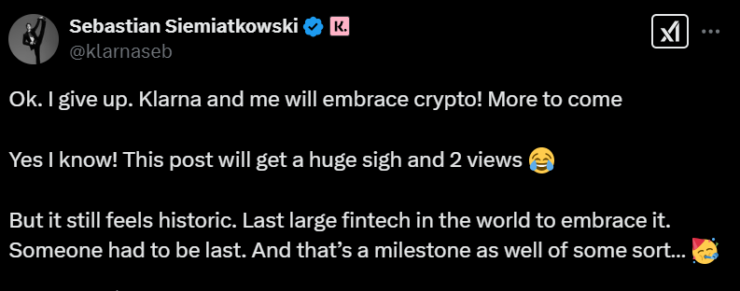

Swedish fintech powerhouse Klarna Bank AB is making headlines as it signals an entry into the cryptocurrency space, a move that aligns with the broader fintech trend of digital asset integration. Klarna’s CEO, Sebastian Siemiatkowski, recently shared his enthusiasm for crypto in a February 8 post, asking followers for input on how the firm should navigate this new frontier. This pivot marks a notable shift in the company’s stance, given Siemiatkowski’s previous skepticism toward digital assets.

Klarna’s Crypto Shift: What’s Driving It?

Klarna is widely recognized for its buy-now-pay-later (BNPL) services and processes around $100 billion in trading volume annually. With a reported U.S. initial public offering (IPO) on the horizon, Klarna’s move into crypto could be a strategic play to bolster its financial technology offerings and appeal to a rapidly growing digital asset market.

Industry leaders quickly responded to Siemiatkowski’s call for input. Circle CEO Jeremy Allaire pitched the use of USD Coin (USDC) stablecoin, while Immutable’s Robbie Ferguson highlighted the potential of integrating Klarna’s BNPL model into the $150 billion in-game item economy.

Catching Up to PayPal and Revolut

Klarna’s interest in crypto is largely a response to competitors PayPal and Revolut, which have already established strong cryptocurrency offerings.

- PayPal introduced its PYUSD stablecoin in August 2023, which has since grown to a $583 million market cap, according to CoinGecko data. The payment giant also allows users to buy, sell, and transfer digital assets seamlessly.

- Revolut, another fintech leader, offers a wide range of 175 crypto tokens to its users, some with trading fees as low as 0%.

For Klarna, expanding into crypto is not just about staying competitive—it’s about remaining relevant in an evolving financial ecosystem where digital assets are becoming a mainstream component of fintech services.

A Change in Tune for Siemiatkowski

Siemiatkowski’s newfound enthusiasm for cryptocurrency marks a dramatic departure from his previous skepticism. In late 2022, he famously called Bitcoin a “decentralized Ponzi scheme” and criticized high transaction fees in crypto payments. He also admitted in June 2021 that he was still trying to understand how blockchain and crypto mining work.

However, fast forward to 2024, and the Klarna CEO has not only opened up to the idea of crypto but has actively engaged in conversations about its integration. On February 10, he even shared a three-minute AI-generated song called “Crypto Boy”, referencing Bitcoin, Binance, Coinbase, staking, NFTs, and mining—suggesting a shift in perspective as Klarna explores the sector.

What Klarna’s Move Means for Digital Payments

Klarna’s foray into crypto could have several far-reaching implications:

- BNPL Meets Crypto: Klarna’s potential integration of BNPL with crypto payments could unlock new consumer financing options, particularly for in-game purchases, NFT marketplaces, and digital asset trading platforms.

- Stablecoin Adoption: Partnering with Circle’s USDC or developing its own digital currency could streamline cross-border transactions and reduce costs for users.

- Increased Crypto Accessibility: Klarna’s millions of global users would gain direct access to cryptocurrency transactions through a familiar financial service provider, fostering mainstream adoption.

- Institutional Trust in Digital Assets: A successful Klarna crypto integration could encourage more traditional fintech firms to explore blockchain technology and digital asset services.

Looking Ahead: Klarna’s Crypto Roadmap

As Klarna prepares for its U.S. IPO, its crypto ambitions could play a crucial role in its market positioning. While details remain scarce, the company’s engagement with industry leaders suggests it is actively exploring multiple avenues—ranging from stablecoin transactions to crypto-powered BNPL models.

Given the rapid evolution of digital finance, Klarna’s shift towards embracing cryptocurrency could shape the future of payments, bridging the gap between traditional fintech services and the decentralized financial ecosystem. Whether the company will fully commit to a robust crypto strategy or take a more cautious approach remains to be seen, but one thing is certain—Klarna is no longer ignoring the crypto revolution.