Texas Representative Brandon Gill is facing mounting criticism after failing to report two sizable Bitcoin purchases—each valued between $100,001 and $250,000—within the timeframe mandated by the STOCK Act. The trades, executed on January 29 and February 27, were disclosed well after the required 45-day reporting deadline, triggering concerns over transparency and potential conflicts of interest.

A freshman lawmaker known for proposing that Donald Trump’s face appear on the $100 bill, Gill’s investment activity is drawing particular scrutiny due to its timing. His first Bitcoin acquisition came just days after Trump signed an executive order aimed at reinforcing U.S. dominance in digital assets. The second followed shortly before Trump floated the idea of a national strategic Bitcoin reserve.

These timelines have fueled ethical questions, with critics speculating whether Gill had advance insight into upcoming crypto policy moves. His close ties to Trump’s inner circle have only intensified calls for accountability.

The STOCK Act, designed to combat insider trading among public officials, imposes modest penalties—typically a $200 fine per violation. But in Gill’s case, the implications stretch beyond the fines, reviving broader debates about the efficacy of current congressional disclosure laws.

Gill Discloses New Bitcoin Trades, But Scrutiny Remains

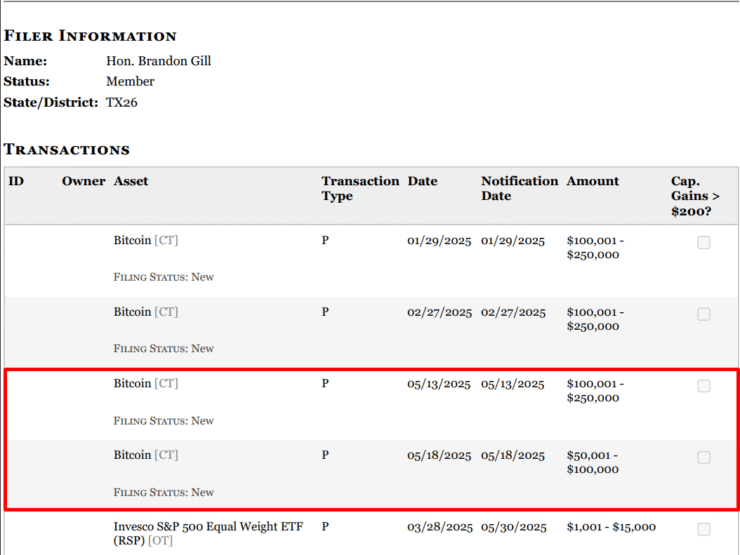

In a follow-up to the earlier controversy, Representative Gill has now disclosed two additional Bitcoin purchases—this time within the required legal window. According to new filings, he acquired $250,000 and $100,000 worth of Bitcoin in May, both of which were submitted on time under the STOCK Act.

Gill also reported more conventional investments, including positions in the Invesco S&P 500 Equal Weight ETF (RSP) and the TOIXX money market fund, all disclosed promptly.

However, the backlash from his earlier violations continues. Critics have called the $200 fine per infraction a token penalty that fails to deter unethical behavior.

“We’ve seen thousands of STOCK Act violations,” posted Quiver Quantitative on X. “The fine is a joke.”

Adding to the controversy is Gill’s influential role in Congress. He currently serves on the House Oversight and Government Reform Committee—the primary ethics and accountability body—along with positions on the Judiciary and Budget Committees. His late filings have therefore drawn amplified scrutiny, given the importance of these assignments.

Gill has been a vocal proponent of digital assets, touting “permissionless peer-to-peer transactions” as a defining feature of crypto, which he compares to digital cash. Ironically, he’s also the sponsor of the Putting Trust in Transparency Act, a bill designed to improve nonprofit funding disclosures—adding another layer of tension to his own reporting lapses.

Trump Ties and Crypto Bets Ignite Political Firestorm

The controversy over Gill’s crypto trades is further complicated by his close family and political ties to Trump-world. Gill is married to the daughter of conservative filmmaker Dinesh D’Souza, who was pardoned by President Trump in 2018 following a campaign finance conviction. Notably, employees of D’Souza Media were among Gill’s top donors in his 2024 congressional race.

Meanwhile, Trump’s own engagement with crypto has drawn fire. From launching NFT collections to promoting pro-crypto policies, the former president’s increasingly visible role in digital assets has led watchdogs to question whether these moves serve public interest—or private gain.

Gill is not alone in violating the STOCK Act. Lawmakers across the aisle, including Jamie Raskin, Dwight Evans, and Neal Dunn, have also reported trades late this year—some involving crypto, others stocks. These repeated violations have bolstered support for bipartisan reform bills seeking to ban lawmakers and their families from trading individual stocks and cryptocurrencies entirely.

The goal: to eliminate even the appearance of insider access and self-enrichment—an issue that Gill’s actions have once again pushed to the forefront.

Quick Facts

- Texas Rep. Brandon Gill disclosed two large Bitcoin trades months late, violating the STOCK Act.

- The trades coincided with Trump’s pro-crypto announcements, raising concerns about potential insider knowledge.

- Gill later reported two more Bitcoin purchases in May—this time within the legal window.

- He sits on key oversight committees and has deep ties to Trump allies, further complicating the optics.

- Bipartisan efforts to ban lawmakers from trading crypto and stocks are gaining traction in response to such cases.