Bitcoin treasury giant Strategy—formerly MicroStrategy—has added another 705 BTC to its balance sheet, representing approximately $75.1 million in new purchases. According to a filing with the U.S. Securities and Exchange Commission, the acquisition took place between May 26 and June 1 at an average price of $106,495 per bitcoin.

This latest addition brings Strategy’s total holdings to 580,955 BTC, accounting for more than 2.8% of Bitcoin’s fixed 21 million supply. The company’s cumulative BTC investment now stands at roughly $40.7 billion, with an average entry price of $70,023. As of this filing, Strategy is sitting on unrealized gains of over $19 billion.

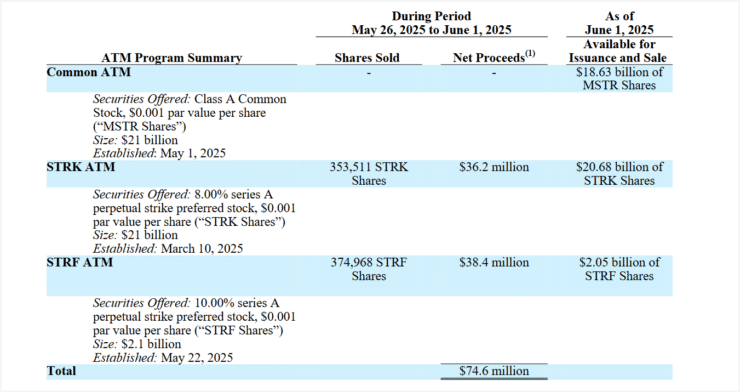

The acquisition was funded through ongoing at-the-market (ATM) offerings involving two classes of perpetual preferred stock: STRK and STRF. In the past week alone, Strategy sold 353,511 STRK shares for $36.2 million and 374,968 STRF shares for $38.4 million. The company still holds authorization to raise up to $20.68 billion in STRK and $2.05 billion in STRF shares, with an additional $18.63 billion available through unissued Class A common stock (MSTR).

These capital-raising activities align with Strategy’s ambitious “42/42” initiative, a plan to raise $84 billion by 2027 through a mix of equity and convertible debt. This expanded vision replaces its earlier “21/21” initiative, which was fully utilized on the equity side earlier this year.

Saylor Teases More Bitcoin Buys Despite Slower Pace

Strategy co-founder and executive chairman Michael Saylor had already hinted at another purchase. On Sunday, he updated Strategy’s Bitcoin tracker on X with a now-familiar phrase:

“Orange is my preferred color”—a cryptic signal often used to precede buy announcements.

The post followed Saylor’s appearance at Bitcoin 2025 in Las Vegas, where he doubled down on Strategy’s core philosophy. In his keynote, he dismissed onchain proof-of-reserves as a “bad idea” and reiterated his belief in Bitcoin as “perfected capital”—underscoring its role as the superior long-term asset for corporate treasuries.

Yet, despite the bullish messaging, Strategy’s accumulation pace has notably slowed. Following the purchase of 4,020 BTC for $427.1 million just a week earlier, the current 705 BTC buy marks a significant pullback. Analysts at K33 attribute the slowdown to a narrowing premium between MSTR stock and Bitcoin itself, which may reduce the firm’s flexibility in raising capital through equity sales.

The slowdown also comes amid rising competition in the Bitcoin treasury space, where more firms are beginning to mirror Strategy’s reserve model.

Bitcoin Treasuries Go Mainstream as Corporates Join the Race

The corporate Bitcoin arms race is heating up. More than 75 companies now report holding BTC on their balance sheets, marking a decisive shift in institutional views toward digital assets. Just this past week, several new entrants announced major purchases, intensifying the competition.

Trump Media disclosed a $2.3 billion private placement, with a portion earmarked for Bitcoin purchases. On the same day, GameStop made headlines by acquiring 4,710 BTC worth nearly $500 million, signaling a bold pivot into crypto.

In sports, Paris Saint-Germain quietly confirmed its entry into Bitcoin treasury strategy during Bitcoin 2025. Meanwhile, European digital asset firm K33 raised $6.2 million to begin building its own BTC reserve.

They join a fast-growing cohort of adopters, including Tether-backed Twenty One, Nakamoto, KULR, and Semler Scientific. In Asia, Japanese firm Metaplanet—already among the region’s top corporate BTC holders—announced a fresh acquisition of 1,088 BTC, bringing its total to 8,888 BTC valued at over $930 million.

What was once Strategy’s bold, contrarian play is now becoming a blueprint for modern treasury management in the digital age.

Quick Facts

- Strategy purchased 705 BTC for $75.1 million between May 26 and June 1.

- Total holdings now sit at 580,955 BTC, or 2.8% of Bitcoin’s total supply.

- The company’s average entry price is $70,023, with over $19B in unrealized gains.

- Recent purchases were funded via STRK and STRF stock offerings.

- Corporate Bitcoin adoption is growing, with Trump Media, GameStop, PSG, K33, and Metaplanet making large BTC acquisitions.