislation, particularly laws recognizing the unique nature of staking services in the crypto ecosystem.

The collapse of the SEC’s case against Coinbase’s staking program marks another blow to the aggressive regulatory approach championed by former SEC Chair Gary Gensler, who resigned on 20 January.

Under Gensler’s tenure, the SEC launched over 100 enforcement actions against crypto firms, targeting everything from staking and lending services to exchange operations.

However, since his departure, there has been a wave of case dismissals, including:

- Cumberland DRW, a crypto trading firm, saw its SEC case dropped on March 4.

- The SEC is reportedly wrapping up its four-year enforcement action against Ripple Labs, signaling a possible end to one of its most contentious legal battles.

Coinbase isn’t stopping at legal victories—it’s demanding transparency. The exchange filed a Freedom of Information Act (FOIA) request seeking details on the number of enforcement actions brought against crypto firms under Gensler’s leadership, including the total cost to U.S. taxpayers.

What’s Next for Crypto Staking in the U.S.?

With Vermont stepping back and the SEC’s case unraveling, the battle over staking regulation in the U.S. is entering a new phase. While some states may still hold out, Vermont’s withdrawal could pressure others including California, New Jersey, and Illinois—to reconsider their stance.

Meanwhile, the broader fight over crypto policy continues in Washington, with lawmakers debating whether staking should be classified as an investment contract (security) or a standard service offered in decentralized networks.

Will other states follow Vermont’s lead, or will the fight over staking continue to be a legal minefield for crypto firms? The next few months could determine the future of staking regulations in the U.S