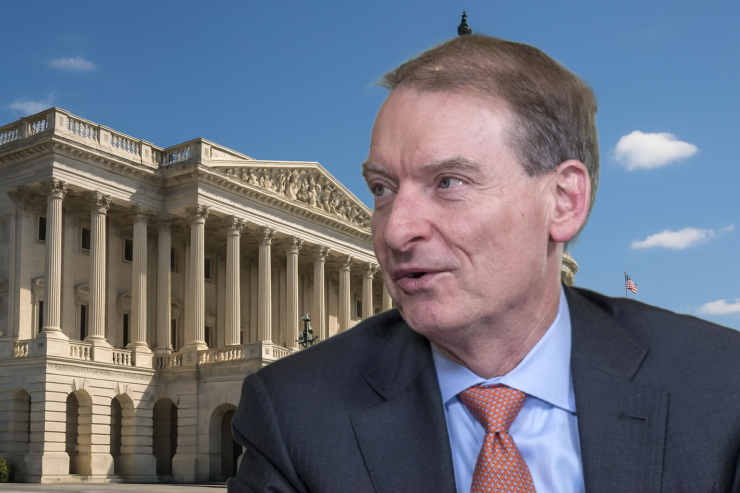

Paul Atkins, President Donald Trump’s nominee to lead the Securities and Exchange Commission, pledged on Thursday to overhaul the agency’s approach to digital assets, signaling a sharp break from the enforcement-driven strategy pursued under former Chair Gary Gensler.

In prepared testimony for his confirmation hearing before the Senate Committee on Banking, Housing, and Urban Affairs, Atkins criticized the current state of crypto regulation as “ambiguous and non-existent.” He called for a “rational, coherent, and principled” framework for digital asset oversight, promising collaboration with fellow commissioners and Congress to build “a firm regulatory foundation.”

Atkins, who served as an SEC commissioner for six years after his appointment by President George W. Bush, has long positioned himself as a proponent of market deregulation. He emphasized that the lack of regulatory clarity since 2017 has hampered innovation in the crypto sector. “Unclear regulation creates uncertainty and inhibits innovation,” he stated.

If confirmed, Atkins would replace Mark Uyeda, the acting chair who assumed the role after Gensler stepped down in January. Uyeda, also known for his pro-crypto stance, was appointed following Trump’s inauguration and the broader leadership transition across federal agencies.

Atkins’ nomination comes amid deep political divides over crypto regulation. Under Gensler and President Joe Biden, the SEC pursued aggressive enforcement actions against several major digital asset firms. Many of those cases were later dropped. Atkins dismissed that era’s regulatory climate as overly politicized and obstructive.

“Unclear, overly politicized, complicated, and burdensome regulations are stifling capital formation,” Atkins said in his remarks.

“American investors are flooded with disclosures that do the opposite of helping them understand the true risks of an investment.”

His statements reflect a broader call to “reset priorities and return common sense to the SEC.” Atkins said he would prioritize cutting red tape and shifting the Commission’s focus away from what he described as counterproductive political entanglements.

Senator Elizabeth Warren (D-MA), Ranking Member of the Banking Committee and a vocal critic of the crypto industry, has emerged as a key opponent of the nomination. On March 24, she sent Atkins a 34-page letter pressing him on his role in the 2008 financial crisis, ties to failed crypto exchange FTX, and ongoing conflicts of interest from his advisory roles with large banks and financial firms.

Atkins is expected to address Warren’s concerns during his hearing. Financial disclosures show he holds up to $5 million in a crypto investment fund and $1 million in equity stakes across two crypto firms. His and his wife’s total assets exceed $328 million, primarily from his wife’s family wealth.

The confirmation hearing began Thursday morning in the Dirksen Senate Office Building and marks the first major test for Trump’s SEC agenda.