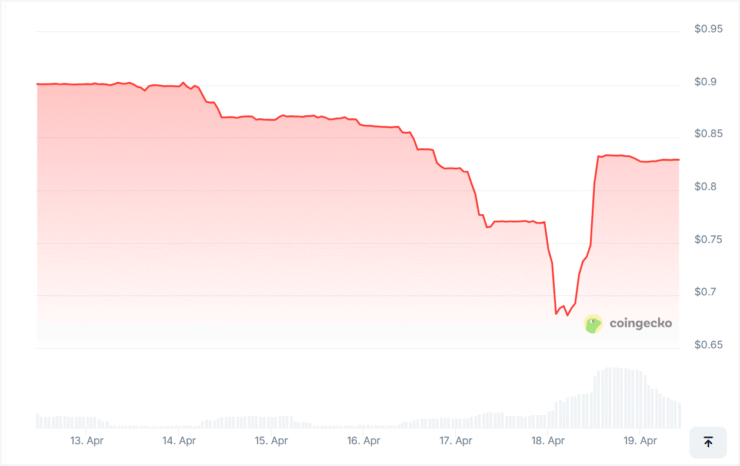

Synthetix’s native stablecoin, sUSD, dropped to a low of $0.63 this week—marking a 37% depeg from its intended $1 target and extending a prolonged period of instability. The ongoing decline has raised fresh concerns over the protocol’s liquidity structure and risk management following major recent upgrades.

While some observers have likened sUSD’s troubles to algorithmic stablecoin failures, Synthetix founder Kain Warwick pushed back.

“It is worth pointing out that sUSD is not an algo stable, it is a pure crypto collateralised stable,” he said in an April 2 post on X.

“The peg can and does drift but there are mechanisms to push it back in line. These mechanisms are being transitioned right now, hence the drift.”

Warwick acknowledged sUSD’s increased volatility compared to decentralized stablecoins like MakerDAO’s DAI or centralized options such as USDT. He reiterated that peg-restoration mechanisms are in development but warned that volatility may persist in the near term.

SIP-420 Update Blamed for Weakening sUSD’s Peg

The sharp decline in sUSD’s value follows the March 7 rollout of Synthetix Improvement Proposal 420 (SIP-420), which restructured sUSD’s backing. The update shifted support from individual SNX-collateralized positions to a shared debt pool and lowered the required collateralization ratio from 750% to 200%.

While the change aimed to improve capital efficiency, it also weakened critical stabilization mechanisms that previously incentivized stakers to defend the peg. As a result, sUSD began drifting from $1 in March—trading around $0.98 by March 20, dropping to $0.91 by month’s end, and eventually bottoming at $0.63 in April.

Mrinal Thakur, head of ecosystem at modular blockchain platform Okto, criticized the update’s impact.

“There is no longer a strong incentive for stakers to buy cheap sUSD and repay debts,” he said.

He added that low liquidity and sUSD-heavy AMM pools are now amplifying volatility, making the system more fragile.

Warwick maintains confidence in Synthetix’s long-term resilience and noted that he’s been accumulating SNX throughout 2024. Still, he cautioned:

“It would be horrible to get shaken out here… but I’m not saying this is the bottom. It could get worse before it gets better.”

sUSD Recovers Slightly, But Stability Remains Shaky

The recent crash caps off a months-long period of instability for sUSD. The stablecoin began slipping from its peg in January, reaching $0.96, and has failed to fully recover since. After a brief rebound in March, the decline resumed in April—culminating in this week’s deep depeg.

As of Friday, sUSD had recovered to roughly $0.83, according to CoinGecko. Still, volatility remains high and investor confidence appears shaken.

In response, Synthetix has begun rolling out corrective measures. In the short term, the team is injecting incentives into Curve liquidity pools and its Infinex derivatives platform. Medium-term plans include introducing “debt-free” staking to reduce protocol debt and sell pressure. Longer-term strategies will target better supply control and incentivized sUSD adoption across the Synthetix ecosystem.

Despite these efforts, market analysts remain cautious. Thakur noted that while the Synthetix treasury reportedly holds $30 million in reserves—including sUSD, USDC, and OP—any renewed instability could pressure SNX further and spill into broader DeFi markets.

Quick Facts

- sUSD dropped to $0.63 before recovering to $0.83

- SIP-420 changes led to oversupply and weakened peg defense

- Synthetix launched new incentives via Curve and Infinex to support recovery

- The event raises renewed concerns over stablecoin risk management