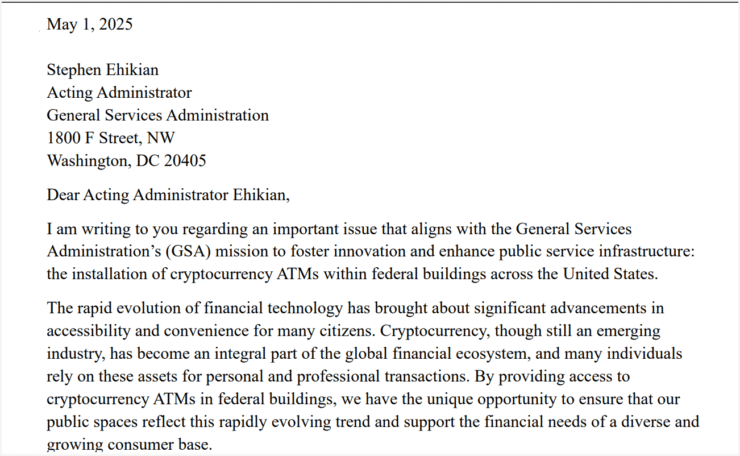

Texas Representative Lance Gooden is calling on the federal government to install cryptocurrency ATMs in public buildings across the United States. In a letter to GSA Acting Administrator Stephen Ehikian, Gooden proposed placing crypto kiosks alongside traditional banking machines managed by the General Services Administration.

Gooden framed the move as part of “President Trump’s vision” for American dominance in blockchain innovation. He emphasized that crypto is no longer fringe but a central pillar of modern finance. According to Gooden, crypto ATMs would support financial access and digital literacy for a growing population of users who rely on digital assets in their daily lives.

“Cryptocurrency is now an integral part of the global financial system,” Gooden wrote, urging the GSA to consider crypto ATMs as both transactional tools and educational gateways.

Though largely symbolic, the initiative represents an effort to normalize crypto access in federal infrastructure, amid increasing political support from pro-crypto lawmakers.

“By providing access to cryptocurrency ATMs in federal buildings, we have the unique opportunity to ensure that our public spaces reflect this rapidly evolving trend,” he added.

Crypto ATM Use Rises—But So Do Scams

While Gooden’s proposal promotes accessibility and innovation, it also comes as crypto ATM-related fraud continues to escalate—especially targeting seniors and vulnerable populations.

According to the FBI’s Internet Crime Complaint Center (IC3), nearly 11,000 complaints involving crypto kiosks were reported in 2024, a near doubling from 2023. These scams resulted in over $246 million in losses, with older adults accounting for $107 million of that total.

Scammers often impersonate tech support agents, government officials, or investment brokers—directing victims to deposit funds into anonymous crypto ATMs, which offer no oversight, instant transactions, and no refund options.

Other nations have responded more aggressively. The UK has banned crypto ATMs, while France, Germany, and Australia are cracking down on unlicensed operators. As the U.S. considers broader access, regulators may soon face a dilemma: support innovation or minimize consumer risk.

Lawmakers Seek Oversight Amid State-Level Crackdowns

As the debate over crypto ATM expansion intensifies, several U.S. jurisdictions are taking steps to rein in the largely unregulated machines. In Minnesota, one town has enacted a full ban on crypto ATMs, citing security and fraud concerns. Nebraska has introduced consumer protection measures, including an 18% fee cap and daily transaction limits to prevent abuse.

On the federal level, Democratic senators are now backing a broader legislative solution. The proposed Crypto ATM Fraud Prevention Act aims to standardize protections nationwide. Key provisions of the bill include mandatory fraud warnings on all machines, transaction caps for new users, and required registration of anti-fraud protocols with the Financial Crimes Enforcement Network (FinCEN). It also outlines a refund mechanism for victims who report scams within a specified timeframe.

Quick Facts

- Texas Rep. Lance Gooden wants crypto ATMs in federal buildings to promote blockchain adoption.

- The initiative aligns with President Trump’s vision for U.S. leadership in financial technology.

- Crypto ATM fraud cost Americans over $246 million in 2024, prompting proposed legislation.

- The Crypto ATM Fraud Prevention Act seeks to establish national protections and fraud safeguards.