The rapid decline of the US dollar is fueling bullish sentiment for Bitcoin (BTC), with investors increasingly turning to digital assets as a hedge against fiat currency weakness.

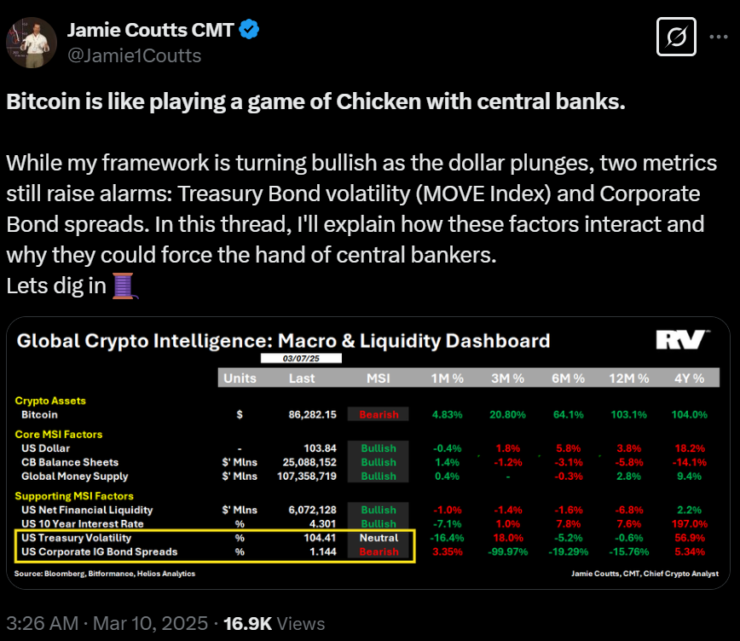

However, Real Vision crypto analyst Jamie Coutts warns that despite a weakening US Dollar Index (DXY), two key metrics—Treasury bond volatility (MOVE Index) and corporate bond spreads, could present risks for Bitcoin’s short-term trajectory.

While Bitcoin’s long-term bullish case remains intact, macro uncertainty could introduce unexpected headwinds.

Coutts framed Bitcoin’s current position as a “game of chicken” with central banks, suggesting that while BTC has strong tailwinds, financial instability could lead to unexpected reversals.

“The dollar’s depreciation, one of the largest in 12 years this month remains the primary driver in my framework,” he noted.

Still, rising Treasury bond volatility and widening corporate bond spreads signal potential trouble. If these indicators worsen, liquidity conditions could tighten, possibly forcing central banks to intervene in ways that impact Bitcoin’s momentum.

The US Dollar Index Drops to a Four-Month Low

The US Dollar Index (DXY), which measures the strength of the dollar against a basket of other major currencies, fell to 103.85 on March 10, its lowest level in four months.

Historically, a declining DXY has been a bullish signal for risk assets, including Bitcoin and equities.

However, Coutts cautions that Treasury bond volatility remains a wild card. The MOVE Index, which tracks expected Treasury volatility, is stable but climbing.

“With the dollar’s rapid decline in March, one might expect volatility to compress or if it doesn’t, for the dollar to reverse, which is bearish,” he explained.

In other words, if bond market instability continues, it could undermine Bitcoin’s bullish momentum.

Corporate Bond Spreads

Another factor that could spell trouble for Bitcoin is the widening corporate bond spreads.

According to Coutts, corporate bond spreads have been expanding for three consecutive weeks, and historically, major reversals in these spreads have coincided with Bitcoin price tops.

If this trend continues, it could suggest that financial conditions are tightening, reducing risk appetite and potentially impacting Bitcoin’s ability to sustain its gains.

Bullish Factors Still in Play

Despite these concerns, Bitcoin has several strong catalysts supporting its bullish case:

- A global race for Bitcoin reserves as more governments and institutions accumulate BTC.

- Michael Saylor’s continued BTC purchases, with estimates that MicroStrategy could add another 100,000 to 200,000 BTC this year.

- Spot Bitcoin ETFs could double their holdings, increasing demand.

- Growing liquidity from institutional and retail investors, further reinforcing price support.

Bravos Research echoed this sentiment on March 6, stating that a declining DXY “could be a major tailwind for risk-on assets like stocks and crypto.”

The Road Ahead

Bitcoin’s relationship with macroeconomic forces is becoming increasingly complex. While a declining dollar strengthens its long-term investment case, short-term risks from bond market volatility and tightening liquidity remain a concern.

Coutts suggests that if Bitcoin holders remain unleveraged, BTC will likely outlast central bank interventions and financial instability. For now, Bitcoin bulls are in control, but the next moves in bond markets and liquidity conditions will determine whether BTC’s rally extends or faces new hurdles.

Bitcoin’s “high-stakes game of chicken” with central planners is far from over, but the odds may be tipping in its favor.