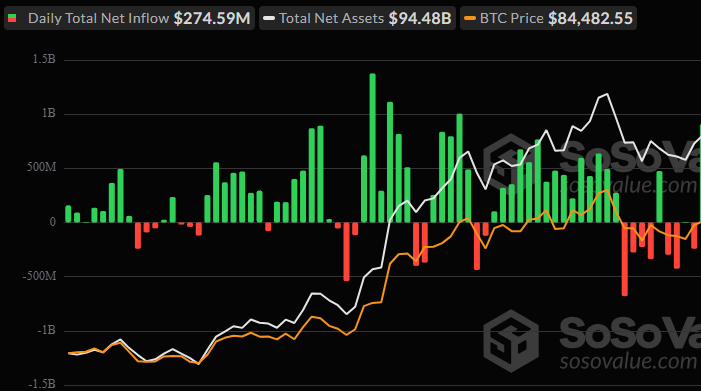

After weeks of mounting pressure, U.S. spot Bitcoin ETFs roared back with their strongest daily inflow in over a month of $274.6 million in net new investments on Monday.

The surge marks a potential shift in sentiment as institutional investors return to the crypto market, eyeing Bitcoin’s price stabilization and the appeal of lower-fee products.

The sudden turnaround comes after five consecutive weeks of outflows, during which the funds hemorrhaged nearly $5.4 billion, according to SoSoValue data. Monday’s inflow could signal renewed confidence in Bitcoin’s long-term prospects—just as the market heads into the critical quarter-end rebalancing period.

Crypto analyst Rachael Lucas from BTC Markets attributes the inflow spike to several converging factors:

- Bitcoin’s price stabilized around $83,000 after weeks of intense volatility

- Institutional portfolio rebalancing ahead of the quarter’s end

- Rising demand for cost-efficient ETFs as investors shift toward funds offering lower management fees

“This shift suggests growing confidence, driven by Bitcoin’s price stabilization and renewed institutional interest,” Lucas explained.

With Bitcoin recently swinging between $78,500 and $94,000, many investors have stepped back. But as prices stabilized, funds again opened their doors to inflows—this time, without a single ETF reporting net outflows for the day.

Fidelity, ARK, and BlackRock Lead the Charge

Among the standout performers:

- Fidelity’s FBTC pulled in $127.3 million, leading the pack.

- ARK and 21Shares’ ARKB followed closely with $88.5 million in new capital.

- BlackRock’s IBIT, the largest spot Bitcoin ETF by assets, reported $42.3 million in net inflows.

- Grayscale’s Mini Bitcoin Trust and Bitwise’s BITB also ended the day in positive territory.

Monday’s total trading volume topped $1.87 billion, pushing cumulative net inflows across spot Bitcoin ETFs to a robust $35.58 billion since their market debut.

Despite the inflow surge, analysts remain cautious. Bitcoin’s recent rally to $83,000 offers some relief, but volatility is far from over.

“Volatility is expected to continue,” Lucas warned. “With quarter-end approaching, investors are closely monitoring positioning shifts. Institutional rebalancing could fuel additional inflows, but any price weakness might trigger another wave of outflows.”

This tug-of-war between bullish institutional flows and lingering market uncertainty will define the coming weeks. The possibility of further rebalancing-driven inflows may act as a tailwind but equally, another sharp downturn in price could spark renewed selling.

The Bigger Picture

Monday’s inflows mark more than a technical rebound; they hint at growing institutional comfort with Bitcoin as an asset class. With spot Bitcoin ETFs now fully embedded in the market, investors increasingly treat them like traditional commodities or index funds—rotating in and out based on macro conditions and risk appetite.

The initial hype cycle that drove early ETF flows has given way to a more calculated approach, where factors like fee structures, liquidity, and macro positioning dominate decision-making.

Final Takeaway

The $274 million surge into U.S. spot Bitcoin ETFs may be the first sign of a broader institutional rotation back into crypto—but it’s far too early to declare victory.

As quarter-end approaches, investors remain cautious, weighing the potential for further inflows against the still-present risk of market pullbacks.

What’s clear is this: Bitcoin ETFs are no longer just a speculative novelty. They’re rapidly becoming a permanent fixture of institutional portfolios, ready to respond to macro shifts like any other major asset class.

The question is whether this momentum holds—or if another bout of volatility sends funds back into retreat.