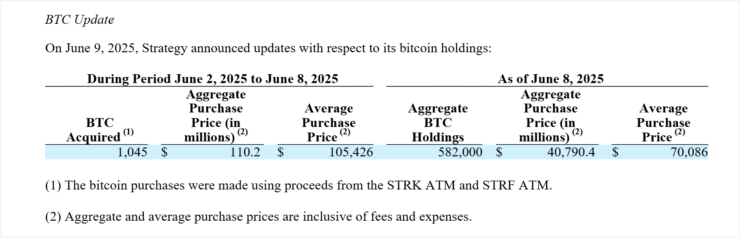

Strategy Inc. has added another 1,045 Bitcoin to its treasury, spending approximately $110.2 million as the cryptocurrency trades just shy of its all-time high. The purchase, disclosed in a June 10 SEC filing, brings the firm’s total holdings to 582,000 BTC—acquired at a cumulative cost of $40.8 billion and an average price of roughly $70,086 per coin.

The latest acquisition was made at an average price of $105,426 per BTC, signaling continued conviction from the company even as the asset flirts with record valuations. Bitcoin was trading at around $107,640 at the time of the announcement—just 3.9% below its previous peak of approximately $112,000 reached in May.

This marks the ninth straight week of Bitcoin accumulation for Strategy, led by executive chairman Michael Saylor. On June 8, Saylor teased another purchase with a cryptic “send more orange” post on X—a signal that has become synonymous with the company’s buying streaks.

With institutional appetite showing no signs of cooling, Strategy’s persistent accumulation continues to shape the narrative around corporate Bitcoin adoption as a long-term reserve strategy.

$1B Stock Sale Backs Latest Bitcoin Accumulation

Strategy’s latest Bitcoin purchase is being funded by a sizable capital raise. The company recently announced a $1 billion preferred stock offering—four times larger than its previously planned $250 million round—aimed at supporting further Bitcoin acquisitions and covering general corporate expenses.

The raise involves issuing 11.76 million shares of Strategy’s 10% Series A Perpetual Stride Preferred Stock, priced at $85 per share. After underwriting and administrative costs, the company expects to net approximately $979 million from the offering.

Unlike earlier rounds that relied on convertible debt or common equity, this offering introduces a non-cumulative 10% dividend structure, appealing to income-focused institutional investors. By targeting professional capital through fixed-yield instruments, Strategy is securing stable funding without diluting its common shareholder base—while continuing to expand its massive Bitcoin treasury.

Strategy’s Bitcoin Model Spurs Global Copycats

What began as a bold treasury experiment in 2020 has evolved into a global corporate strategy. Since its first Bitcoin purchase of 21,454 BTC for $250 million, Strategy (formerly MicroStrategy) has become the world’s largest corporate Bitcoin holder—now controlling over 582,000 BTC, or more than 2.75% of the total supply.

That aggressive accumulation has paid off. Strategy’s market capitalization has soared from $1.2 billion in July 2020 to more than $104 billion today, proving the market’s appetite for Bitcoin-aligned business models. As a result, a wave of corporate imitators has emerged—and many are being rewarded by investors.

Japan’s Metaplanet, often called “Asia’s MicroStrategy,” has joined the top 10 corporate Bitcoin holders globally, recently unveiling plans to reach 210,000 BTC by 2027. France’s Blockchain Group saw its share price surge 225% after shifting its strategy toward Bitcoin accumulation in November 2024 and has since added 580 BTC to its reserves.

Norway’s crypto exchange NBX (Norwegian Block Exchange) also joined the movement. Earlier this month, its share price jumped 138% in a single day following its announcement to begin holding Bitcoin on its balance sheet.

This growing trend underscores how Bitcoin is evolving from a speculative play into a strategic treasury reserve—and how public markets are increasingly rewarding early adopters.

Quick Facts

- Strategy purchased 1,045 BTC (~$110.2M), bringing its total to ~582,000 BTC at a cumulative $40.8B.

- The buy was funded by a $1B preferred stock issuance offering a 10% dividend.

- BTC is trading just 3.9% below its all-time high of $112K.

- Dozens of public companies are adopting BTC treasury strategies, fueling structural demand.