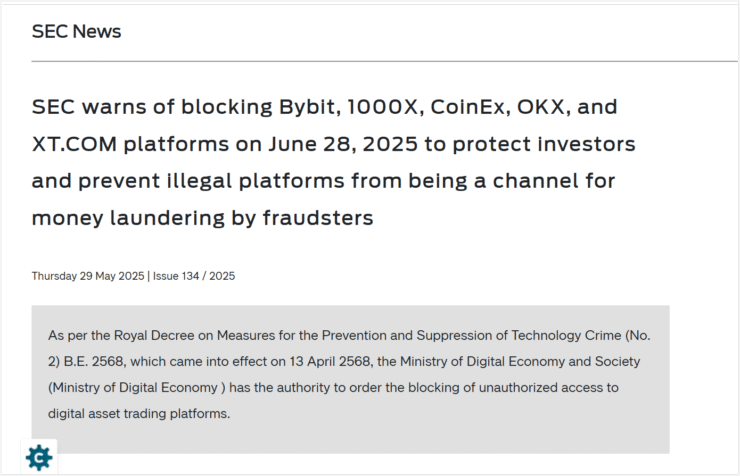

Thailand’s Securities and Exchange Commission (SEC) has announced it will block access to five major cryptocurrency exchanges—Bybit, OKX, 1000X, CoinEx, and XT.COM—effective June 28. The decision, disclosed on May 29, stems from concerns over investor safety and potential money-laundering activities facilitated by these platforms.

According to the SEC, the exchanges are operating without licenses required under Thailand’s Digital Asset Business Act, which governs the activities of crypto companies in the country. The enforcement is part of a broader crackdown on illegal digital asset activity and coincides with recent updates to Thailand’s cybercrime laws.

The ban is being implemented in collaboration with the Ministry of Digital Economy and Society (MDES) under a Royal Decree that empowers authorities to block unauthorized digital platforms. Officials urged users to withdraw funds before the enforcement date to avoid losses.

This latest move underscores Thailand’s growing efforts to foster a transparent and secure digital finance environment, especially as scams and illicit capital flows become more frequent.

Thailand Enforces New Crypto Law on Unlicensed Exchanges

Thailand’s crypto regulatory landscape has tightened significantly since April, following cabinet-approved amendments to both the country’s cybercrime laws and the Digital Asset Business Act. These changes grant regulators increased powers to penalize unlicensed operations—particularly peer-to-peer (P2P) platforms and foreign-run exchanges.

The SEC launched investigations into several platforms and concluded that Bybit, OKX, 1000X, CoinEx, and XT.COM violated licensing rules under the Royal Decree on Digital Asset Businesses. As a result, the SEC formally reported the platforms to the MDES, initiating a nationwide block that begins on June 28.

Authorities warn that using these unlicensed exchanges exposes users to fraud, asset loss, and lack of legal protection. The move is part of Thailand’s broader strategy to enforce compliance across all digital asset services, especially as the country’s crypto adoption continues to grow.

Government Balances Enforcement With Pro-Crypto Innovation

Despite aggressive actions against illegal operators, Thai regulators continue to promote digital finance innovation. In early May, government officials announced plans to enable tourists to make crypto payments via card-linked platforms—a move aimed at boosting tourism and aligning with global payment trends.

In another forward-looking initiative, the Ministry of Finance is preparing to issue $150 million in digital investment tokens, giving retail investors direct access to government bonds via blockchain. This marks a significant modernization of the country’s capital markets.

Additionally, regulators approved the use of major stablecoins like USDT and USDC in March, allowing regulated exchanges to list and trade these digital dollars. The move adds legitimacy to Thailand’s evolving approach to digital asset regulation and highlights a commitment to selective, structured integration of crypto into the national economy.

Quick Facts

- Thailand’s SEC will block Bybit, OKX, CoinEx, 1000X, and XT.COM on June 28.

- The exchanges failed to obtain licenses under the Digital Asset Business Act.

- Users have been advised to withdraw funds before the ban takes effect.

- New laws target unlicensed P2P platforms and enhance cybercrime enforcement.

- Thailand is also embracing innovation with stablecoin trading and digital bond issuance.