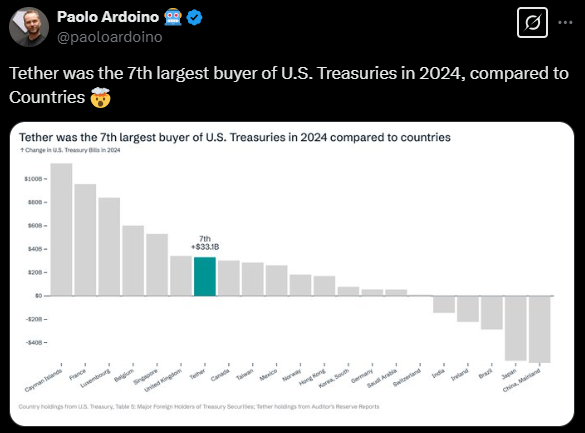

In a striking display of crypto’s growing influence on traditional markets, stablecoin giant Tether has officially become the seventh-largest holder of US Treasuries worldwide, surpassing countries like Canada, Taiwan, Mexico, and Hong Kong.

Tether, the issuer of the $143 billion USDt stablecoin, has accumulated $33.1 billion worth of US Treasury bills, positioning itself among the world’s top sovereign debt holders. The figures, shared by CEO Paolo Ardoino on March 20, shows how fast crypto-backed entities are becoming entrenched in global finance.

“Tether was the 7th largest buyer of US Treasurys in 2024, compared to countries,” Ardoino confirmed in a post on X.

While Ardoino clarified that some rankings, like Luxembourg and the Cayman Islands, reflect hedge fund activity funneled through those jurisdictions, Tether’s position represents a single entity making direct purchases.

Stablecoins Emerging as Global Financial Powerhouses

Tether’s heavy investment in US Treasuries highlights its strategy to bolster USDt’s backing with the safest and most liquid assets available. As short-term government debt, Treasuries are a cornerstone of traditional finance and now, increasingly, of crypto-backed reserves.

This move signals growing confidence in the stablecoin market, which has ballooned to $219 billion and counting. Analysts at IntoTheBlock suggest the sector remains “mid-cycle,” reflecting strong demand from investors and institutions not a market peak.

Amid this surge, stablecoins like USDt are no longer just crypto trading tools — they’re becoming integral to cross-border settlements, DeFi protocols, and traditional finance bridges.

US Lawmakers Eye August for Stablecoin Legislation

Tether’s expanding role comes as the US government races to finalize a legal framework for stablecoins. Kristin Smith, CEO of the Blockchain Association, revealed during the 2025 Digital Asset Summit that stablecoin regulations could pass as soon as August.

“I think we’re close to being able to get those done for August,” Smith stated, citing active bipartisan efforts in Congress and strong interest from the White House.

The timeline aligns with predictions from Bo Hines, executive director of the Presidential Council of Advisers on Digital Assets, who also expects comprehensive stablecoin legislation in the coming months.

If passed, the bill could formalize the role of entities like Tether within US financial systems potentially giving them greater legitimacy while subjecting them to regulatory oversight.

A New Era of Crypto-Backed Sovereign Influence?

Tether’s massive Treasury holdings mark a profound shift in global finance — one where crypto-native companies now influence US debt markets once dominated by nation-states.

As stablecoin adoption accelerates, so does the interdependency between crypto and traditional financial systems. With billions flowing into Treasuries from stablecoin issuers, their impact on US debt markets, interest rates, and even geopolitical dynamics is growing harder to ignore.

The road ahead will be shaped by regulatory clarity. However, one thing is certain: crypto firms like Tether no longer operate on the fringe. They’re now financial heavyweights, shaping the future of money.