As financial markets roil under escalating trade tensions, tokenized gold is asserting itself as crypto’s go-to safe haven. On Wednesday, the total market capitalization of gold-backed tokens surged to just under $2 billion, climbing 5.7% in 24 hours, according to CoinGecko. This spike coincided with physical gold briefly hitting a record high of $3,170 per ounce.

The rally wasn’t limited to price—activity around these tokens has intensified dramatically. Weekly trading volume in tokenized gold surpassed $1 billion, the highest level since the U.S. banking crisis in March 2023, per a new report from digital asset platform CEX.IO.

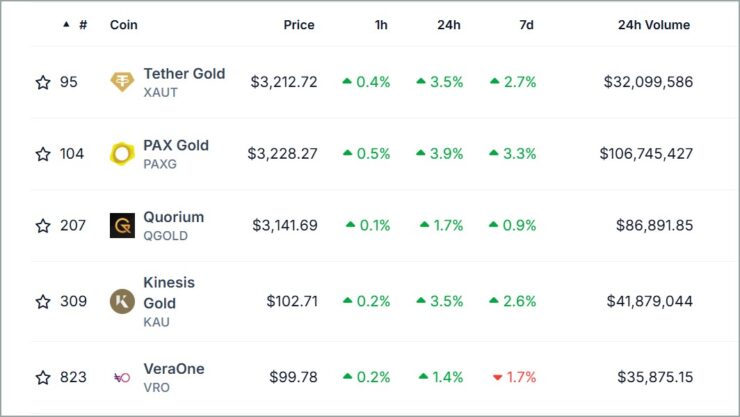

Paxos Gold (PAXG) and Tether Gold (XAUT), the dominant players in this sector, have seen weekly volumes skyrocket since President Trump’s return to office on January 20. PAXG’s volume alone surged over 900%, while XAUT posted a 300% increase. Additionally, DeFiLlama data shows that PAXG has attracted consistent inflows totaling $63 million since January.

Investor Shift Toward Safe-Haven Assets

The surge in tokenized gold mirrors a broader rally in physical gold, which has posted double-digit gains in 2025 amid persistent inflation fears and geopolitical uncertainty. But even gold was not immune to the shockwaves of Trump’s tariff campaign. During the recent sell-off, gold briefly dipped 6% before rebounding to new all-time highs.

Despite this volatility, gold-backed tokens have become one of crypto’s most resilient sectors since Trump’s return. According to CEX.IO, the market cap of tokenized gold has climbed 21% since January—vastly outperforming stablecoins (up 8%) and Bitcoin (down 19%). The broader crypto market is down 26% over the same period.

“Tokenized gold is emerging as one of the key diversification strategies among crypto-native users, alongside Bitcoin,” wrote Alexandr Kerya, VP of product management at CEX.IO.

“It provides a safer and more stable approach to portfolio management, enabling users to stay within the crypto ecosystem while benefiting from the value and stability of the underlying physical asset.”

Kerya added that the rise of real-world asset (RWA) tokenization has made exposure to gold easier and more appealing for users who previously stayed on the sidelines.

As global markets continue to wrestle with tariff-fueled volatility, tokenized gold is quietly carving out a dominant role in the digital asset ecosystem. With investors seeking both liquidity and safety, gold-backed tokens like PAXG and XAUT are emerging as a rare intersection of crypto flexibility and traditional asset security. As macro uncertainty lingers, the appetite for decentralized safe havens may only deepen, positioning tokenized gold as a strategic pillar in modern portfolios.

Quick Facts

- Tokenized gold’s market cap nears $2 billion amid rising tariff concerns.

- PAXG and XAUT trading volumes have surged by 900% and 300%, respectively, since January 20.

- Physical gold prices reached a record high of $3,170 per ounce.

- The trend highlights the increasing role of tokenized real-world assets as safe havens in the crypto market.