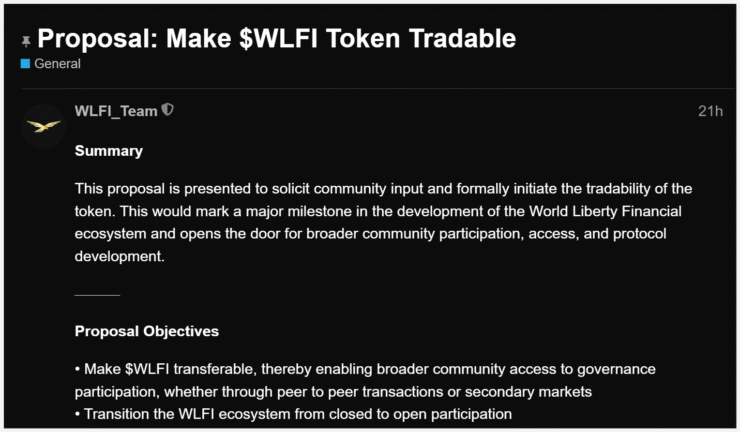

World Liberty Financial (WLFI), the decentralized finance platform co-founded by members of the Trump family, has introduced a proposal to make its governance token transferable across secondary markets.

The measure aims to shift WLFI from a closed system—where tokens are restricted to internal governance—toward a model embracing broader DeFi participation. If approved, the change would allow trading on decentralized exchanges and peer-to-peer marketplaces, increasing liquidity and price discovery.

Tokenholders would also gain the ability to vote on emissions schedules, incentives, and treasury policies, marking a significant step in the project’s roadmap to decentralize control.

Trump Family Trims Stake as Crypto Profits Mount

The move to decentralize comes as WLFI and other Trump-affiliated crypto ventures draw mounting scrutiny in Washington. Critics have argued that the president’s deep ties to the industry create potential conflicts of interest as the administration shapes regulatory policy.

Amid the attention, the Trump family has gradually scaled back its holdings. According to company disclosures, DT Marks DeFi LLC—an entity overseeing the family’s WLFI investment—cut its stake from 75% to 55% over the past six months.

Meanwhile, President Trump disclosed a $57 million profit from WLFI alone in June filings with the U.S. Office of Government Ethics. Bloomberg estimates that the president’s total crypto earnings—including profits from NFTs, the TRUMP memecoin, and other holdings—have added more than $600 million to his net worth.

Lawmakers Push for Limits on Presidential Crypto Activity

With cryptocurrencies now accounting for nearly 9% of President Trump’s estimated $6.4 billion fortune, Democratic lawmakers have begun drafting legislation to curb potential conflicts.

Representative Adam Schiff introduced the Curbing Officials’ Income and Nondisclosure (COIN) Act in June. The bill proposes restrictions preventing the president, immediate family, and senior executive officials from launching or promoting specific digital assets.

Supporters argue the measure is necessary to preserve public trust in federal policy, while critics say it risks stifling innovation and entangling political leaders in protracted legal disputes over compliance.

Quick Facts

- WLFI proposed making its governance token tradable on secondary markets.

- The Trump family has reduced its stake in WLFI as the president reports large crypto profits.

- New legislation aims to bar presidents and their families from promoting or issuing tokens.