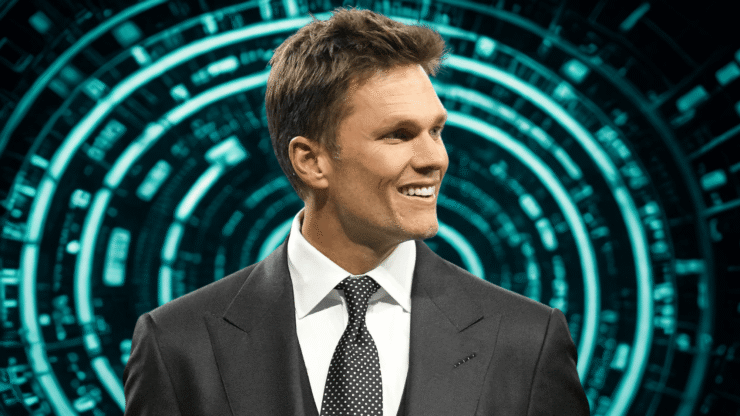

After taking a hit from the collapse of FTX, former NFL quarterback Tom Brady is stepping cautiously but confidently back into the crypto arena—this time, with a future-focused twist. The seven-time Super Bowl champion has joined a high-profile group of investors backing Catena Labs, a Boston-based fintech startup at the intersection of blockchain and artificial intelligence.

Catena Labs aims to build what it describes as the world’s first AI-native financial institution, centered around the emerging concept of “agentic commerce.” The idea? Autonomous AI agents capable of executing transactions and managing finances on behalf of users, offering a radically new approach to how money moves in an increasingly digitized economy.

The startup was co-founded by Sean Neville, a well-known figure in crypto circles and the co-creator of the USDC stablecoin. After operating in stealth, Catena has now announced an $18 million seed round led by Andreessen Horowitz’s a16zcrypto. Other backers include Coinbase Ventures, Circle Ventures, Stanford Engineering Venture Fund, Breyer Capital, and prominent angel investors like Balaji Srinivasan, Bradley Horowitz, and Twitch co-founder Kevin Lin.

Startup Bets Big on Agentic Commerce

Catena Labs is positioning itself at the bleeding edge of financial technology with a bold mission: to build an AI-native financial institution designed for a world where intelligent software agents—not just humans—transact autonomously. Co-founder Sean Neville described the company’s goal as enabling AI systems, along with the businesses and consumers they serve, to interact with money “safely and efficiently.”

To realize that vision, Catena is leveraging regulated stablecoins like USDC to power seamless AI-driven transactions, integrating them alongside existing payment rails. This infrastructure is designed to support a range of use cases—from supply chain automation to AI-run retail operations—areas where current financial systems often fall short when interfacing with autonomous digital agents.

As part of its public debut, the firm has launched the Agent Commerce Kit, an open-source developer toolkit that allows AI systems to verify identities, initiate payments, and operate independently in financial environments. The tool is aimed at developers building the next generation of machine-to-machine commerce applications.

With support from crypto giants like a16zcrypto, Circle Ventures, and Coinbase Ventures—and a high-profile endorsement from Tom Brady—Catena Labs is making a decisive bet that the convergence of AI and blockchain will reshape the financial sector. It wants to be the foundational layer powering that shift.

Brady’s Strategic Pivot After FTX Fallout

Brady’s first foray into digital assets came through his high-profile partnership with FTX, where he served as a paid brand ambassador. He featured in national ad campaigns and earned up to $30 million in equity from the now-defunct exchange. That stake turned worthless when FTX imploded in 2022 amid revelations of massive financial misconduct, including the misuse of customer funds to cover trading losses.

The collapse triggered widespread industry turmoil and left Brady caught in a class-action lawsuit alongside other celebrity endorsers. Earlier this month, he was formally cleared of legal responsibility in that case—opening the door for a more cautious reentry into the sector.

His recent investment in Catena Labs reflects a strategic shift away from front-facing endorsements and into infrastructure-focused plays. Before Catena, Brady also co-founded Autograph, a startup that initially centered on NFTs but later pivoted to broader digital collectibles, raising $200 million in the process.

Quick Facts

- Tom Brady invests in AI-blockchain startup Catena Labs

- Catena Labs raised $18 million in seed funding led by a16zcrypto

- Startup aims to enable agentic, AI-driven financial transactions

- Brady shifts from endorsements to infrastructure plays after FTX collapse