World Liberty Financial (WLFI), the DeFi project linked to U.S. President Donald Trump’s family, has successfully finalized its token sale, securing $550 million in funding.

According to updates from WLFI’s official website, the project aims to reinforce the role of U.S. dollar-pegged stablecoins in the financial ecosystem and position itself as a leading player in the DeFi lending space.

Launched in September 2024, WLFI operates on the Ethereum blockchain, offering lending and borrowing services similar to platforms like Aave. The project enables users to access liquidity using Bitcoin, Ethereum, and stablecoins as collateral. Despite its ambitious start, the initial fundraising efforts faced challenges before gaining momentum through heightened political and market interest.

The Token Sale

The public sale of WLFI tokens began on October 15, 2024, with an initial target of raising $300 million. The plan was to sell 20 billion tokens at a price of $0.015 each, with sales restricted to whitelisted participants. However, the first phase struggled, generating only $11 million from the sale of 766 million tokens. In response to the underwhelming demand, the WLFI team reduced their target to $30 million.

A major shift occurred after launching Trump’s official token, $TRUMP, and Melania Trump’s memecoin, $MELANIA, in January 2025. These political-themed tokens generated substantial market attention, increasing demand for other Trump-affiliated crypto projects, including WLFI.

By January 20, 2025, 20% of WLFI’s token supply had been sold, prompting the team to issue an additional 5 billion tokens at an increased price of $0.05 each. The second phase of the sale was met with overwhelming demand, and by March 13, 99% of the newly issued tokens had been sold, bringing the total raised to $550 million.

Key Investors and Project Structure

One of the most notable backers of the WLFI project is Tron founder Justin Sun, who initially invested $30 million in November 2024. Sun later doubled down on his commitment, increasing his stake by an additional $45 million in January 2025, making him one of the largest investors in the project.

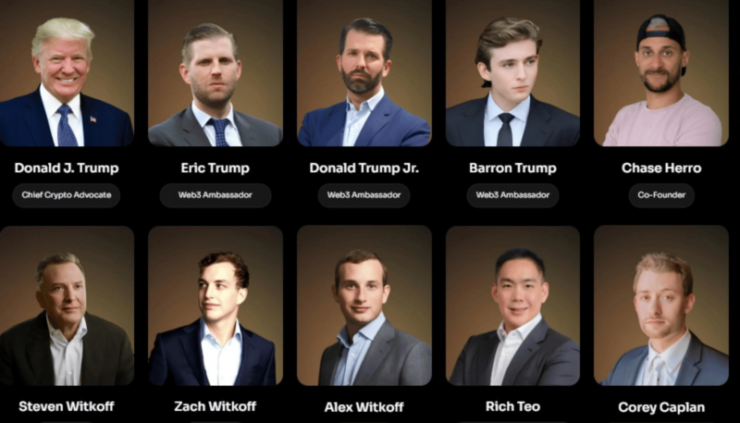

Despite strong ties to the Trump family, WLFI’s whitepaper explicitly states that Donald Trump, Eric Trump, and Donald Trump Jr. do not own or manage the project—though they may receive undisclosed compensation for their association.

WLFI token holders gain governance rights within the WLFi Protocol, allowing them to participate in key decisions regarding the platform’s operations. However, the tokens will remain non-transferable for the first 12 months after launch, and there is currently no confirmed listing date for exchanges.

Political Influence on Crypto and Market Reactions

The rapid success of WLFI token sale and other Trump-related tokens has been primarily propelled by his pro-crypto promises and actions, before and after taking the Presidential role at the White House.

Trump’s vocal support for crypto has been a key driver of investment activity, with his administration actively pursuing policies that favor digital asset adoption.

This trend is not limited to the U.S. Argentina’s President Javier Milei, who has also championed cryptocurrency, endorsing $Libra, a token that later faced severe allegations of fraud. The incident has raised concerns about politically affiliated crypto projects, their ethical considerations, and long-term sustainability.

Despite regulatory scrutiny, politically linked cryptocurrencies continue to attract massive capital inflows. Given their ties to influential figures, investors view such projects as speculative opportunities and potential hedges against regulatory crackdowns.

Quick Facts

- World Liberty Financial (WLFI) completed its token sale, raising $550 million amid growing political crypto interest.

- The public sale began in October 2024, initially struggling to meet its $300 million target.

- Tron founder Justin Sun is one of the largest investors, committing $75 million to the project in multiple funding rounds.

- WLFI tokens are non-transferable for the first 12 months, granting governance rights but with no confirmed exchange listing date.