Ethereum’s role as an investment vehicle is coming under fire, with venture capitalists and market analysts pointing to Layer-2 networks and excessive token creation as key factors eroding the network’s value proposition.

In a stark critique on March 28, Castle Island Ventures partner Nic Carter declared that Ether “died by its own hand,” calling out what he sees as an internal breakdown in Ethereum’s economic model.

According to Carter, the root of the problem lies in “greedy L2s” siphoning users, transaction volume, and fees from the Layer-1 Ethereum chain, while providing minimal value back to the base network.

“The #1 cause of this is greedy Eth L2s siphoning value from the L1 and the social consensus that excess token creation was A-OK,” Carter posted on X.

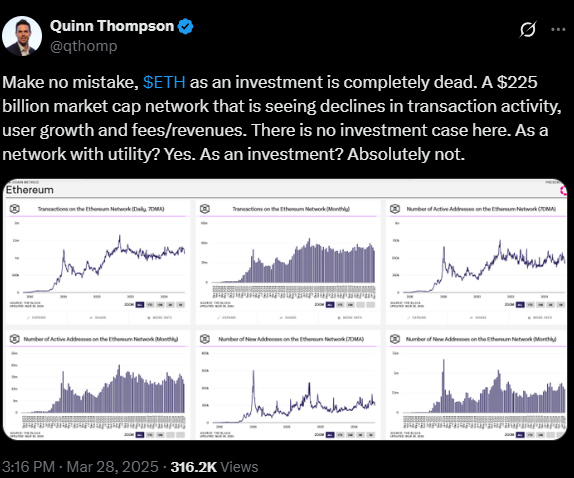

He was responding to Lekker Capital founder Quinn Thompson, who asserted that Ether is now “completely dead” as an investment, citing falling user growth, transaction activity, and fee revenues.

“A $225B market cap network that is seeing declines in transaction activity, user growth and fees/revenues. There is no investment case here. As a network with utility? Yes. As an investment? Absolutely not,” Thompson stated.

ETH Struggles to Keep Pace With Bitcoin

The ETH/BTC ratio has tumbled to 0.02260, its lowest point in nearly five years, reflecting Ethereum’s declining strength relative to Bitcoin.

At the time of writing, ETH trades at $1,894, down over 5% in the past week, according to CoinMarketCap.

Critics argue that Ethereum’s revenue model has broken down as activity has migrated to Layer-2 chains, which operate independently and bypass the fee structure of the Ethereum mainnet.

A September 2024 report from Cointelegraph Magazine found Ethereum’s fee revenue collapsed by 99% over six months, attributing it to “extractive L2s” that absorbed users and liquidity while contributing little to Layer 1.

Not all experts are writing Ethereum off. Adam Cochran of Cinneamhain Ventures proposed “Based Rollups” as a structural solution to redirect economic value back to Ethereum L1. By altering incentive models, Cochran believes these rollups could restore monetization potential and revive ETH’s investment appeal.

The criticisms come just months after bullish forecasts predicted Ethereum would hit $10,000 by the end of 2025.

That sentiment has since faded amid the broader market pullback and waning enthusiasm for Ethereum’s growth metrics.

Bulls Still See Opportunity

Despite bearish takes from institutional voices, not everyone is abandoning ship.

Pseudonymous traders Doctor Profit and Merlijn The Trader have both recently expressed “insanely bullish” views on ETH, calling it one of the best long-term opportunities in the market today.

While the short-term narrative remains divided, the long-term future of ETH may depend on how quickly Ethereum can rebalance value flows between its layers and reestablish its status as a store of value within Web3.