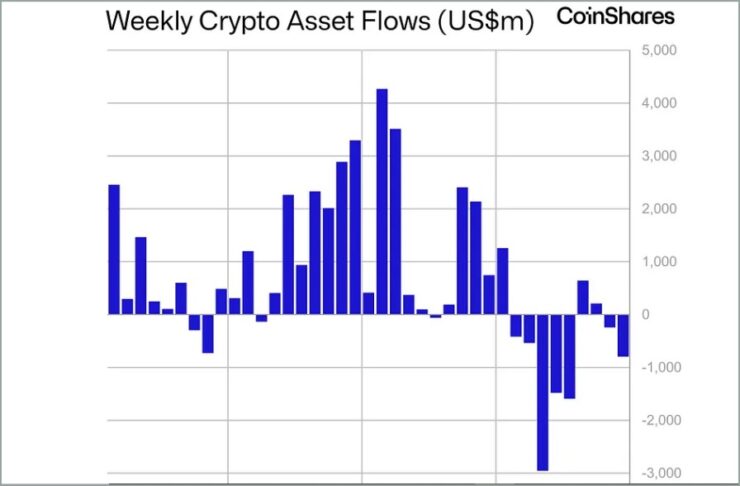

The cryptocurrency market experienced a major blow last week as investors pulled $795 million from digital asset investment vehicles, extending a downward trend that has plagued the sector since February. According to CoinShares, leading asset managers such as BlackRock, Fidelity, Bitwise, ProShares, and Grayscale all recorded significant net outflows, contributing to a total capital flight of $7.2 billion over the past two months.

This wave of redemptions has been attributed primarily to mounting economic anxiety driven by former President Donald Trump’s aggressive tariff agenda. The reintroduction of sweeping trade measures has rattled investor confidence in risk assets, particularly those linked to cryptocurrencies. James Butterfill, Head of Research at CoinShares, noted that the renewed negativity around tariff policy has nearly erased all year-to-date inflows, which now stand at just $165 million.

Despite the bleak trend, there were some signs of resilience. A late-week recovery in crypto prices provided temporary relief, helping total assets under management rebound to $130 billion. This figure represents an 8% increase from the cycle low recorded on April 8—the weakest level seen since November 2024. The uptick was largely attributed to a softening in Trump’s tariff rollout, which temporarily lifted sentiment, even as tariffs on Chinese goods remained intact.

Bitcoin, which dipped below the $75,000 mark earlier in the week, rallied by Friday to climb back above $84,000. The broader crypto market followed suit, with the total market cap increasing by 13% over the same period. The recovery suggests that while sentiment is cautious, investors have not completely abandoned the space.

U.S. Leads Global Crypto Outflows as Bitcoin Funds See Sharpest Decline

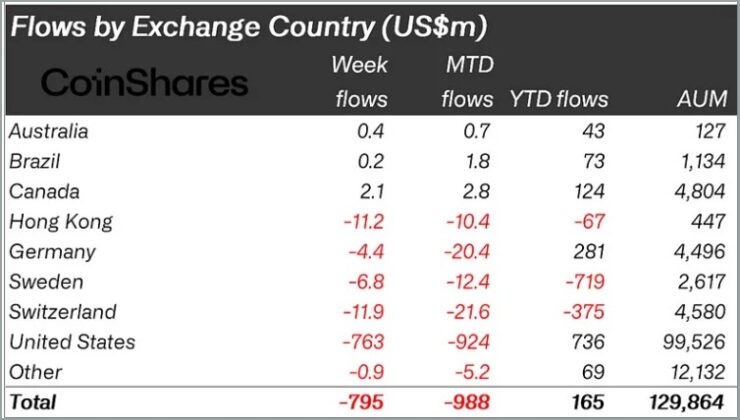

The United States accounted for the lion’s share of last week’s exodus. American crypto investment products alone recorded $763 million in outflows, reflecting growing investor concern over the domestic economic climate and the intensifying trade war. Europe and Asia also felt the impact, with Switzerland, Hong Kong, Sweden, and Germany collectively shedding $34.3 million. Smaller inflows in Canada, Brazil, and Australia—amounting to $2.7 million—did little to stem the global retreat.

Bitcoin-linked investment vehicles were hit the hardest, suffering $751 million in outflows last week alone. Despite holding $545 million in net inflows for 2025, the reversal has been stark. Even short-Bitcoin funds, which typically gain from falling prices, recorded $4.6 million in redemptions, suggesting that investors are exiting crypto markets altogether rather than rotating into bearish positions.

Ethereum funds posted the second-highest losses globally, with $37.6 million in outflows. U.S.-listed spot Ethereum ETFs experienced $82.5 million in redemptions, which international inflows failed to counterbalance. Other altcoin investment products, including those tied to Solana, Aave, and Sui, also reported minor losses. Notably, funds connected to XRP, Ondo, Algorand, and Avalanche bucked the trend with modest inflows, suggesting selective repositioning rather than widespread optimism.

Market Volatility Extends Beyond Crypto

The effects of the tariff uncertainty have rippled beyond crypto, rattling traditional financial markets as well. U.S. government bonds, particularly long-dated Treasuries, experienced sharp sell-offs, with the 30-year yield logging its largest three-day rise in over 40 years. This spike indicates heightened investor fears about inflationary pressures and long-term economic health.

Venture capital markets are also showing signs of stress. Funding activity has slowed as investors delay deals and re-evaluate valuations. This trend echoes past periods of macroeconomic tension, where capital grew scarce and the appetite for risk diminished. Across asset classes, the mood has shifted decisively toward caution, with crypto caught at the center of the storm.

Quick Facts

- Global crypto funds saw $795 million in outflows last week, marking the second consecutive week of significant withdrawals.

- Bitcoin’s price fell below $75,000 during the week, reflecting investor concerns over escalating trade tensions.

- Traditional markets, including U.S. government bonds, experienced volatility, with the 30-year Treasury yield seeing its largest three-day increase in over 40 years.

Venture capital funding is slowing, with investors delaying deals and reassessing valuations amid economic uncertainty.