Quick Facts:

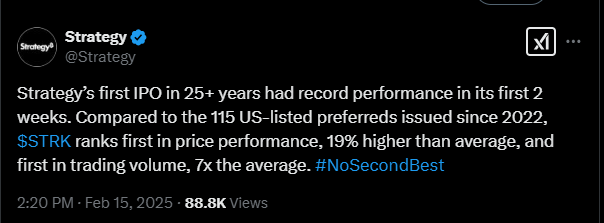

- STRK Performance: Best-performing U.S. preferred stock since 2022.

- Trading Volume: Increased 7x within two weeks.

- Price Gain: Up 19% from average performance.

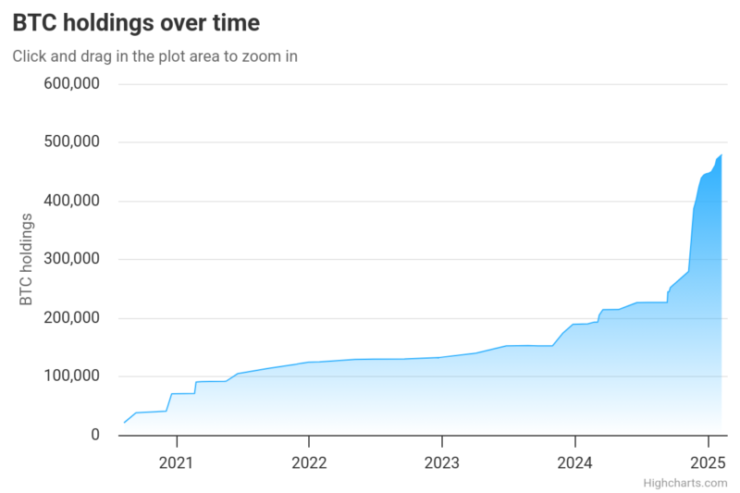

- Bitcoin Strategy: Continued accumulation despite market volatility.

Strategy’s STRK preferred stock has achieved record-breaking performance within its first two weeks of trading, ranking as the best-performing U.S. preferred stock since 2022. The stock’s price surged 19% above the average preferred stock performance, accompanied by a 7x increase in trading volume, driven by investor enthusiasm for Strategy’s Bitcoin-focused strategy.

Founder Michael Saylor hailed the success, stating on X that:

“In the initial two weeks of trading, $STRK is the best performing and most liquid perpetual preferred security.”

This achievement contradicts predictions from Barron’s analyst Andrew Bary, who had forecast an 8% price cut for the offering.

Strategy’s STRK Stock Outshines Bitcoin with Strong Year-to-Date Gains

Strategy’s Series A Perpetual Strike Preferred Stock (STRK) is driving its latest push for Bitcoin accumulation, aiming to raise $250 million for BTC purchases. The convertible preferred stock, which carries a $100 liquidation preference, can convert into Class A shares under specific conditions.

Despite Bitcoin’s sluggish performance—up only 3.42% year-to-date (YTD) and struggling to break the $100,000 mark—Strategy has thrived. The company’s stock is up 16.61% YTD, outperforming BTC amid macroeconomic headwinds like inflation and tariffs.

MicroStrategy owns 478,740 bitcoins as of Feb. 10, 2025. MicroStrategy states the average purchase price as $62,473.01 USD per bitcoin with a total cost of $27.954 billion USD.

Investor sentiment remains strong for Strategy and its STRK preferred stock, despite recent Bitcoin acquisitions costing more than BTC’s current price. Analysts attribute the optimism to Strategy’s consistent Bitcoin accumulation strategy and its commitment to avoiding shareholder dilution, as well as the upcoming adoption of FASB accounting rules in Q1 2025, which could enhance its financial reporting.

The bullish sentiment extends beyond Strategy to other institutional Bitcoin investment products, particularly spot Bitcoin ETFs, which continue to attract large institutional investors. For example, Abu Dhabi’s Mubadala Investment Company holds $461.23 million in BlackRock’s IBIT ETF, making it the seventh-largest known holder, while Tudor Investment Corporation, led by legendary investor Paul Tudor Jones, holds $426.9 million worth of IBIT shares.

IBIT’s performance has been notable, recording only two outflow events totaling $50 million since Donald Trump’s return to office, signaling strong institutional confidence.

Strategy Rebrands to Cement Bitcoin-Centric Identity

Founded in 1989 as a business intelligence and software firm, Strategy (formerly MicroStrategy) has fully embraced its Bitcoin-centric identity following its rebranding in February 2025. The change marks a decisive shift from its software roots, reinforcing its position as the largest publicly traded Bitcoin treasury firm.

The rebrand includes a new Bitcoin-inspired logo and an orange color scheme, symbolizing the company’s deep commitment to digital assets. Chairman Michael Saylor described “Strategy” as a powerful term representing the firm’s mission, calling the rebrand a “natural evolution” reflecting its five-year Bitcoin accumulation strategy.