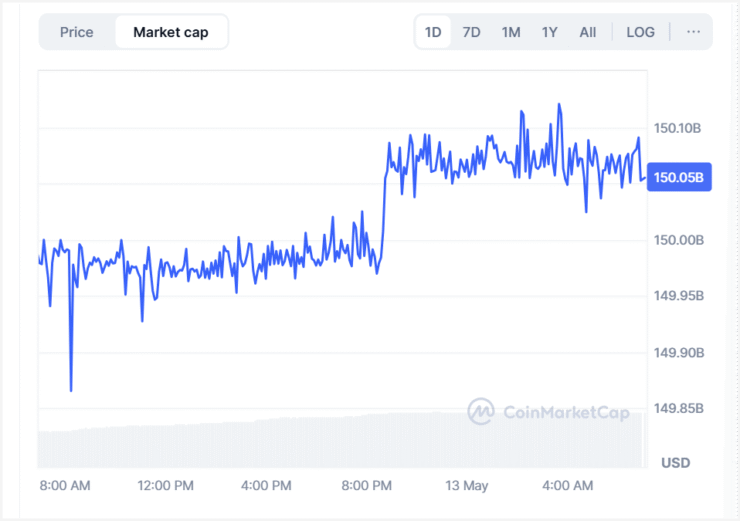

Tether’s flagship stablecoin, USDT, has reached a historic market capitalization of $150 billion as of May 12, further cementing its dominance in the rapidly growing stablecoin sector. Despite ongoing regulatory scrutiny in several developed markets, USDT holds a commanding 61% share of the global stablecoin supply, according to CoinMarketCap.

The token’s circulating supply has surged over 36% year-over-year, with momentum accelerating notably after Donald Trump’s presidential victory in November—an event that reignited investor optimism across the broader digital asset market. USDT continues to serve as a critical layer of infrastructure in crypto, facilitating liquidity across centralized exchanges, DeFi protocols, and cross-border remittance systems.

Trailing behind is Circle’s USDC, which commands nearly 25% of the market, as stablecoin competition intensifies. Yet, Tether’s grip on the global market remains firm—even as the company prepares for a long-awaited expansion into the United States.

Recent analytics from Dune and Artemis reveal that active stablecoin wallet addresses have surged from 19.6 million to over 30 million in the past year—a growth rate exceeding 50% and pointing to increasing adoption of digital dollars for everyday financial activity worldwide.

Tether Targets U.S. Launch With New Stablecoin

Despite its global dominance, USDT has remained largely sidelined in the U.S. due to regulatory limitations. That could soon change. Tether is now preparing to launch a U.S.-focused, dollar-backed stablecoin designed to comply with domestic regulatory frameworks.

Speaking at the Token2049 conference in Dubai, Tether CEO Paolo Ardoino stated that the new product will differ from the international version of USDT, with customizations aimed at aligning with U.S. regulatory requirements.

This move comes at a time of increased legislative activity in Washington. The STABLE Act—introduced by House Financial Services Committee Chair French Hill and Digital Assets Subcommittee Chair Bryan Steil—is one of several bills in play that could reshape the future of stablecoin issuance in the United States.

However, the proposal has drawn criticism. Former CFTC Chair Timothy Massad, speaking at a House subcommittee hearing in February, argued that the STABLE Act lacks sufficient federal oversight and could create inconsistencies by delegating too much authority to state regulators.

Amid this evolving policy landscape, Tether has significantly increased its lobbying presence in Washington, aiming to shape upcoming legislation that could redefine the rules for compliant digital dollar issuers.

The planned U.S. launch marks a strategic pivot by Tether as it seeks to maintain its leadership in a market that is on the brink of clearer regulation—and potentially, broader institutional adoption.

Quick Facts

- Tether’s USDT has reached a record $150 billion in market capitalization.

- USDT holds a 61% share of the global stablecoin market, with USDC trailing at nearly 25%.

- Active stablecoin wallets have grown from 19.6 million to over 30 million in the last 12 months.

- Tether plans to launch a U.S.-compliant stablecoin tailored for domestic regulatory standards.

- U.S. lawmakers are advancing several stablecoin bills, including the STABLE Act, amid industry pushback.