Quick Facts:

- World Liberty Financial acquired $5 million in Wrapped Bitcoin (WBTC) and $1.4 million in MOVE tokens using USDC reserves.

- The firm’s crypto portfolio also includes ETH, LINK, and TRX from previous investments.

- WLF established a strategic token reserve to manage volatility, invest in DeFi projects, and build a stable asset base.

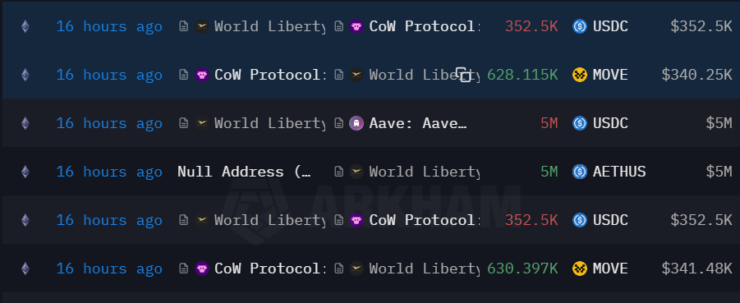

In a series of transactions on Thursday, World Liberty Financial spent $1.4 million in USDC to acquire 2.52 million MOVE tokens, Movement Labs’ native utility token. The firm also used $5 million in USDC to purchase 52 wrapped Bitcoin (WBTC). Beyond direct purchases, WLF staked 2,221 ETH worth $5.9 million through Lido Finance and deposited an additional $5 million USDC into Aave’s lending protocol according to data from Arkham Intelligence. Earlier in the week, WLF acquired 830,469 MOVE tokens and 1,917 ETH by leveraging its USDC holdings

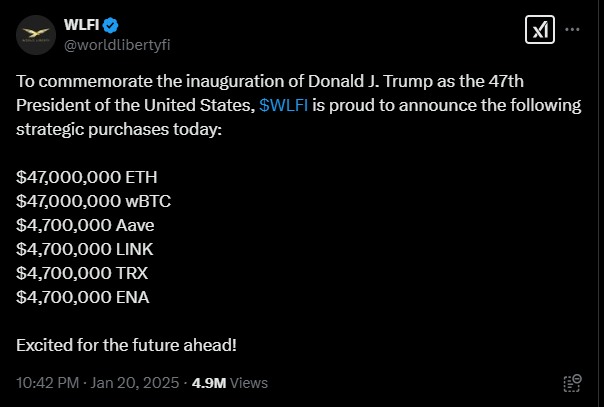

World Liberty Financial has consistently pursued portfolio diversification through calculated cryptocurrency investments. The latest acquisitions of WBTC and MOVE tokens add to its growing collection of digital assets, which already includes Ethereum (ETH), Chainlink (LINK), Solana (SOL) and Tron (TRX). This strategy aligns with WLF’s broader vision to establish itself as a dominant player in the crypto market. Notably, on President Trump’s first day back in office, WLF made a headline-worthy $112.8 million investment in cryptocurrencies, with significant allocations to ETH and WBTC.

WLF’s Macro Strategy Reserve

World Liberty Financial has recently unveiled its Macro Strategy token reserve, a significant step aimed at diversifying the project’s cryptocurrency holdings, mitigating market risks, and establishing a resilient financial foundation. This announcement comes as the Trump-backed DeFi project continues its aggressive expansion in the digital asset space.

“World Liberty Financial (WLFI) is proud to unveil the Macro Strategy, our strategic token reserve designed to bolster leading projects like Bitcoin, Ethereum, and other cryptocurrencies that are at the forefront of reshaping global finance.” WLFI on X

Since November 30, 2024, WLF has spent over $315 million on crypto acquisitions, steadily building a diverse portfolio. The firm has accumulated 63,030 ETH at an average price of $3,331 and 699 wrapped Bitcoin (WBTC) at an average price of $105,197. Beyond these flagship tokens, WLF has also made substantial investments in Tron’s TRX, Chainlink’s LINK, Aave’s AAVE, and Ethena’s ENA, further diversifying its exposure to key projects within the DeFi ecosystem.

WLFI Token: Governance and Future Utility

Alongside its growing portfolio and Macro Strategy reserve, World Liberty Financial’s WLFI token is set to play a critical role in the project’s governance framework. Despite the project not being fully operational yet, over 96% of the WLFI token supply has already been sold, with approximately 926.9 million tokens still available, according to the official WLF website. Unlike many cryptocurrencies, WLFI tokens are non-transferable. Holders of WLFI tokens will have voting rights on key governance proposals, giving the community a direct voice in shaping the project’s future developments and strategic decisions.