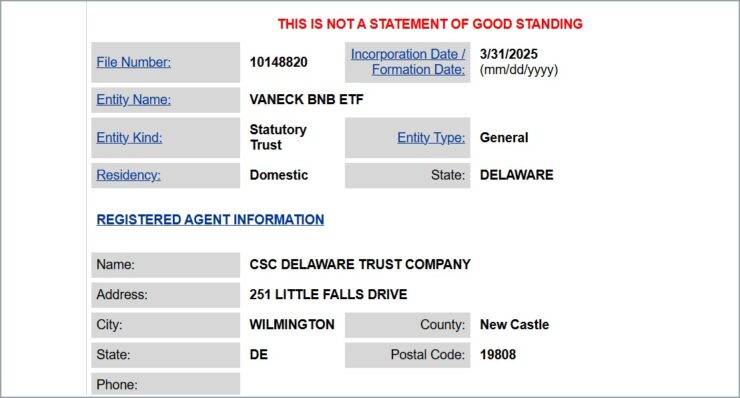

Asset manager VanEck has registered a new trust named “VanEck BNB ETF” with the Delaware Division of Corporations, signaling a possible move to launch the first U.S.-based exchange-traded fund tied to Binance Coin (BNB). The registration, dated March 31, marks an early but critical step in the ETF formation process—one that typically precedes a formal filing with the U.S. Securities and Exchange Commission.

The registration, filed under number 10148820, indicates VanEck’s intention to create an investment vehicle that would track the performance of BNB, the native cryptocurrency of Binance’s BNB Chain ecosystem. BNB currently ranks as the fifth-largest cryptocurrency by market capitalization, trading around $598 at the time of the filing.

Such a fund would mark the first attempt to bring a BNB-focused ETF to American markets if pursued. Currently, the only regulated BNB investment product available is the 21Shares Binance BNB ETP, which trades on several European exchanges.

Still, market watchers have urged caution. Delaware’s public registry has seen prior instances of unauthenticated crypto-related ETF listings, prompting some skepticism until a corresponding SEC filing is made. Nonetheless, VanEck’s reputation as an early mover in the digital asset ETF space lends credibility to the filing, particularly given its active history with similar products tied to Bitcoin, Ethereum, Solana, and Avalanche.

VanEck’s Expanding Crypto ETF Portfolio

VanEck’s recent BNB trust registration adds to its growing roster of crypto ETF efforts, making it the fifth digital asset-focused filing the firm has made in Delaware. Prior filings include trusts for Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Avalanche (AVAX)—each aimed at building a diverse suite of regulated crypto investment products.

The firm has been active on multiple fronts in recent months. On March 14, VanEck submitted an S-1 form to the U.S. Securities and Exchange Commission for a proposed Avalanche ETF, just days after registering the trust in Delaware. Its spot Solana ETF, filed last June, was formally acknowledged by the SEC in February.

As one of the earliest institutional players in the crypto ETF space—having filed the first Bitcoin futures ETF application in 2017—VanEck continues to position itself at the forefront of digital asset adoption. The latest BNB filing signals a continued push to offer investors broader exposure to the evolving crypto landscape through familiar financial instruments.

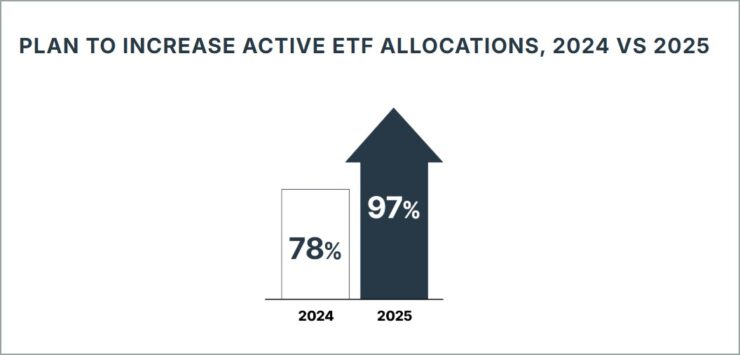

The registration aligns with a growing trend among asset managers to diversify their crypto offerings amid increasing investor interest. A recent survey revealed that 71% of ETF investors plan to increase their cryptocurrency allocations within the next year. This surge in demand reflects a broader acceptance of digital assets in traditional investment portfolios.

Quick Facts

- VanEck registered the “VanEck BNB ETF” trust in Delaware on March 31, 2025.

- This marks VanEck’s fifth crypto ETF registration in the state, following BTC, ETH, SOL, and AVAX.

- BNB is the fifth-largest cryptocurrency, trading around $598 at the time of filing.

- 71% of ETF investors intend to increase crypto allocations in the coming year.