U.S. President Donald Trump is preparing to host Salvadoran President Nayib Bukele at the White House on April 14, 2025, in a meeting that could reverberate well beyond diplomatic and security circles. With both leaders known for their vocal support of Bitcoin, the summit has attracted significant attention from crypto markets, investors, and analysts anticipating a landmark policy moment.

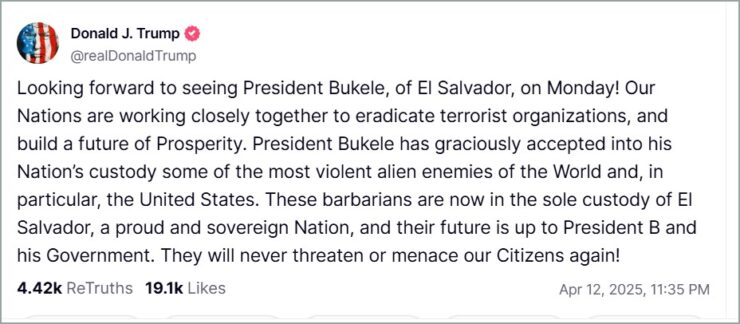

While the official agenda centers around joint security cooperation and combating transnational crime, speculation is mounting that the two heads of state may also explore digital asset collaboration. Trump praised Bukele in his announcement as a “model of strength” in restoring law and order across El Salvador, but it’s their shared Bitcoin advocacy that could define the headlines coming out of this meeting.

President Bukele cemented El Salvador’s place in crypto history when he made Bitcoin legal tender in 2021, a decision that sparked both praise and criticism globally. Since then, El Salvador has steadily accumulated Bitcoin as part of its national reserves and continues to champion the asset as a tool for economic transformation. Trump, meanwhile, has embraced a more explicitly pro-crypto stance in his second term, supporting digital innovation and recently enacting major executive orders involving cryptocurrency policy.

Bitcoin Markets Watch Closely Ahead of Summit

With the meeting just days away, financial markets are bracing for potential crypto-related announcements that could shift both regulatory narratives and investor sentiment. Bitcoin, which has experienced a 10% dip over the past two months amid broader market volatility, was trading at $84,655 on Friday, with a market cap of $1.68 trillion. While daily trading volume has decreased by 22% to $29.35 billion, analysts note that the overall appetite for digital assets remains strong—especially as political support begins to align with long-term adoption goals.

Analysts suggest that even symbolic gestures—such as the endorsement of Bitcoin as a legitimate national reserve asset or the formation of a cross-border crypto framework—could provide bullish momentum to the digital asset sector. The optics of two sitting presidents, both overseeing nations that hold substantial Bitcoin reserves, discussing crypto at the highest level could fuel fresh institutional interest and regulatory clarity.

National Bitcoin Reserves Take Center Stage

Both the United States and El Salvador have taken strategic steps to embed Bitcoin into their national frameworks. In March 2025, President Trump signed an executive order creating the Strategic Bitcoin Reserve—essentially a digital Fort Knox—comprising approximately 200,000 BTC valued at over $16.5 billion. These holdings, acquired primarily through legal forfeitures, are intended to be held indefinitely as a long-term store of value. The policy marks a significant departure from earlier U.S. positions that treated seized Bitcoin as disposable assets to be auctioned off.

El Salvador, meanwhile, has continued its Bitcoin acquisition strategy, with its national holdings now totaling 6,137 BTC. Bukele’s government has maintained a daily purchase schedule—typically acquiring one BTC per day—despite international pressure and economic headwinds. The country’s Bitcoin investment is part of a broader plan to integrate the asset into its financial infrastructure, from tourism to public services.

The upcoming meeting may result in further alignment between the two countries on Bitcoin policy, and possibly set a precedent for other nations evaluating whether to follow suit. Whether the summit yields concrete action or remains symbolic, it underscores the increasing interplay between geopolitics and the future of money.

Quick Facts

- President Trump and President Bukele are scheduled to meet at the White House on April 14, 2025.

- Topics of discussion include joint security cooperation and digital asset strategy.

- El Salvador was the first country to adopt Bitcoin as legal tender in 2021.

- Crypto markets are monitoring the meeting for potential policy signals.