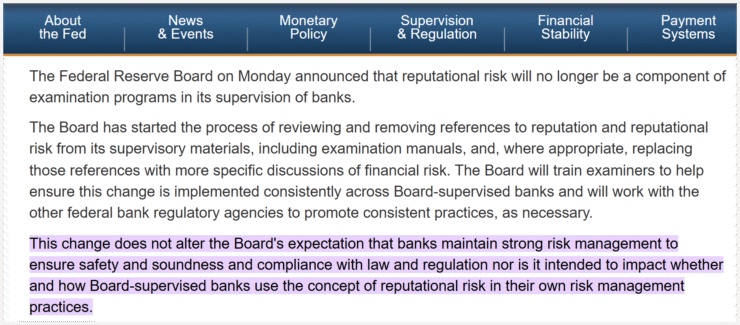

The U.S. Federal Reserve has eliminated “reputational risk” from its official bank examination framework, a move hailed by the crypto industry as a breakthrough in improving banking access. Announced Monday, the updated policy replaces vague optics-based considerations with measurable metrics like liquidity, operational exposure, and regulatory compliance.

The change is intended to standardize how banks are evaluated, allowing them to serve crypto clients without fear of being penalized for perceived reputational issues. While the Fed emphasized that risk standards remain rigorous, the shift marks a step away from the discretionary power examiners once held—often used to restrict relationships with digital asset companies.

Policy Shift Aligns Fed with Other Agencies

The update brings the Fed into alignment with agencies like the OCC and FDIC, which have also phased out the use of reputational criteria in supervision. In its statement, the Fed said the goal is to focus on “quantitative and qualitative aspects of risk” and ensure proper follow-up procedures are grounded in objective analysis.

Despite this positive step, the Fed made clear that banks are still expected to maintain strong controls and comply with all regulatory standards. The goal, according to the agency, is not deregulation but clarity—a key demand from crypto-aligned financial institutions for years.

Pro-crypto lawmakers welcomed the Fed’s decision, though many said it doesn’t go far enough.

“This is a win, but there is still more work to be done,” said Senator Cynthia Lummis, a leading voice for digital asset regulation.

Senator Tim Scott, chair of the Senate Banking Committee, introduced legislation in March that would ban the use of reputational risk as a supervisory tool altogether. Supporters argue this is essential to ensure consistency across administrations and protect legal businesses—including those in crypto—from future exclusion.

FTX Collapse Sparked Accusations of ‘Chokepoint 2.0’

The debate over reputational risk intensified after the FTX collapse in 2022, which triggered a wave of regulatory scrutiny and alleged informal pressure campaigns targeting crypto firms. Industry figures like Nic Carter referred to the phenomenon as “Operation Chokepoint 2.0,” referencing earlier efforts to cut off politically sensitive industries from banking access.

The crypto community claimed that federal agencies, under the Biden administration, had pushed banks to drop crypto clients—often without formal regulation. Earlier this year, Donald Trump accused the administration of weaponizing regulators to suppress the industry, further politicizing the battle for fair financial access.

Quick Facts

- The U.S. Federal Reserve has officially removed “reputational risk” from its bank examination criteria.

- This change is expected to ease restrictions that previously discouraged banks from serving crypto companies.

- Lawmakers such as Senators Cynthia Lummis and Tim Scott support the move but emphasize the need for permanent legal reforms.

- The decision follows mounting industry pressure after the FTX collapse, which sparked allegations of a coordinated campaign to “debank” crypto firms.