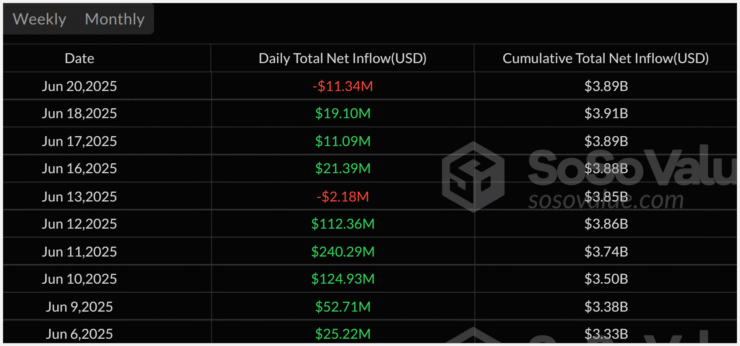

Bearish pressure on Ethereum intensified over the weekend, as U.S. spot ETH ETFs recorded their largest net outflows in more than a month. Ether’s price slipped below the $2,400 mark on Saturday, raising concerns about investor sentiment ahead of the summer trading cycle.

Leading the exodus was BlackRock’s ETHA fund, which reported $19.7 million in outflows on Friday. Despite the decline, ETHA remains the largest Ethereum ETF by assets under management, holding $4.03 billion—just ahead of the combined total of Grayscale’s ETHE and ETH funds, which sit at $4.02 billion.

The outflows from ETHA were partially offset by moderate gains in other funds. Grayscale’s ETH product saw a $6.6 million inflow, while VanEck’s ETHV attracted $1.8 million. Still, these positive figures were not enough to reverse the broader trend of over $11 million outflows, as ETH fell roughly 5% over the past week.

Meanwhile, Bitcoin ETFs have continued their positive momentum, posting a nine-day streak of net inflows—highlighting a sharp divergence in sentiment between the two largest cryptocurrencies.

Despite the recent volatility, ETH ETFs have collectively brought in approximately $840 million in net inflows since the start of June. This suggests that long-term institutional interest remains intact, although profit-taking and price swings have temporarily shaken short-term confidence.

Bitcoin ETF Inflows Hit Record, But Momentum Slows

While Ethereum ETFs struggle with redemptions, Bitcoin ETFs continue to see inflows—reaching a new cumulative record for the fifth straight trading day on Friday. Data from SoSoValue indicates that total net inflows now stand at $46.7 billion, underscoring Bitcoin’s strong institutional demand.

However, signs of weakening momentum are beginning to emerge. Friday’s net inflow of $6.4 million was the lowest daily total since early June. BlackRock’s IBIT led the day with $46.9 million in inflows, but this was nearly offset by a $40.6 million outflow from Fidelity’s FBTC.

Currently, spot Bitcoin ETFs account for about 25% of all global BTC trading activity—a significant influence on overall market structure. Yet, on-chain activity is slowing. Transaction volumes on Bitcoin’s base layer have dropped to an 18-month low, and interest in trends like Runes and Ordinals appears to be fading.

Bitcoin’s price fell by roughly 1% in the past 24 hours, suggesting that although institutional ETF demand remains solid, broader retail and speculative participation may be cooling off.

While the Ethereum ETF market remains structurally sound, persistent outflows could weigh on short-term market confidence. With accumulation wallets still growing, long-term ETH investors may yet see this as a buy-the-dip opportunity—if selling pressure doesn’t intensify further.

Quick Facts

- Ethereum ETF outflows topped $19.7M Friday, led by BlackRock’s ETHA.

- ETH has fallen below $2,400, losing 5% over the week.

- Bitcoin ETF inflows hit $46.7B total, but daily volume dipped.

- On-chain Bitcoin activity has dropped to 18-month transaction lows.