Quick Facts:

- $494 million in Bitcoin ETF outflows over the past 3 days.

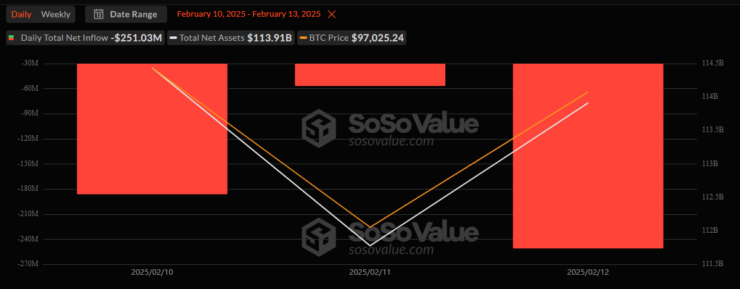

- $251 million withdrawn on Wednesday alone.

- Fidelity FBTC saw the largest outflow at $102 million.

- Bitcoin trades below $96,000, stuck in a range since early february.

- Low trading volume across Bitcoin ETFs, with IBIT falling to the 10th most-traded U.S. ETF.

U.S. spot Bitcoin ETFs have seen three consecutive days of outflows totaling $494 million, highlighting waning investor demand as Bitcoin trades within a stagnant range around $96,000 since the beginning of February.

Wednesday marked the largest outflow of the three days, with $251 million pulled from Bitcoin ETFs. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led with $102 million in outflows, while BlackRock’s iShares Bitcoin Trust (IBIT) saw $22.1 million withdrawn. Total ETF trading volume remained low at $2.58 billion, with IBIT slipping from its typical top 5 most-traded U.S. ETFs to the tenth position during Bitcoin price surges.

Bitcoin Price Action: The Current Situation

Bitcoin is trading at $95,825, reflecting slight daily gains but a 2.8% weekly decline, with the OG Crypto asset exhibiting a range-bound behavior. Analysts attribute this stagnation to mixed market sentiment driven by economic uncertainties and U.S. monetary policy shifts.

Retail investors, rattled by market volatility, are exiting positions, fueling short-term price swings. In contrast, institutional players are capitalizing on the dip, accumulating Bitcoin aggressively. Bitwise analysts emphasize that while retail sentiment remains negative, institutional buying during such periods often signals potential for long-term price appreciation.

Bitcoin’s 24-hour trading volume stands at $41.3 billion, showing steady market activity despite price fluctuations. The ongoing divergence between retail fear and institutional confidence is expected to shape Bitcoin’s near-term trajectory, with many watching for signs of a breakout from its current price range.

The broader crypto market is exhibiting mixed performance, with Ethereum trading at $2,647, up 2.6% in 24 hours but down 5% over the week. XRP has shown resilience, climbing 2.8% in the past day despite a 1% weekly decline. Meanwhile, BNB stands out with a strong 9.5% daily surge and a remarkable 19.4% weekly gain. Solana, however, continues to face pressure, down 4.6% this week.