A prominent early investor in Uber has ignited a firestorm in the Bitcoin community by suggesting that the world’s leading cryptocurrency is destined to be replaced. Jason Calacanis, a well-known angel investor, argued that Bitcoin’s dominance is temporary and that the time has come to “build a better Bitcoin.”

His remarks, posted on March 14, quickly drew criticism from Bitcoin advocates, industry executives, and layer-2 developers, who argued that Bitcoin’s position is unshakable and that improvements will come on top of the existing network, not as a replacement.

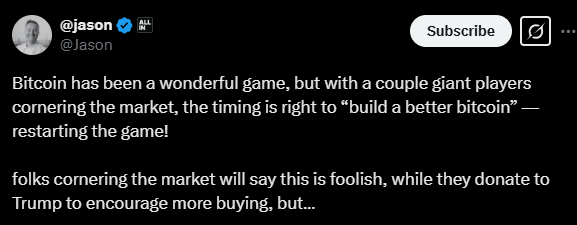

Calacanis, an early investor in Robinhood and Bitcoin startup Keza, took to X (formerly Twitter) to share his belief that Bitcoin’s reign won’t last forever.

“Bitcoin has been a wonderful game, but with a couple of giant players cornering the market, the timing is right to build a better Bitcoin — restarting the game,” he wrote to his 981,600 followers.

He added that Bitcoin is no different from other technologies that have eventually been replaced, arguing that innovation will ultimately push Bitcoin aside in favor of something more advanced.

The comments triggered immediate backlash from Bitcoin supporters, who argued that Bitcoin is not just another tech product but a fundamental shift in money and value transfer.

Bitcoin Founders and Industry Leaders Push Back

Prominent figures in the Bitcoin space rejected the idea that Bitcoin could be replaced, emphasizing that Bitcoin will evolve through second-layer solutions instead of being replaced.

- Brady Swenson, co-founder of Swan Bitcoin, countered: “Winning protocols don’t get replaced; they are built upon. Bitcoin will never be replaced as a protocol for value transfer.”

- Cory Klippsten, Swan’s other co-founder, took a broader stance, arguing that Bitcoin’s impact extends beyond just being a technology: “Bitcoin is a technological revolution changing all industries, not following the adoption curve of a single technology like an iPad.”

- David Marcus, CEO of Lightspark (and former PayPal executive), emphasized the power of layer-2 solutions: “What it lacks in functionality can be built on L2s. Trying to build a better Bitcoin is a fool’s errand.”

- Eric Voorhees, CEO of ShapeShift, agreed that Bitcoin’s base layer should remain unchanged, but added that other blockchains could offer additional features.

The argument highlights a growing industry consensus that Bitcoin itself doesn’t need to change—its improvements will come from additional layers that build on top of it, such as the Lightning Network.

Bitcoin’s Growing Network Effect Makes Replacement Unlikely

Beyond the tech debate, some industry leaders argued that Bitcoin’s sheer size and adoption make its replacement highly improbable.

- Wayne Vaughan, a Bitcoin advocate, explained that many misunderstand Bitcoin’s resilience: “People wrongly assume Bitcoin is easily replaceable because they see it as just an asset, application, or platform. I think of Bitcoin as a network. The larger the network gets, the less likely it is for something else to replace it.”

- Matt Cole, CEO of Strive Funds, dismissed the idea that a “better Bitcoin” could emerge: “There will not be a ‘better’ Bitcoin. I do think we will get occasional alt seasons of ever-diminishing strength that will continue to make insiders money. Most people will end up with less Bitcoin by going to that casino.”

The sentiment reflects a broader economic principle known as the Lindy Effect, which suggests that the longer a technology or system has survived, the more likely it is to persist in the future.

This isn’t the first time Jason Calacanis has riled up the crypto community. In June 2020, he made headlines when he claimed that most crypto projects were run by “unqualified idiots” or “grifters” with subpar skills. His latest remarks follow the same skeptical outlook on digital assets, particularly Bitcoin.

Despite his criticism, Calacanis has invested in multiple Bitcoin-related companies, including Robinhood, which has been a major gateway for retail investors to buy Bitcoin.

Bitcoin’s Future

While Bitcoin’s critics argue that it will eventually be replaced, its supporters maintain that it is the foundation upon which future financial systems will be built.

The current debate highlights an important distinction, rather than a new version of Bitcoin overtaking it, the real innovations will likely happen on second-layer solutions like the Lightning Network or sidechains.

Whether Calacanis’s prediction proves true remains to be seen. However, history suggests that Bitcoin’s dominance has only grown stronger over time, and with increasing institutional adoption, its position as the world’s premier decentralized digital asset seems more entrenched than ever.

Final takeaway? Bitcoin isn’t just another tech product—it’s an entirely new financial paradigm. And those betting against it have been proven wrong time and time again.