Quick Facts:

- TMTG, the parent company of Truth Social, has announced its move into Bitcoin ETFs under the Truth.Fi brand.

- The Truth.Fi Bitcoin Plus ETF aims to provide regulated Bitcoin exposure, marketed as an alternative to existing ETFs.

- TMTG has partnered with Charles Schwab and Yorkville Advisors, with plans to invest up to $250 million into the ETF initiative.

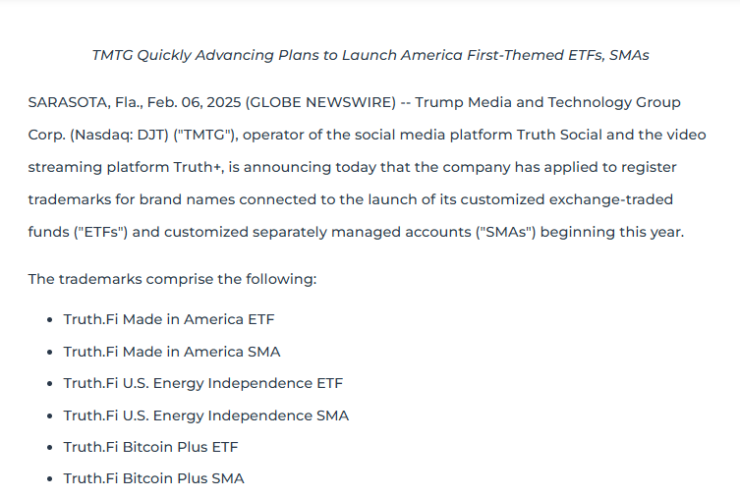

Trump Media and Technology Group (TMTG), the parent company of Truth Social, is making its entry into the financial sector with plans to launch a Bitcoin exchange-traded fund (ETF). As part of its expansion, TMTG is preparing a suite of ETFs, including the Truth.Fi Bitcoin Plus ETF, which aims to give investors exposure to Bitcoin through a regulated investment vehicle.

The ETF initiative is being pitched as a direct alternative to existing funds, with a focus on U.S. energy, manufacturing, and financial independence—themes central to Trump’s economic policies. The bitcoin-focused fund would go under the name Truth.Fi Bitcoin Plus ETF. The other two funds are the Truth.Fi Made in America ETF and a Truth.Fi Energy Independence ETF.

Devin Nunes, CEO and Chairman of TMTG, emphasized the company’s mission to challenge what he describes as “woke funds”. He said:

“We aim to give investors a means to invest in American energy, manufacturing, and other firms that provide a competitive alternative to the woke funds and debanking problems that you find throughout the market. We’re exploring a range of ways to differentiate our products, including strategies related to bitcoin.”

TMTG has already partnered with major financial services firms, including Charles Schwab as a custodian and Yorkville Advisors as an investment adviser, with plans to inject up to $250 million into the ETF initiative.

Yorkville President Mark Angelo said,

“Yorkville is pleased to take this next important step with TMTG in its development of America First investment vehicles. We greatly value our position as a strategic financial partner to TMTG and are proud to join with TMTG in the Truth.Fi movement.”

Regulatory Landscape and SEC Approval Process

The Truth.Fi Bitcoin Plus ETF comes at a time when the SEC, now led by crypto friendly acting Chairman Mark Uyeda, is reshaping its stance on crypto-related financial products.

The Regulatory giant on its first day under the Donald Trump led regime, set up a crypto task force led by none other than the ‘Crypto Mom’, Commissioner Hester Pierce. This task force has been given the assignment of coming up with the best approach to lead the SEC into establishing clear regulations and guidelines for the cryptocurrency ecosystem, something that eluded the commission under the past leadership of the infamous Gary Gensler.

The SEC in it’s early days under Uyeda, also Rescinded the Controversial SAB 121 bulletin that is seen by many, as an anti-crypto bulletin

The SEC’s decision on the Truth.Fi Bitcoin Plus ETF will be closely watched, as it could set a precedent for future financial products in the crypto space.

Given Trump’s pro-crypto policies and recent changes in the SEC, analysts believe the ETF, when filed, is more likely to be approved. However, competition among Bitcoin ETFs is heating up, with BlackRock, Fidelity, and Grayscale already securing dominant positions in the market. Senior Bloomberg ETF Analyst, Eric Balchunas shared about this:

“One other note about this: Despite Trump’s brand, these will likely be microscopic in asset gathering compared to IBIT, FBTC et al. That said, just the fact they launching it adds to the mainstreamification narrative, which matters.”