FTX creditors may be waiting over two years to recover their funds, but one trader who foresaw the exchange’s downfall argues that the delay is actually a victory especially considering the scale of the collapse and global legal complexities involved.

For many, waiting two years for repayment after one of the largest financial frauds in U.S. history feels like an eternity. But for Ishan Bhaidani, a crypto trader and one of the first to predict FTX’s collapse, the timeline is surprisingly swift.

“I thought it would take longer,” Bhaidani told Turner Wright in a Feb. 28 interview at ETHDenver.

“You’re working with so many different governments, different levels of enforcement, different levels of compliance… candidly, I thought it would take longer,” he added, referring to FTX’s multinational operations spanning the U.S., the Bahamas, and beyond.

Given these hurdles, Bhaidani believes creditors receiving repayments after two years is a relative win.

FTX Repayment Plan: What Creditors Can Expect

FTX officially collapsed on Nov. 11, 2022, after revelations that the exchange had misused customer funds to cover losses at its sister trading firm, Alameda Research. The liquidity crisis left billions of dollars in customer funds inaccessible, triggering a Chapter 11 bankruptcy filing.

After years of legal battles, FTX initiated its first round of repayments on Feb. 18, 2025, with the next wave scheduled for May 30. Creditors eligible for the second round must verify their claims by April 11.

According to FTX’s restructuring plan:

- 98% of creditors are expected to receive at least 118% of their claim value in cash.

- Those who held FTX claims and sold them at deep discounts may not benefit as much as those who held on or bought claims strategically.

Who Really Won from the FTX Collapse?

Bhaidani highlighted an interesting twist in the repayment saga whether those who bought FTX claims at low valuations ended up making bigger profits than expected.

“If you were taking $0.25 on the dollar and buying Bitcoin at $18,000, $20,000, or $30,000, you did pretty well, right?” Bhaidani said.

For those who bet on FTX-linked assets like Solana (SOL) which has surged over 900% from its post-collapse lows the FTX debacle may have turned into an opportunistic trade rather than a total loss.

Spotting FTX’s Collapse Before It Happened

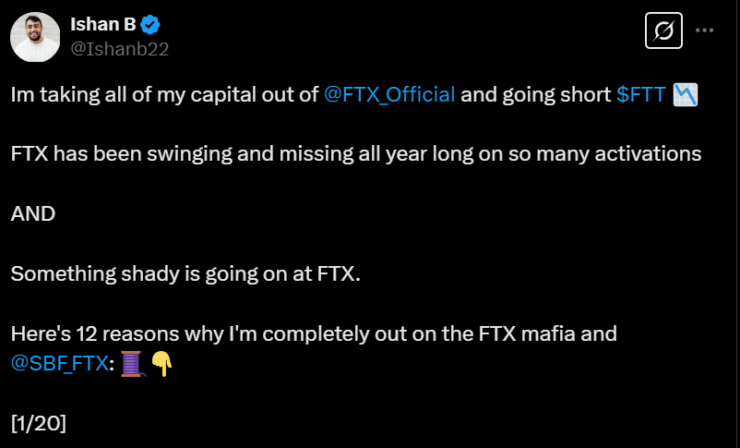

Bhaidani’s reputation as one of the few who predicted FTX’s downfall stems from early warning signs he spotted in 2022.

One major red flag? The $60 billion Terra Luna ecosystem collapse, which exposed Alameda Research’s vulnerabilities and set off a chain reaction that ultimately crushed FTX.

Another critical moment was when FTX US President Brett Harrison abruptly resigned just before his equity could vest.

“He doesn’t even hit his vest on a $32 billion company… we’re talking about hundreds of millions of dollars in potential equity. Why is he leaving without vesting?” Bhaidani said.

“To me, something had to be wrong in the kitchen over there.”

Will Sam Bankman-Fried Ever Be Pardoned?

With former FTX CEO Sam Bankman-Fried now facing a 25-year prison sentence, speculation has already begun about whether he could receive a pardon in the future.

Bhaidani puts the odds of a presidential pardon at just 2% to 5%, stating that under a Trump administration, it’s even less likely.

While Bankman-Fried’s legal team continues to fight, the broader crypto industry is moving on, with FTX creditors seeing an unlikely, yet promising, path toward full recovery.

Final Takeaway

The FTX collapse shook the crypto industry, but the fact that creditors are on track to receive more than their claim value within two years is remarkable especially considering past high-profile collapses like Mt. Gox, where creditors have been waiting over a decade.

While the road has been long, those who strategically played the post-collapse market or simply held on may emerge from the FTX disaster in a far better position than anyone initially expected.