Stablecoins have emerged as the primary engine powering digital payments across the internet, now eclipsing traditional card networks in on-chain transaction volume, according to Noam Hurwitz, head of engineering at blockchain infrastructure provider Alchemy.

Speaking to Cointelegraph, Hurwitz described stablecoin adoption as “explosive,” noting that digital dollars are increasingly the “default settlement layer for the internet.” He emphasized that platforms like PayPal and Stripe have integrated stablecoins to improve the speed and cost of transactions compared to legacy systems.

“They’ve already surpassed Visa and Mastercard in on-chain volume by 7%,” Hurwitz said, highlighting the scale of this transition.

Alchemy sits at the center of this transformation. The company’s infrastructure underpins stablecoin flows for major fintech players including Visa, Stripe, Circle, and PayPal, and also powers Robinhood Wallet’s on-chain capabilities.

New Use Cases and Massive Treasury Holdings

Hurwitz explained that the appeal of stablecoins lies in their simplicity: they make moving money “cheap, fast, global, and secure.” This combination has driven adoption not only for cross-border payments but also in prediction markets like Polymarket.

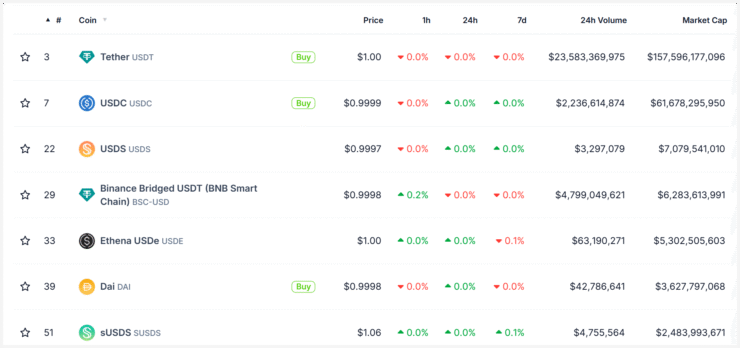

He underscored that stablecoins have quietly become some of the largest buyers of U.S. Treasurys. Tether, the world’s largest stablecoin issuer, reportedly earned $13 billion in profits last year while holding over $113 billion in government debt.

Yet, he cautioned that the ecosystem remains fragmented, with institutions forced to weigh counterparty risk and service reliability when working with a patchwork of providers. “Can a small startup really support enterprise-grade operations while building and scaling the services they need?” he asked.

Hurwitz also called JP Morgan’s recent launch of Kinexys—a permissioned tokenized deposit for institutional clients—“a major milestone,” citing its combination of 24/7 settlement, real-time liquidity, and the possibility of paying yield to token holders.

Regulation and Interoperability Will Define the Next Phase

The regulatory landscape for stablecoins has also evolved rapidly. Last week, the U.S. Senate passed the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), providing the first clear federal framework for issuers.

“With the recent passage of the GENIUS Act, the regulatory landscape is becoming clearer and more structured, which benefits established financial players while also encouraging innovation,” Hurwitz said.

He noted that while institutional adoption is growing, infrastructure bottlenecks persist. Companies want to leverage crypto rails but decouple the end-user experience from the underlying complexity—a challenge that requires deep technical sophistication.

Looking ahead, Hurwitz predicted that most major financial services providers will deploy their own purpose-built blockchains or layer-2 networks to capture more value and improve performance. He expects these networks to become increasingly interoperable, paving the way for a more integrated financial system powered by stablecoins.

Despite Hurwitz’s optimism, the Bank for International Settlements (BIS) recently raised doubts about stablecoins’ long-term viability. In its Annual Economic Report 2025, the BIS argued that stablecoins fail critical tests of monetary integrity, elasticity, and singleness, describing them as “digital bearer instruments” more akin to financial assets than true money.

Quick Facts

- Alchemy says stablecoins have overtaken Visa and Mastercard in on-chain transaction volume.

- Tether alone holds over $113 billion in U.S. Treasurys and made $13 billion in profit last year.

- The GENIUS Act establishes the first federal regulatory framework for stablecoins in the U.S.

- BIS has questioned whether stablecoins can function as real money in modern economies.