The U.S. Treasury Department is pushing to end its court battle over Tornado Cash without a final ruling, a move that could have lasting consequences for decentralized privacy protocols and crypto regulation.

Following Tornado Cash’s recent delisting from sanctions, the Treasury now argues the case is “moot,” but critics say the fight is far from over.

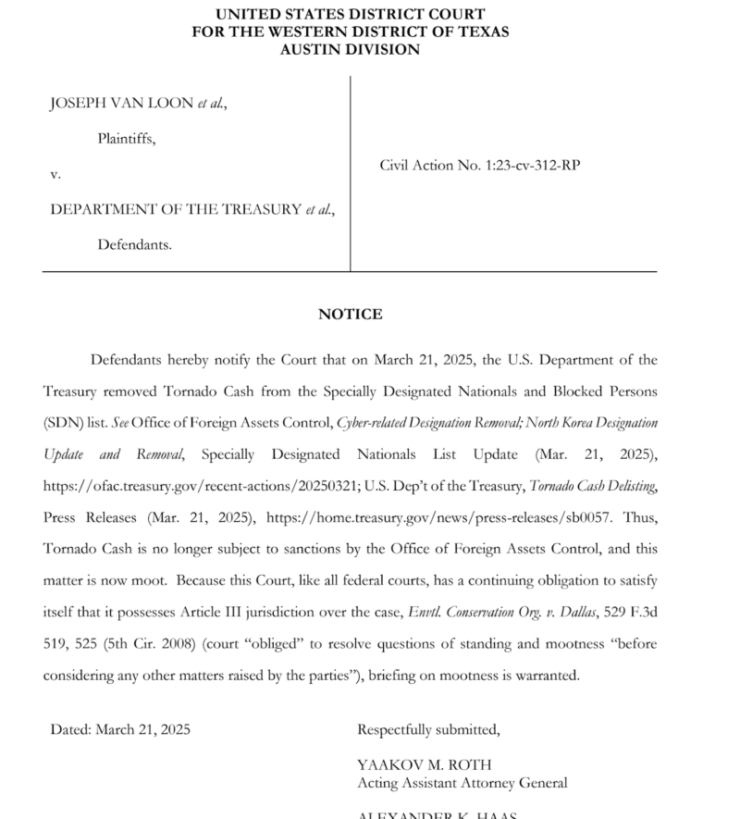

After two years of legal wrangling, the Treasury’s Office of Foreign Assets Control (OFAC) unexpectedly dropped Tornado Cash and related smart contract addresses from the Specially Designated Nationals (SDN) list on March 21.

However, instead of allowing the court process to conclude, the agency now claims that since Tornado Cash is delisted, a final judgment is unnecessary.

“Briefing on mootness is warranted,” the Treasury stated, asserting that federal courts must ensure they maintain jurisdiction.

Coinbase Calls Out Treasury’s Attempt to Escape Judgment

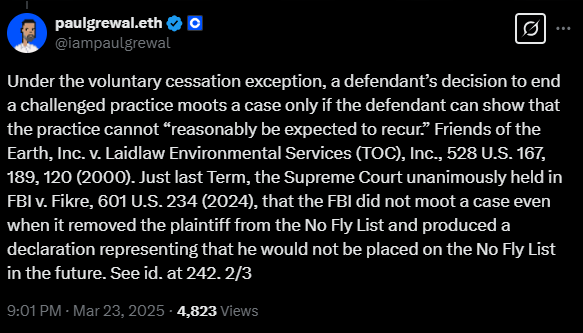

Coinbase’s Chief Legal Officer Paul Grewal quickly pushed back, accusing the Treasury of trying to sidestep accountability. “That’s not the law, and they know it,” Grewal said, referencing the “voluntary cessation” doctrine — a legal principle that prevents defendants from temporarily halting actions just to avoid a ruling.

Grewal argued the Treasury provided “no assurance” that Tornado Cash won’t be re-sanctioned in the future — leaving the platform and developers in ongoing legal uncertainty.

Grewal pointed to a 2024 Supreme Court case involving the No Fly List, where the Court ruled that removing someone from the list didn’t automatically nullify the case because the ban could be reinstated.

The parallel is clear: delisting Tornado Cash without a final ruling leaves the door open for future re-designation, undermining the community’s demand for legal clarity on decentralized protocols.

The Ongoing Legal Saga — Sanctions, Appeals, and Criminal Trials

The lawsuit — led by six Tornado Cash users and supported by Coinbase — challenged the legality of sanctioning immutable smart contracts. After mixed rulings, an appeals court ultimately sided with Tornado Cash in January 2025, forcing the Treasury’s hand.

Yet, Tornado Cash’s legal troubles aren’t over. Founders Roman Storm and Roman Semenov still face criminal charges for allegedly enabling over $1 billion in laundering. Semenov remains on the FBI’s Most Wanted list, while Storm awaits trial in April.

Meanwhile, developer Alexey Pertsev continues his legal battle in Europe after securing release from Dutch prison.

The Takeaway

The Treasury’s latest maneuver reveals deeper tensions in U.S. crypto policy, how far can regulators go in policing decentralized, open-source protocols?

For now, the crypto community is bracing for a renewed courtroom fight. The outcome could shape the future of DeFi privacy tools and clarify whether governments can re-sanction protocols at will, leaving developers and users in perpetual legal limbo.