President Donald Trump’s cryptocurrency venture, the Official Trump Memecoin (TRUMP), has generated a staggering $350 million in revenue since its launch, according to an analysis by the Financial Times. The project, which was launched just before Trump’s anticipated return to the White House, has raised significant amounts through token sales and transaction fees, while also drawing scrutiny over potential market manipulation.

The memecoin, which was minted in January 2025, earned at least $314 million through the sale of tokens, with an additional $36 million collected from fees on the Solana blockchain. The financial success of the memecoin has granted a hint into the potential for celebrity-backed cryptocurrencies to generate massive returns. However, Trump’s personal profit from the initiative remains unclear.

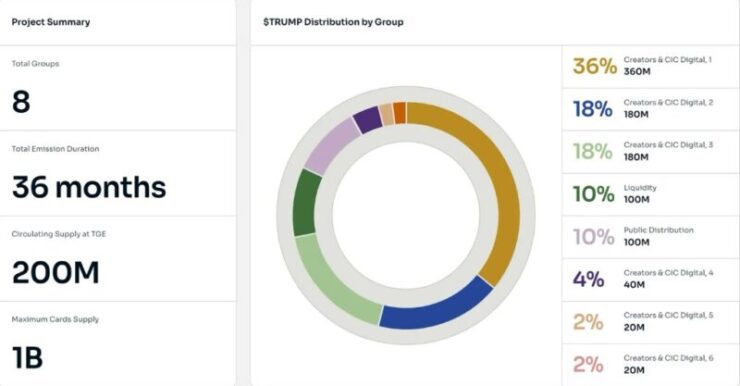

The memecoin’s website, Gettrumpmemes.com, reveals that Trump’s affiliated companies, CIC Digital and Fight Fight Fight, own 80% of the token supply. These entities have played a significant role in operating the TRUMP memecoin.

The Token Launch and Market Activity

The TRUMP token saw an initial minting of 1 billion coins, with 200 million tokens released in the first batch. The remaining 800 million tokens are set to be rolled out over the next three years. However, the launch has raised concerns within the crypto community about the potential for market manipulation. According to the Financial Times, token flows from their creation were carefully tracked, revealing a complex series of transactions aimed at maintaining the token’s price.

The analysis tracked how the TRUMP tokens were distributed into official wallets before being sold on Solana-based trading platforms. This information has fueled concerns about the concentration of control over the token supply and the influence of Trump-affiliated entities in manipulating the market.

Alleged Market Manipulation and Controversies

The analysis reveals that Trump-linked wallets sold the first 100 million TRUMP tokens the day of the token’s launch at a price below $1.05 each, significantly affecting the token’s initial market price. Afterward, the TRUMP wallets withdrew the USDC earnings from these sales and promptly reinvested approximately $291 million back into another liquidity pool in a bid to stabilize the market. These actions, which have raised red flags for market manipulation, also saw 14.7 million TRUMP tokens sent to major exchanges like Binance, Bybit, and Coinbase.

Further complicating matters, the analysis found that Trump-affiliated accounts spent $1 million on their own tokens, purchasing them at a price of $33.20 on January 19 and January 20 to prevent a price decline. This move occurred amid the drop in TRUMP’s price after the launch of MELANIA memecoin.

Despite the alleged market interventions, the TRUMP token’s price has since plunged by 82%, from a peak of $75 in mid-January to a current value far lower. However, with 831 million tokens still held by Trump-affiliated accounts, the notional value of these tokens is estimated at around $10.8 billion.

The Political and Legal Backlash

In response to the concerns over market manipulation and the proliferation of memecoins, U.S. lawmakers have started taking action. House Democrat Representative Sam Liccardo introduced a draft bill in late February aimed at banning U.S. officials and their families from engaging in the creation or promotion of memecoins. This proposal seeks to curb the potential for undue influence and market manipulation by politicians in the crypto space.

On March 5, New York state Assembly member Clyde Vanel introduced a separate bill, which proposes criminal penalties for so-called “memecoin rug pulls.” This legislation would serve to protect investors from fraudulent schemes, where a token’s price is artificially inflated and then quickly dumped, leaving retail investors with worthless assets.

Quick Facts:

- The TRUMP Memecoin generated at least $350 million in revenue, with $314 million coming from token sales and $36 million from fees.

- Analysis suggests that Trump-linked accounts manipulated the market by buying back tokens to stabilize prices.

- Despite initial success, the value of TRUMP has fallen 82% from its peak of $75, leading to significant scrutiny.

- The memecoin has drawn criticism from lawmakers, with proposed legislation aimed at restricting political figures from launching such projects.