In a landmark step to de-escalate mounting trade tensions, the United States and China have agreed to significantly reduce tariffs on each other’s goods for an initial 90-day period. The breakthrough, reached during high-level negotiations in Geneva, was jointly announced on May 12, 2025, by U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer.

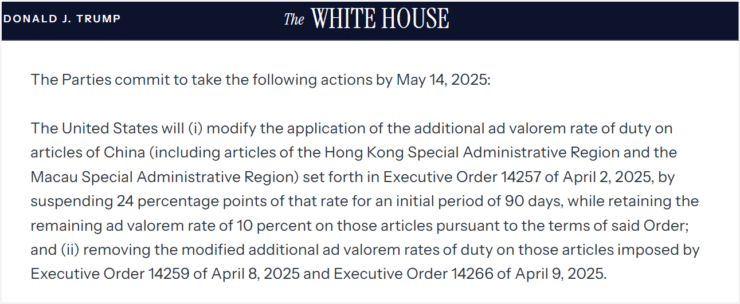

Under the terms of the agreement, the U.S. will reduce its tariffs on Chinese imports from 145% to 30%, while China will slash its tariffs on U.S. goods from 125% to 10%. The temporary tariff rollback is intended to open a diplomatic window for resolving longstanding trade disputes between the world’s two largest economies.

The two sides also committed to establishing an ongoing dialogue mechanism. According to the joint statement, the discussions will be co-led by Chinese Vice Premier He Lifeng, Treasury Secretary Bessent, and Trade Representative Greer. The meetings may alternate between China, the U.S., or a mutually agreed third country, and working-level consultations on economic and trade issues may be scheduled as required.

Market Reactions and Economic Implications

Global financial markets welcomed the news, with major indices posting gains across the board. In the U.S., S&P 500 and Dow Jones futures each rose more than 2%, while Hong Kong’s Hang Seng Index climbed nearly 3%. European markets also rallied modestly, with German and French benchmarks gaining approximately 0.7%.

Analysts say the truce may relieve pressure on global supply chains and ease cost burdens on businesses and consumers impacted by the prior tariff regime. The move is also expected to improve investor sentiment and restore some degree of economic stability in the face of ongoing geopolitical uncertainty.

Speaking at a press conference in Geneva, Bessent noted:

“The consensus from both delegations is that neither side wants to be decoupled. These very high tariffs were the equivalent of an embargo—neither side wants that. We want trade. We want more balanced trade. And I think both sides are committed to achieving that.”

Ongoing Challenges and Future Negotiations

Despite the breakthrough, several contentious issues remain unresolved. Key topics such as intellectual property protection, forced technology transfers, and non-tariff barriers are still on the negotiation agenda. Both governments have acknowledged the complexity of these matters and agreed to use the 90-day window to deepen engagement.

Additionally, certain tariffs remain in place due to national security concerns. The U.S. has preserved tariffs on goods tied to fentanyl production, while China continues to restrict exports of critical rare earth materials—underscoring that full normalization is still a distant prospect.

Quick Facts

- The U.S. and China agreed to reduce tariffs for 90 days, with U.S. duties cut from 145% to 30% and China’s from 125% to 10%.

- The deal was reached during high-level negotiations in Geneva and is intended as a first step toward broader trade resolution.

- Global financial markets responded with strong gains across U.S., Asian, and European indices.

- Key unresolved issues include IP rights, tech transfers, and national security-related tariffs, with ongoing negotiations planned.