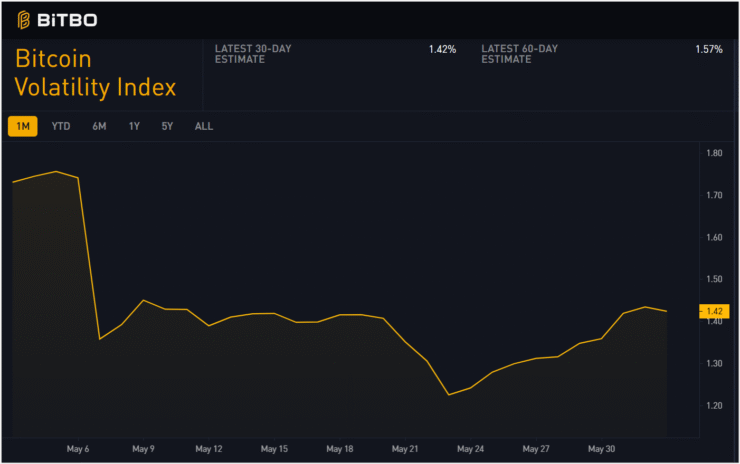

As market conditions become increasingly reactive to political developments, traders are shifting away from long-hold strategies and favoring short-term tactics to navigate heightened volatility. According to Arrash Yasavolian, founder and CEO of the AI-driven Web3 trading platform Taoshi, Donald Trump’s renewed push for aggressive U.S. tariffs has triggered a meaningful change in trading behavior.

Speaking with Cointelegraph, Yasavolian explained that the current climate is marked by headline-driven swings, with sentiment turning sharply in just a few hours.

“Trading behavior has essentially changed to be more intraday — when you have your profit, you just take it when you can get it,” he said.

“So, behavior is essentially cutting confidence on further upside or downside if you are taking a position on longing or shorting.”

Taoshi has adapted its internal trading models to fit this new volatility-focused environment. Yasavolian stated the firm has reduced risk exposure and prioritized short-term positions in light of macroeconomic uncertainty tied to tariffs, inflation, and inconsistent policy direction.

While some of the initial market shock from Trump’s tariff messaging has faded, Yasavolian warns that underlying instability still weighs heavily on risk-on markets, including Bitcoin. With trade policies capable of reversing overnight, both retail and institutional traders are growing hesitant about long-term positioning.

Tariff Delay Triggers Rally, But Optimism May Be Misplaced

Markets briefly rallied after President Donald Trump announced a delay in tariffs on European Union goods, moving the deadline to July 9. Bitcoin reacted swiftly, climbing over 3% in intraday trading as investors embraced the reprieve from rising trade tensions.

The short-term rally has crypto traders cautiously optimistic. Many are now eyeing ongoing U.S.-China and U.S.-EU negotiations for signs of progress that could trigger sustained upside for both Bitcoin and altcoins. The broader belief is that even the perception of a trade breakthrough could serve as a macro tailwind for digital assets.

European Commission President Ursula von der Leyen echoed this sentiment in a May 25 post on X, describing the EU-U.S. trade partnership as “the world’s most consequential” and expressing Europe’s readiness to continue negotiations.

However, some analysts remain skeptical. Several commentators argue that these diplomatic gestures may be more about optics than substance. One market observer warned that temporary exemptions and tariff rollbacks could be political tools to calm investor nerves—without delivering real structural change to trade relations or economic fundamentals.

Quick Facts

- Traders are shifting from long-term to short-term strategies amid tariff volatility.

- Taoshi has reduced risk exposure and shortened trading time frames in response.

- Bitcoin rose 3% after Trump delayed EU tariffs until July 9.

- Analysts warn the rally may be driven by political optics, not policy change.